Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

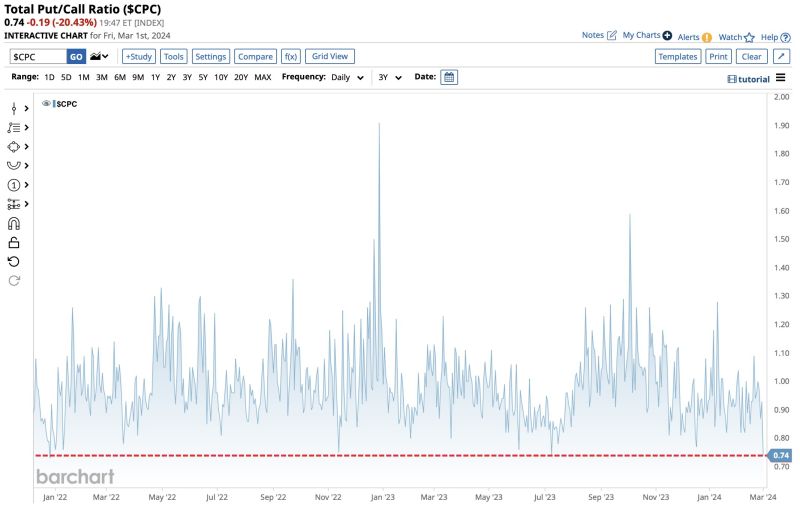

Total Put/Call Ratio drops to 0.74, the lowest level since December 28, 2021 👀 Retail continues to YOLO calls

Source: barchart

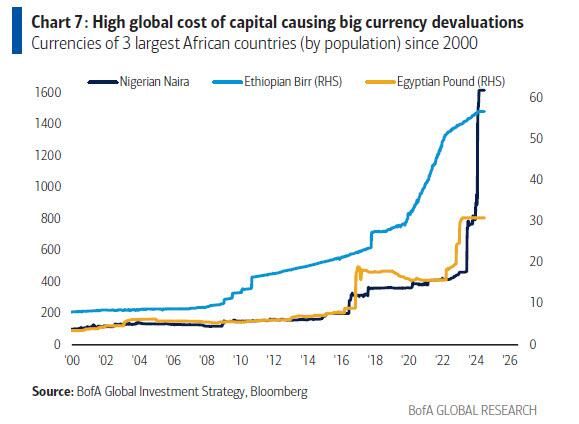

High global cost of capital hurts weak global balance sheets

Pakistan, Nigeria, Ethiopia, Egypt, DRC, Iran, Türkiye, Argentina account for 12% of world population (>1bn people) and they are all hit by inflation rates >30% (Argentina 250%, Türkiye 60%, DRC 50%), interest rates >20% & pressure of currencies. Source: BofA

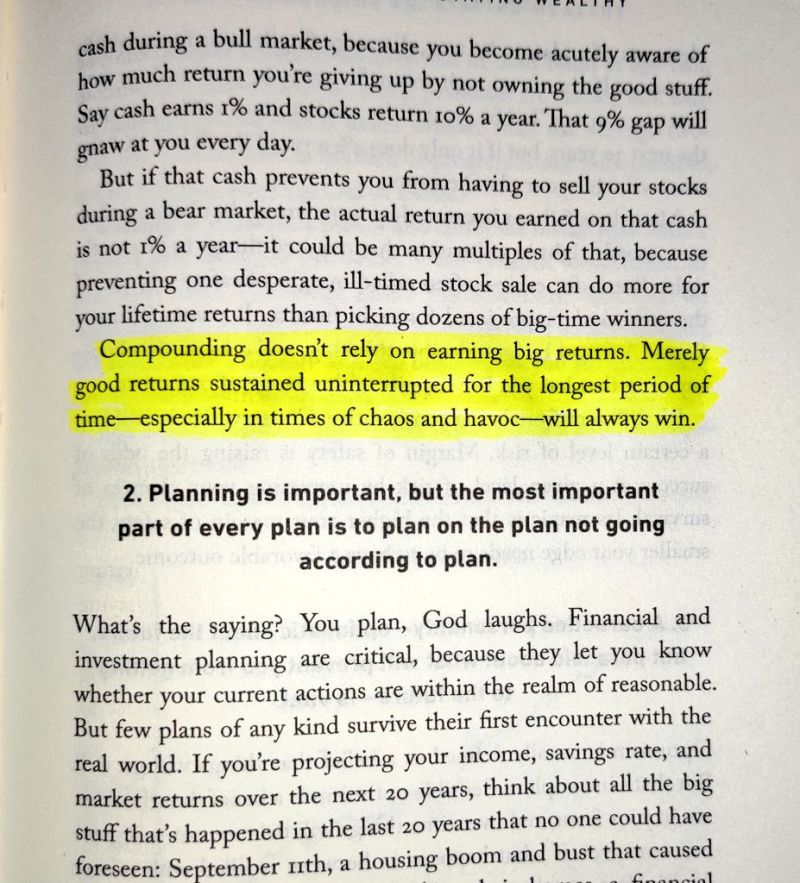

Compounding doesn't rely on earning big returns

Merely good returns sustained uninterrupted for the longest period especially in times of chaos and havoc-will always win Source: Investment books (Dhaval)

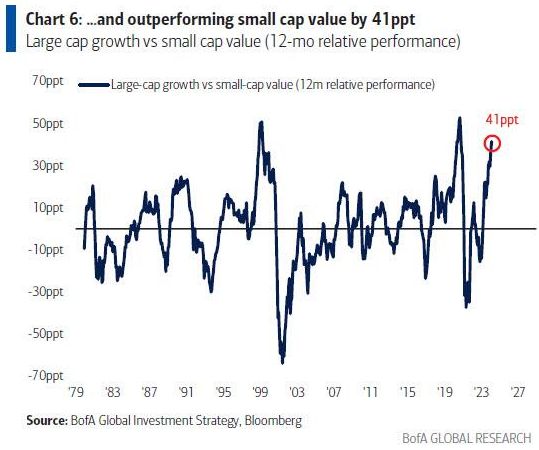

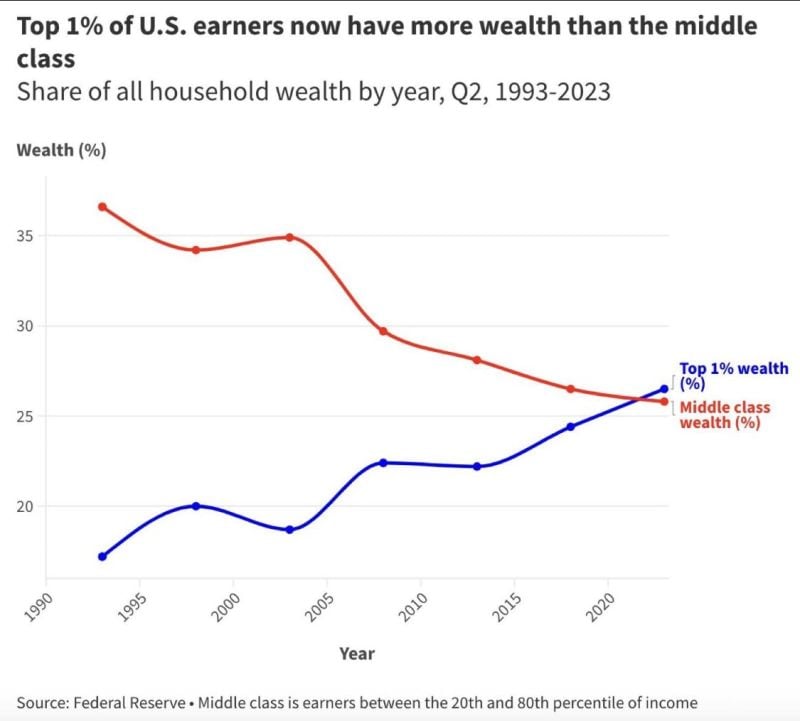

Wealth inequality keeps rising

The Top 1% of US earners now have more wealth than the middle class

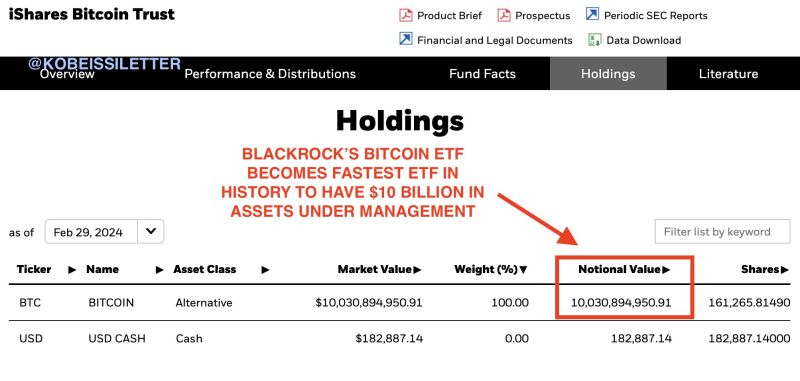

BREAKING: BlackRock's Bitcoin ETF, $IBIT, hits a record $10 billion in assets under management

This is the fastest an ETF has hit $10 billion in assets under management, at 37 trading days. Just ~4% of all ETFs have reached the $10 billion mark. More history made by Bitcoin. Source: The Kobeissi Letter

Eurozone CPI slowed less than anticipated in Feb, highlighting stickiness in inflation

Headline inflation eased to 2.6% YoY in Feb, above 2.5% consensus estimate in BBG survey. Core inflation came down by 0.2%-pt to 3.1%, also an upward surprise compared to 2.9% consensus estimate. Source: Bloomberg

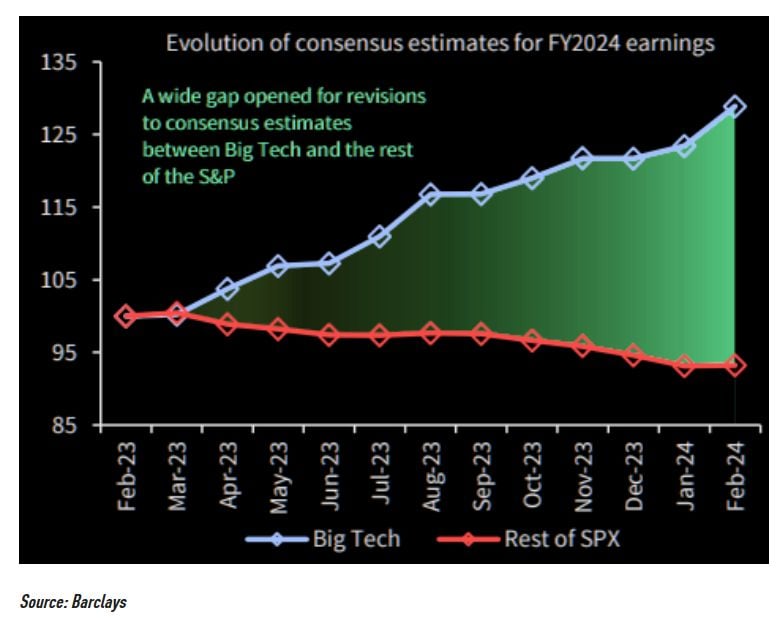

Thanks God for tech! Big tech is the only space seeing upward revisions

Source: TME, Barclays

Investing with intelligence

Our latest research, commentary and market outlooks