Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

BREAKING: Binance ex-CEO CZ Zhao sentenced to FOUR months in prison.

Former Binance CEO Changpeng "CZ" Zhao was sentenced to four months in prison Tuesday, punished after pleading guilty to money laundering violations last year. Zhao founded Binance in 2017, and under his leadership, the company grew into crypto’s largest exchange by trading volume—cementing Zhao’s presence as a key business figure in the nascent crypto industry. But the former CEO was forced to step down from Binance last November as part of a $4.3 billion settlement between him, the exchange, and U.S. law officials. U.S. Justice Department officials said that Zhao created a company culture in which Binance’s growth was prioritized over compliance with U.S. financial rules. By serving American customers without the proper controls in place, funds linked to virtual theft and terrorism were able to flow through Binance undetected, officials said. Source: Decrypt

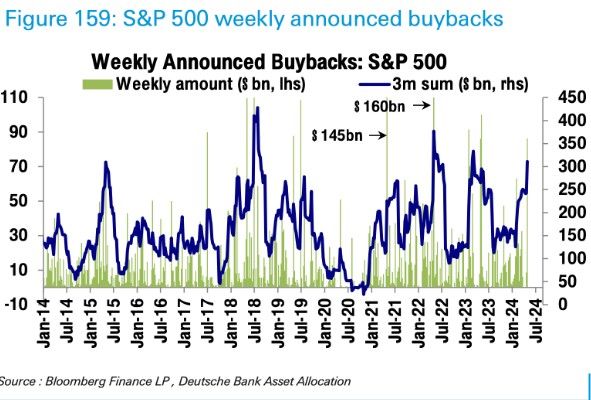

Halfway thru earnings season and buyback announcements are ticking up..

DB notes $85B announced last week. Source: DB

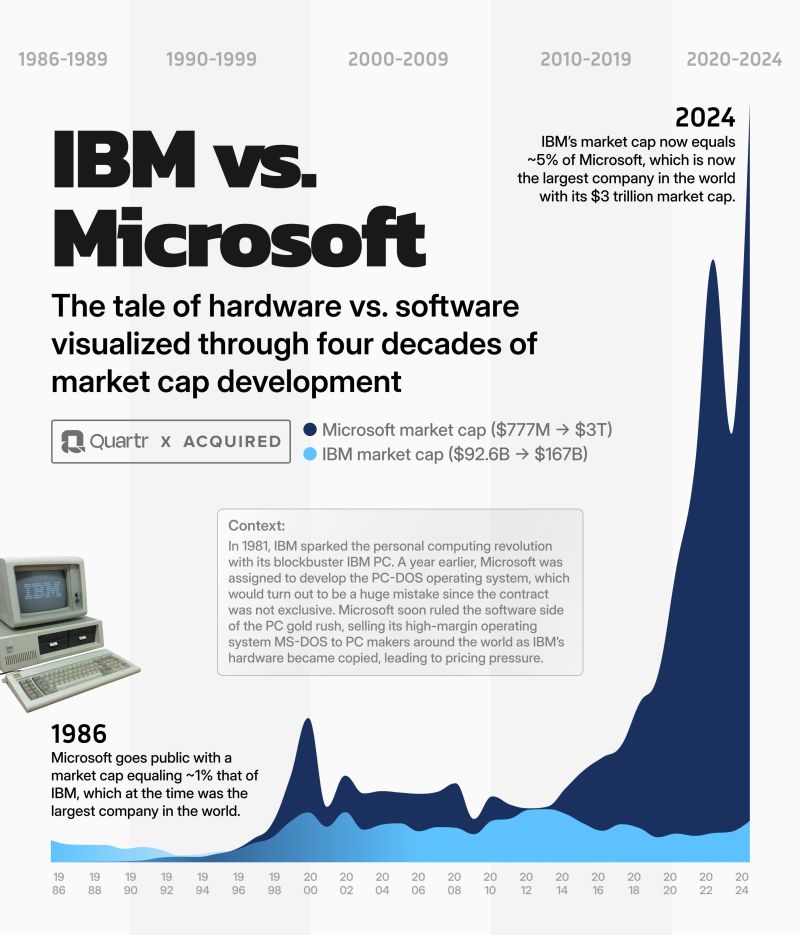

The tale of hardware vs. software visualized through four decades of market cap development by Quartr

Four intriguing facts: → In 1981, $IBM sparked the personal computing revolution with the release of its blockbuster IBM PC. → $MSFT was assigned to develop the operating system under a non-exclusive deal, instantly catapulting the company into a market-leading position in software. → In 1986, Microsoft went public with a market cap equaling 1% of IBM's, which at the time was the largest company in the world. → IBM's market cap now equals ~5% of Microsoft's, which now is the largest company in the world with a market cap exceeding $3 trillion.

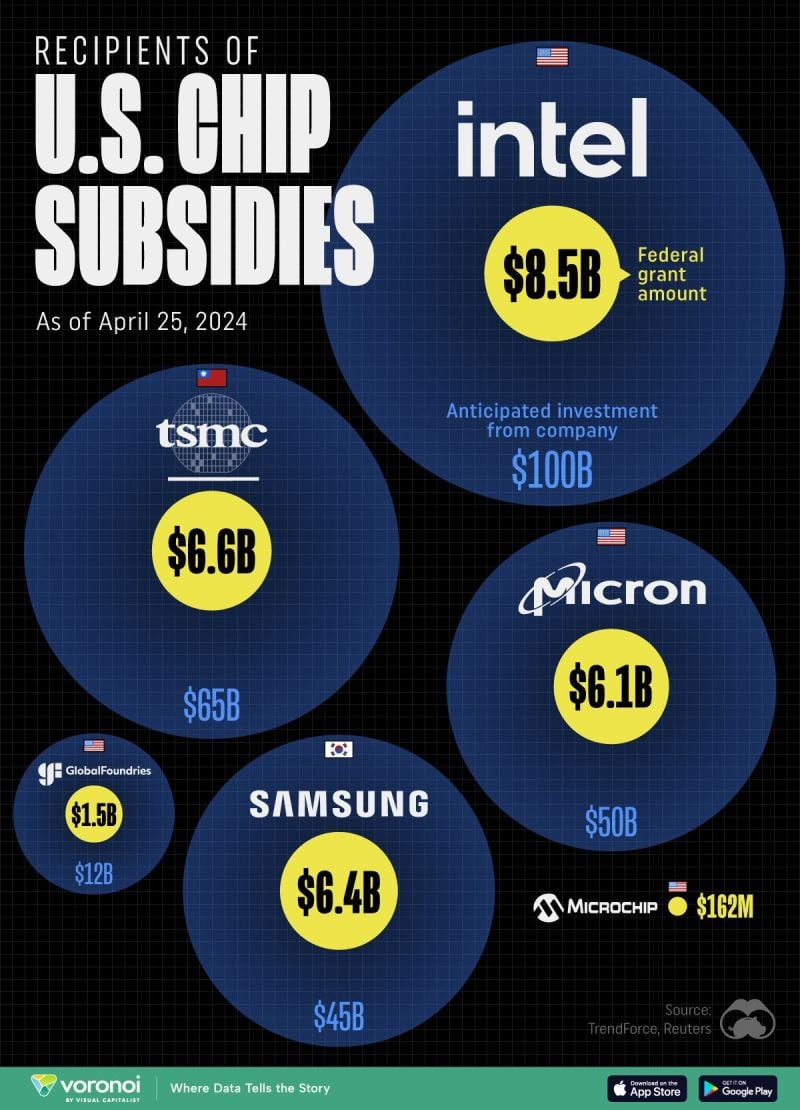

All of the Grants Given by the U.S. CHIPS Act 💻️

Source: Visual Capitalist

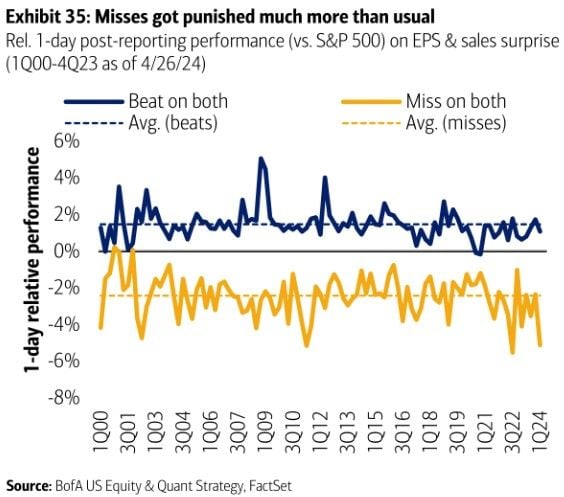

US earnings season update >>>

Double beats are being rewarded by less than the historical average while double misses are being punished by more than usual. Source: BofA

Investing with intelligence

Our latest research, commentary and market outlooks