Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

BREAKING 🚨: U.S. Treasury

U.S. Treasuries are now paying out $2 million per minute! Source: Barchart

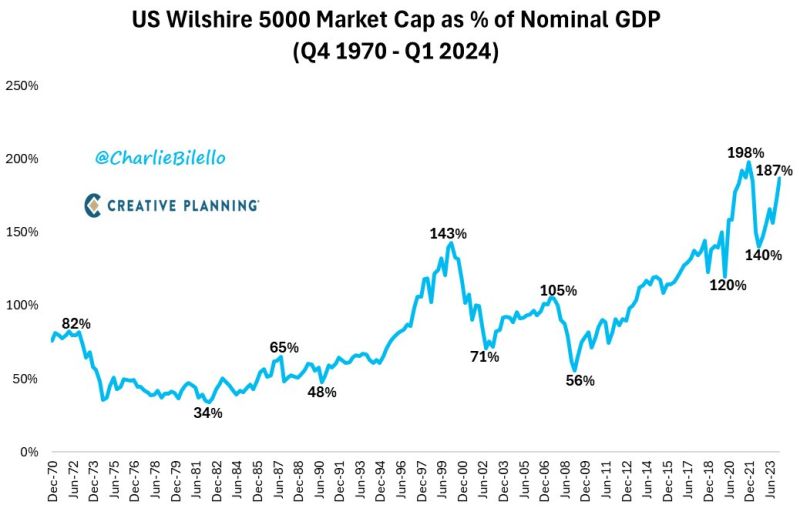

US Stock Market Capitalization as % of GDP...

1984: 42% 1994: 63% 2004: 93% 2014: 114% 2024: 187% Source: Charlie Bilello

“If you cannot control your emotions, you cannot control your money.”

— Warren Buffett Andrew Lokenauth | TheFinanceNewsletter.com

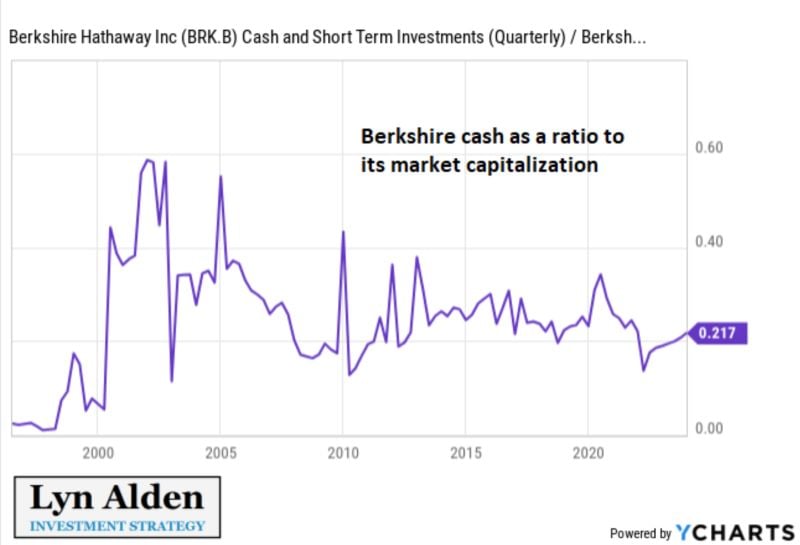

As highlighted by Lyn Alden ->

"People often report the nominal amount of cash that Berkshire $BRK.B has, as though Buffett is hoarding cash. You can't just look at the nominal cash level. All of Berkshire's numbers go up. An insurer needs a lot of liquidity. His cash as a % of his assets is in a normal range".

Investing with intelligence

Our latest research, commentary and market outlooks