Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Just a friendly reminder that experts are not always right

Source image: Michel A.Arouet

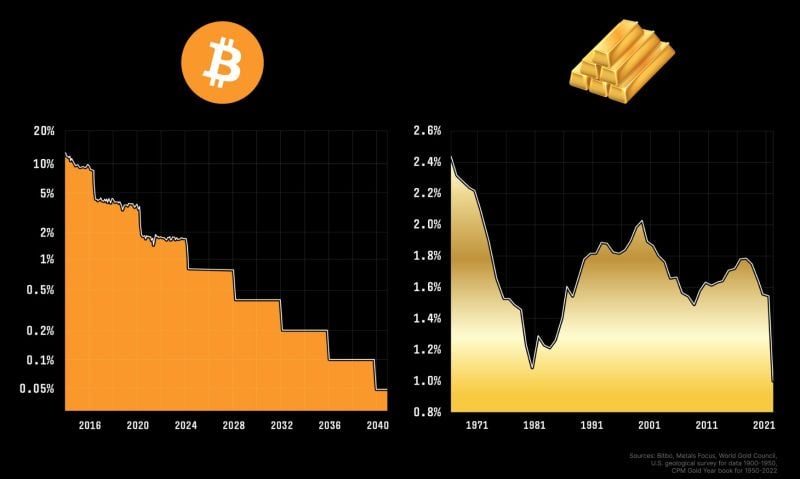

Have a look at the yearly Gold Forecast based on Bloomberg:

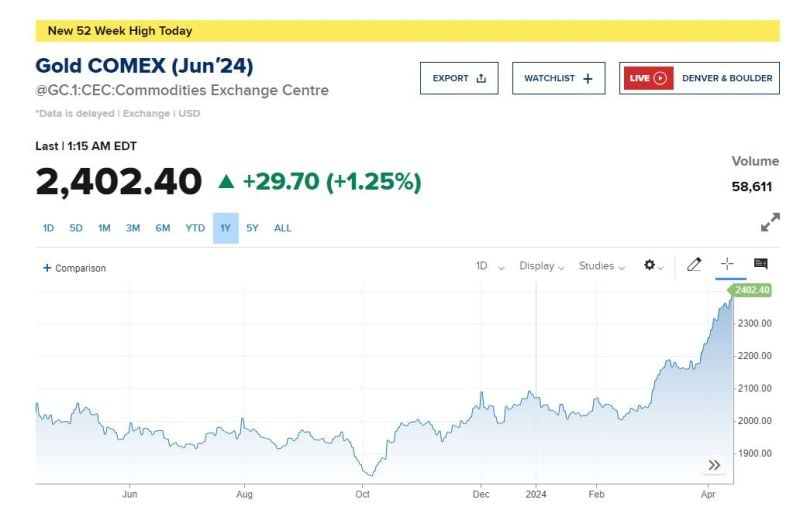

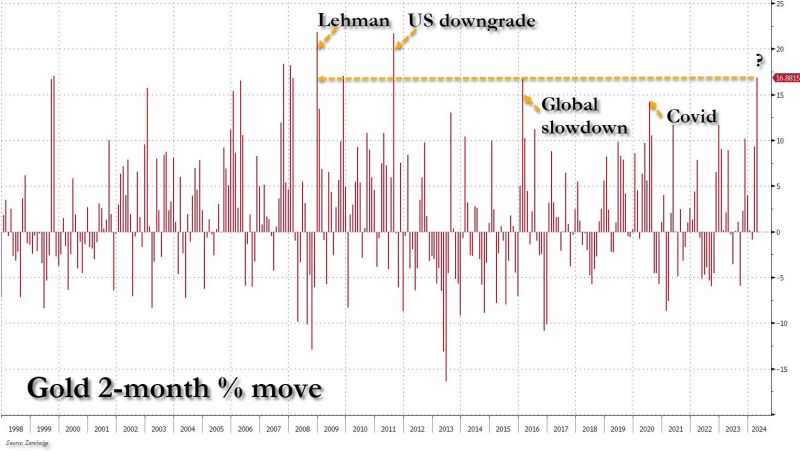

Highest forecast for 2024: 2,260, Median: 2,050 Highest forecast for 2025: 2,220, Median: 2,050 Highest forecast for 2026: 2,280, Median: 1,887 Highest forecast for 2027: 2,350, Median: 1,807 Consensus doesn't look optimistic at all on gold. We are far from bubble territory. Is the bull market just starting? Source: Ronnie Stoeferle

Just In: Gold rising to new all-time highs above $2,400 per ounce

for the first time in history.

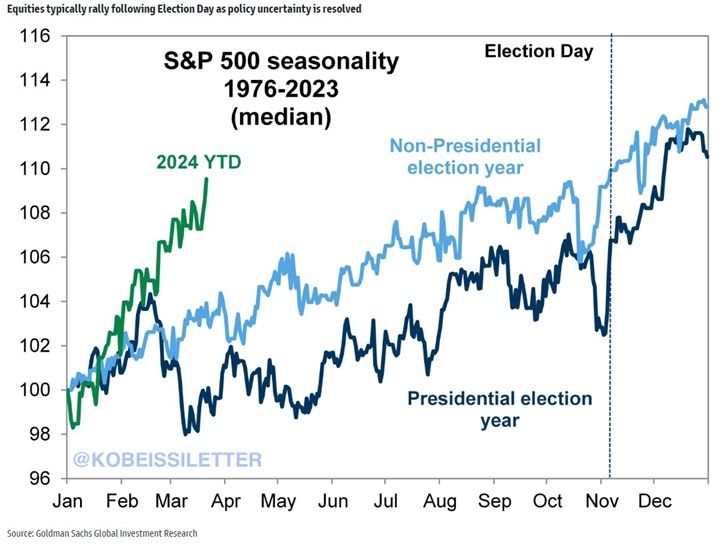

The S&P 500's performance has been truly outstanding this year.

The index is up 9% year to date which is more than DOUBLE the average YTD return in an election year. In the past, the median return during a US presidential election year was about 11%. There are still several months until the presidential election but the index is on track to significantly exceed its historical performance. Source: The Kobeissi Letter

BREAKING 🚨: St. Louis Commercial Real Estate

The Former AT&T Building in St. Louis just sold for $3.6 million. In 2006, it sold for $205 million. A total loss of more than 98%. Source: Barchart

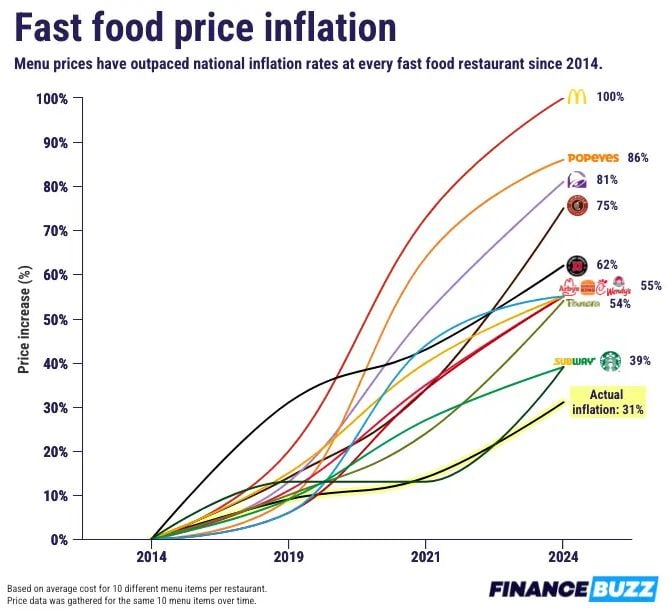

Price increases over last decade...

McDonald's: +100% Popeyes: +86% Taco Bell: +81% Chipotle: +75% Jimmy John's: +62% Arby's: +55% Burger King: +55% Chick-fil-A: +55% Wendy's: +55% Panera: +54% Subway: +39% Starbucks: +39% US Government Reported Inflation (CPI): +31% Source: Charlie Bilello

Investing with intelligence

Our latest research, commentary and market outlooks