Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

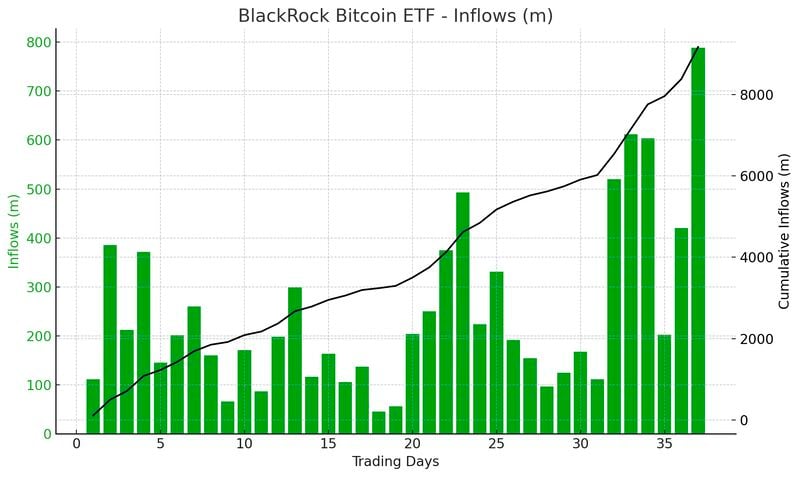

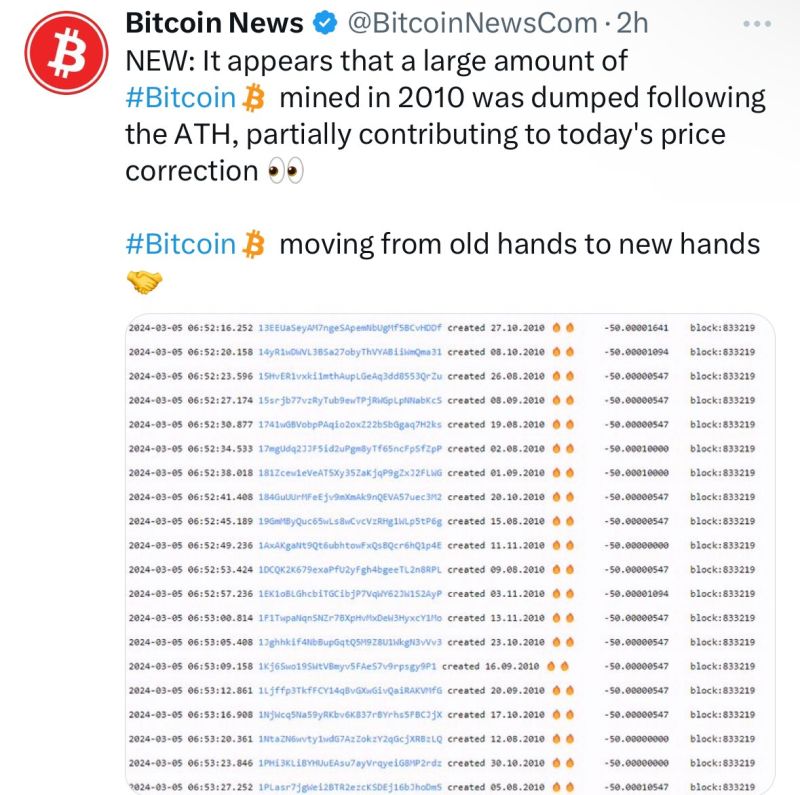

BlackRock's Bitcoin ETF pulled in a MASSIVE $788m yesterday.

It smashed the previous record of $612m. They could be taking in +$1 Billion a day soon. Source: Bitcoin archive

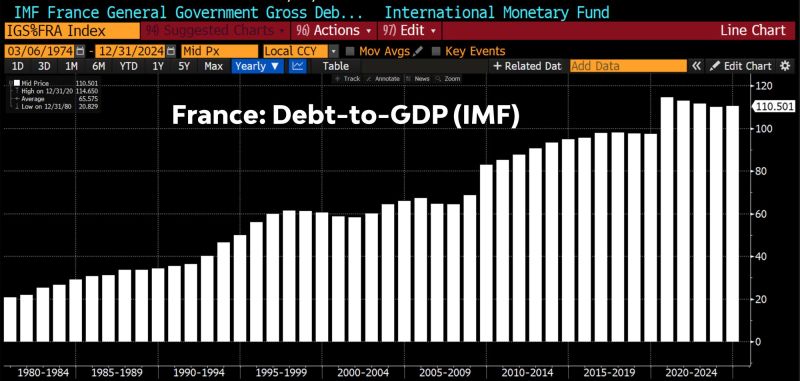

France's 2023 Deficit 'Significantly' Above 4.9%' (BBG)

France's budget (in)discipline... Since the Great Financial Crisis in 2008, France managed to keep its budget deficit below the 3% threshold (remember the Maastricht Treaty) just once (2018). This is far worse than Italy. France's debt-to-GDP ratio is at 110%, up from 64% pre-financial crisis. With potential GDP growth at a paltry 1% and declining, structurally low interest rates is needed to keep the debt burden afloat. Source: Jeroen Blokland, Bloomberg

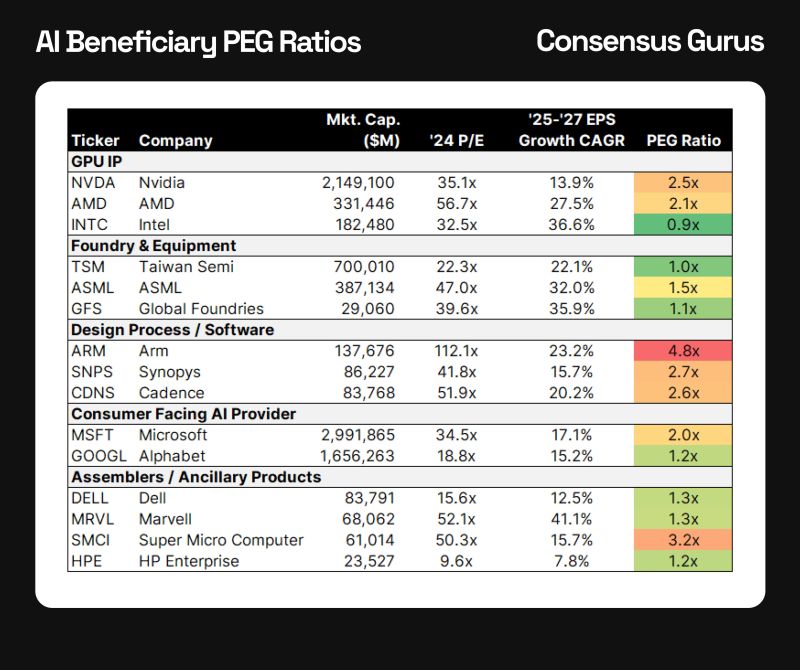

AI Beneficiary PEG Ratios - Locating the Value

Will nvidia $NVDA really plateau at 14% earnings growth after this year? Will arm $ARM come back to earth or will earnings rocket? Source: Consensus Guru

ouch... too bad... a sign that we are late-cycle?

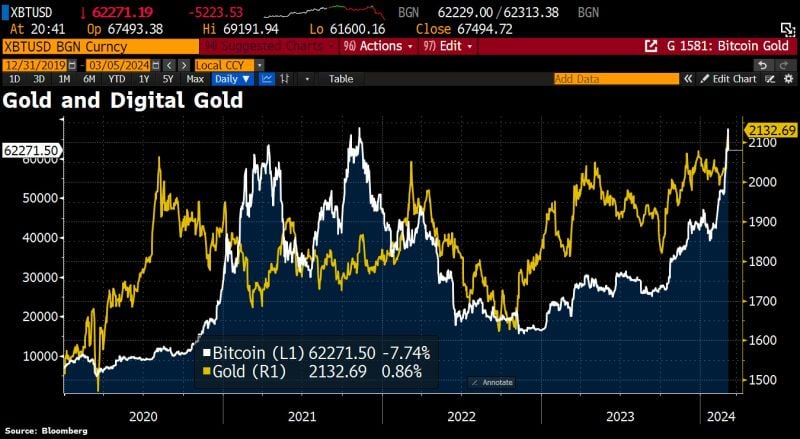

A bitcoin effect? Or just a remainder of the power of scarcity ?

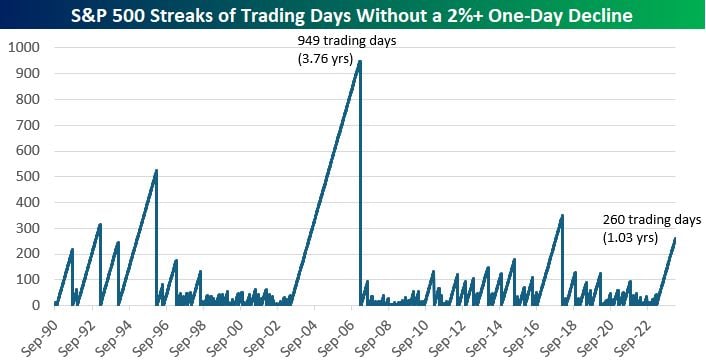

It has now been over a year since the S&P 500 had a one-day drop of 2%+.

- 3rd longest streak since 2000. - The S&P went 949 trading days (3.76 years!) from 5/19/03 to 2/26/07 without a one-day drop of 2%+. Source: bespoke

Investing with intelligence

Our latest research, commentary and market outlooks