Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

There's two hotbeds for re-export of western goods to Russia in Central Asia and the Caucasus: Armenia (top left) and Georgia (bottom left).

Armenia stands out for massive direct exports to Russia (black), Georgia for a huge surge in exports to Russia's satellite economies blue). Source: Robin Brooks

On Wednesday, Nvidia, $NVDA, will report their Q4 2023 earnings results.

Since their last earnings report, on November 21st, the stock has gained an incredible 45% in value. Over these 3 months, the stock has added $600 BILLION in market cap. In other words, Nvidia has added an average of $10 billion PER TRADING DAY since their last earnings report. Can Nvidia continue its historic run? Source: The Kobeissi Letter

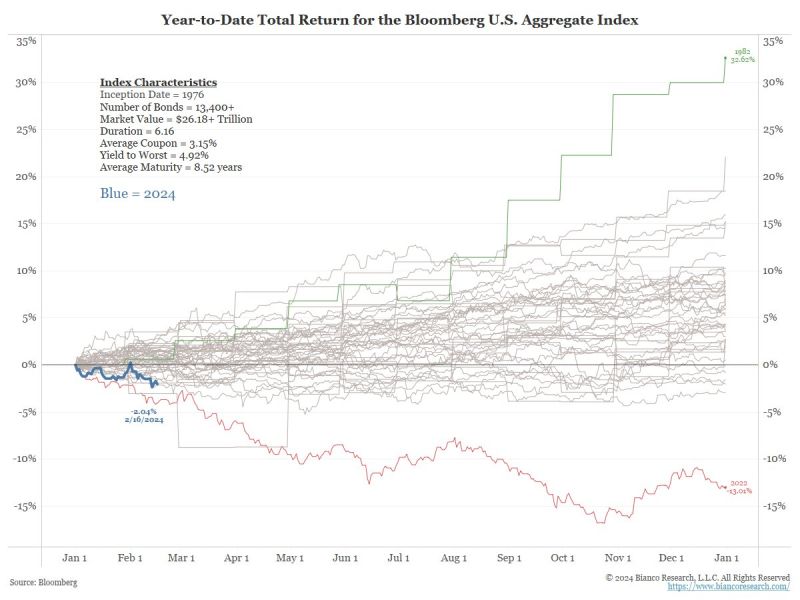

Six weeks into 2024, the bond market is struggling ... again.

YTD total return (through Feb 16) of the Bloomberg Agg Bond Index is -2.04% (blue line). Only 1980, 2018, and 2022 had a worse start. (Data started in 1976, so this is the 49th year of data). Source: Jim Bianco, Bianco Research

This chart vividly shows the pronounced overvaluation of US equities versus the rest of the world.

It's important to emphasize that price-to-book is just one metric for comparison. Source: Bloomberg, Tavi Costa

Mag 8: Could Eli Lilly $LLY be the first trillion dollar pharma stock?

$LLY price performance has significantly outpaced the Mag 7 YTD. Source: Factset, TME

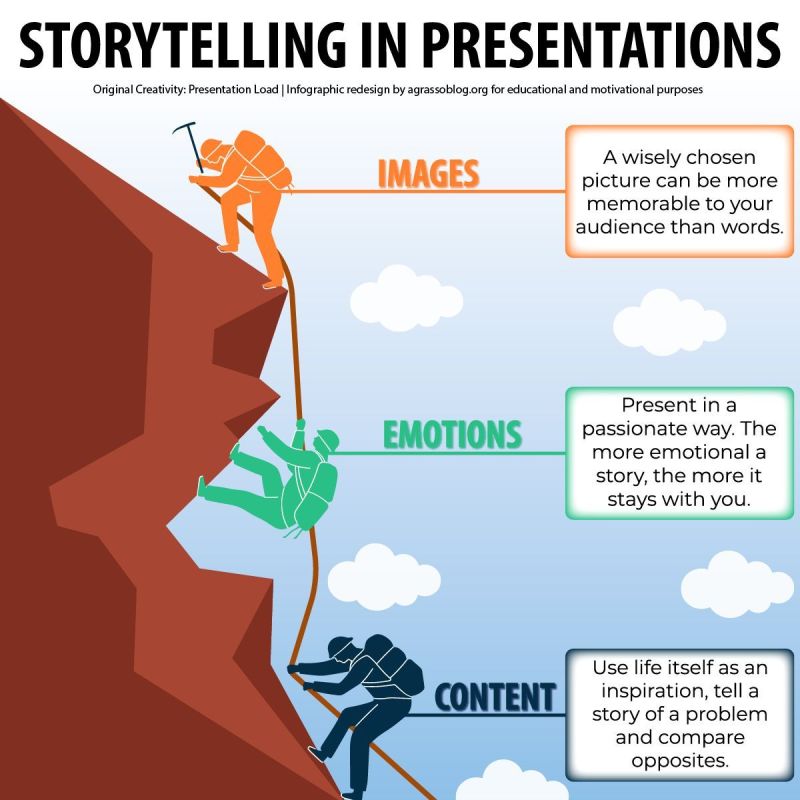

Storytelling is a powerful tool in presentations.

It connects ideas to emotions, making lessons memorable. Source: agrassoblog.org

Investing with intelligence

Our latest research, commentary and market outlooks