Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

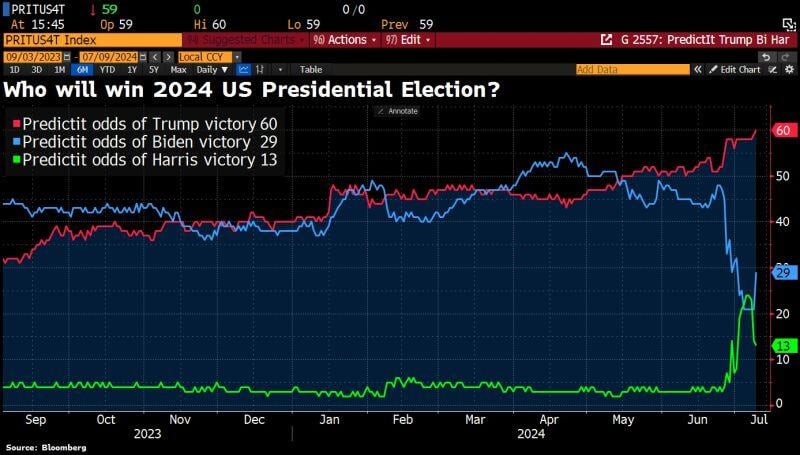

Looks like Biden keeps the lead on Democrats nomination and this means a high probability of Trump winning Presidential election

Source: HolgerZ, Bloomberg

What do Serbia, Czech Republic and India have in common?

central banks are ALL accumulating gold... Source: Bloomberg, Krishan Gopaul

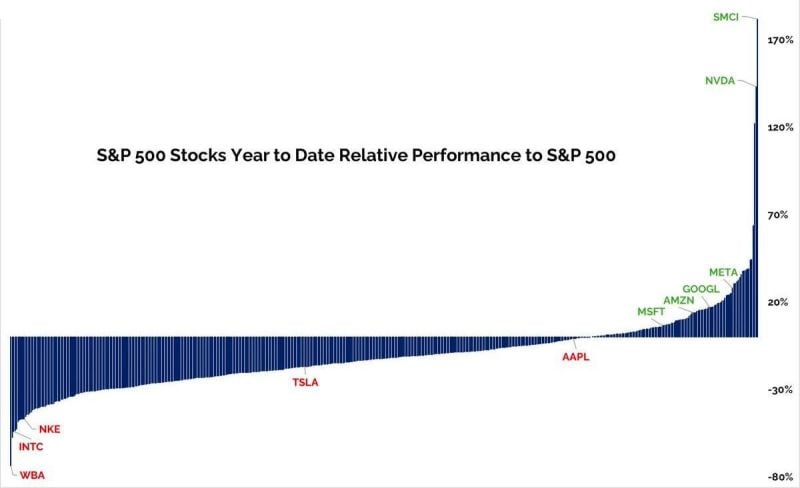

A good chart on how narrow the US market has been this year:

Source: Hidden Value Gems This was actually made originally by Grant Hawkridge https://lnkd.in/e8nwsZYA

Federal Reserve Chair Jerome Powell on Tuesday expressed concern that holding interest rates too high for too long could jeopardize economic growth.

Setting the stage for a two-day appearance on Capitol Hill this week, the central bank leader said the economy remains strong as does the labor market, despite some recent cooling. Powell cited some easing in inflation, which he said policymakers stay resolute in bringing down to their 2% goal. “At the same time, in light of the progress made both in lowering inflation and in cooling the labor market over the past two years, elevated inflation is not the only risk we face,” he said in prepared remarks. “Reducing policy restraint too late or too little could unduly weaken economic activity and employment.” Source: CNBC, Yusuf on X

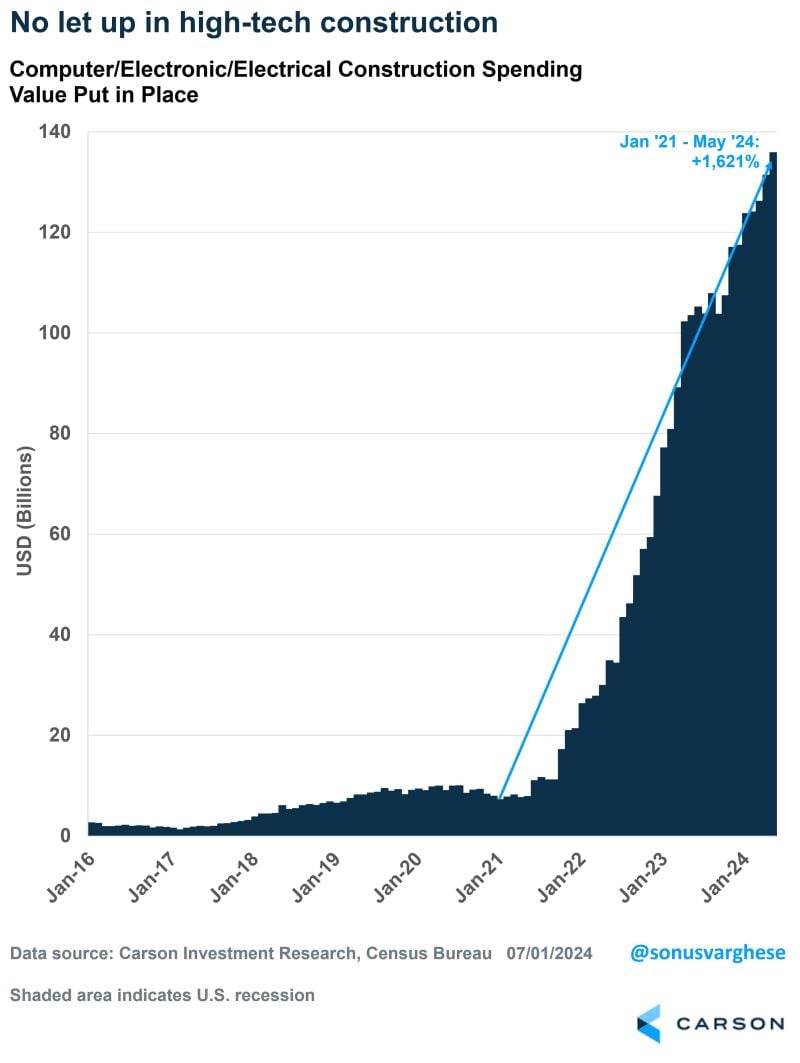

Amazing stat here from Sonus Varghese / Carson thru Ryan Detrick.

High-tech construction was only 11% of overall manufacturing construction in late '20. Today it is 58%!

Rare image of the constitution of the new Government in France

Source: RadioLondres

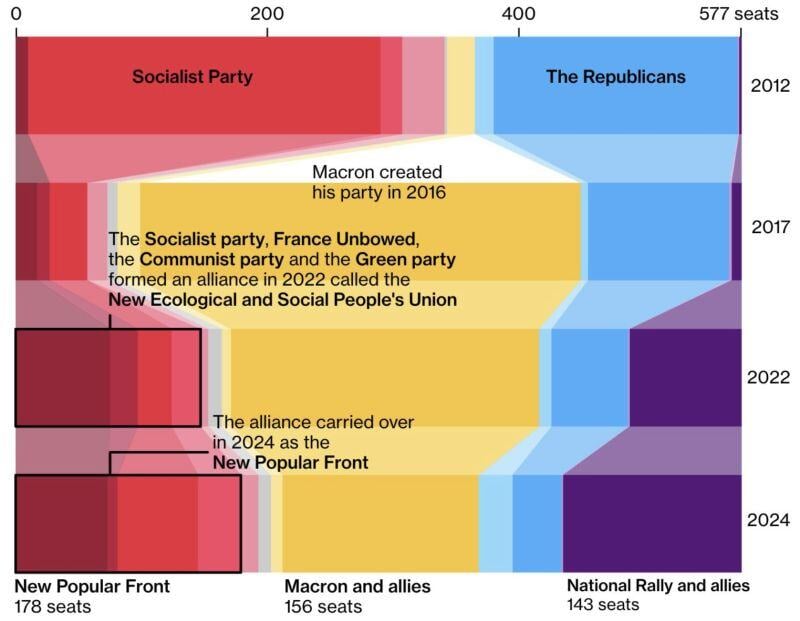

Macron’s Rise and Fall in one chart: at first, he kicked out opposition coming from the traditional right and left parties.

Fast forward to 2024 and the parliament is in gridlock with Macron's Renaissance being stuck between left and far-right. French assets could feel more pressure in the near-term -- even in the case of a hung parliament -- after the Nouveau Front Populaire came out on top in a second round of parliamentary elections. Its fiscal expansion and anti-business program could push the French-German yield spread back toward 80-85 basis points and weigh on all companies with a large exposure to hashtag#France. Source: Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks