Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

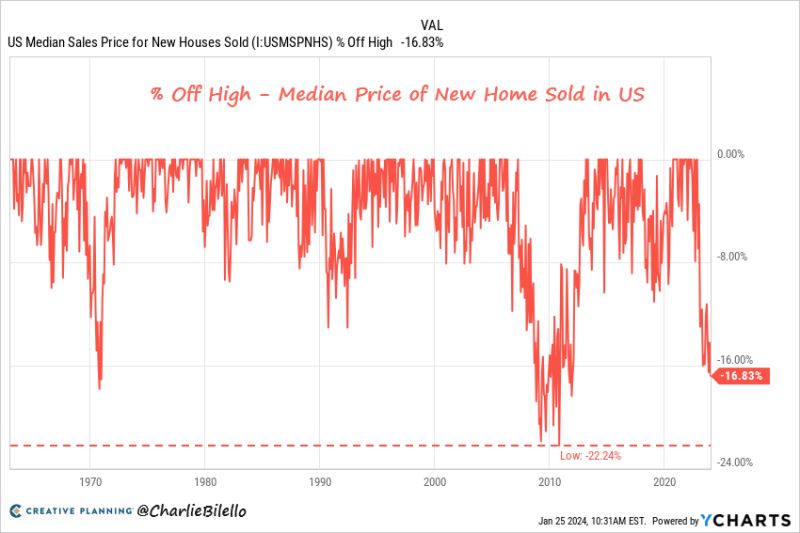

The median price of a new home sold in the US is down 17% from its peak in October 2022 (from $496,800 to $413,200)

After the last housing bubble peak the median new home price fell 22% nationally before bottoming. Source: Charlie Bilello

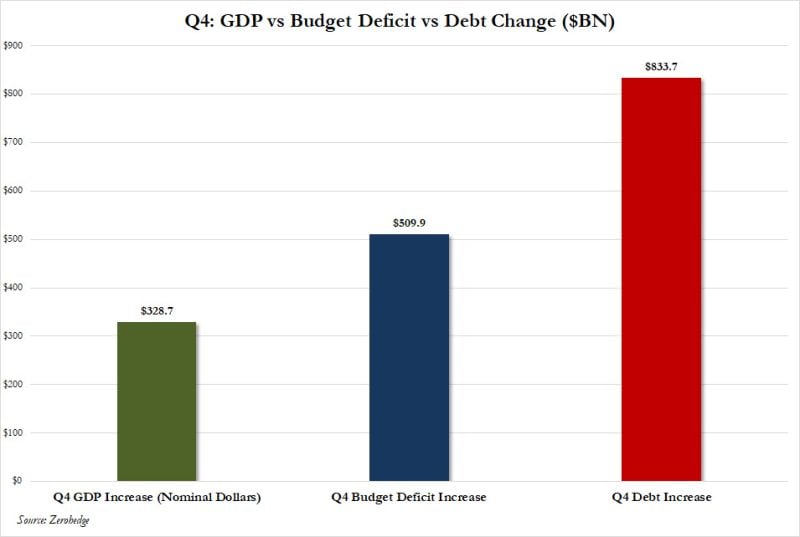

Gross domestic product data showed the U.S. economy grew at a rate of 3.3% in the fourth quarter

That’s much higher than the 2% expectation from economists polled by Dow Jones, underscoring continued economic resiliency despite interest rate hikes from the Federal Reserve. The result, for better or worse, speak for themselves: while Q4 GDP rose by $329 billion to $27.939 trillion, a respectable if made up number, what is much more disturbing is that over the same time period, the US budget deficit rose by more than 50%, or $510 billion. And the cherry on top: the increase in public US debt in the same three month period was a stunning $834 billion, or 154% more than the increase in GDP. In other words, it now takes $1.55 in budget deficit to generate $1 of growth... and it takes over $2.50 in new debt to generate $1 of GDP growth! Source; www.zerohedge.com

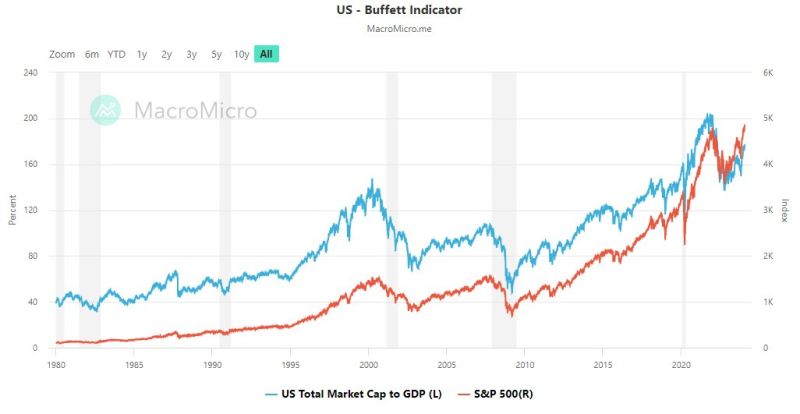

The Buffett Indicator (total value of all publicly-traded stocks/GDP) is near all-time highs and at a significantly higher level than during the Dot Com Bubble and the Global Financial Crisis.

Source: Macro Micro, Charlie Bilello

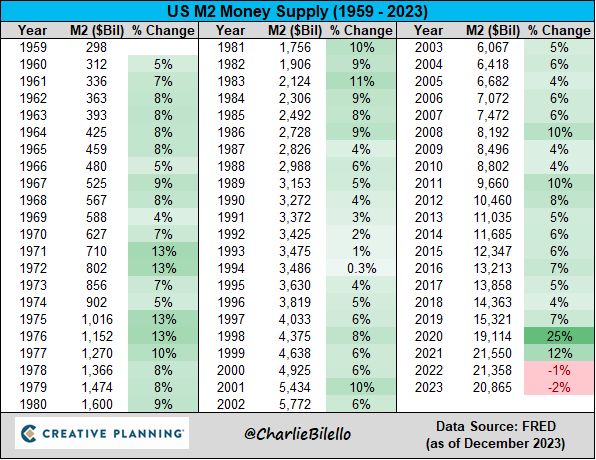

The US Money Supply decreased by 2% in 2023, the largest annual decline on record with data going back to 1959

This was the second straight annual decline which followed the record 40% expansion in the money supply in 2020-21. Source: Charlie Bilello

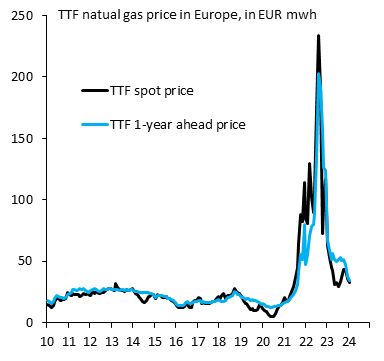

European natural gas prices have fallen massively from 2022 levels, so why is German manufacturing doing so badly?

Because - even with all the declines since 2022 - naturalgas prices are over 60% ABOVE their historical averages. That's a huge adverse energy shock hitting Europe. Source: Robin Brooks

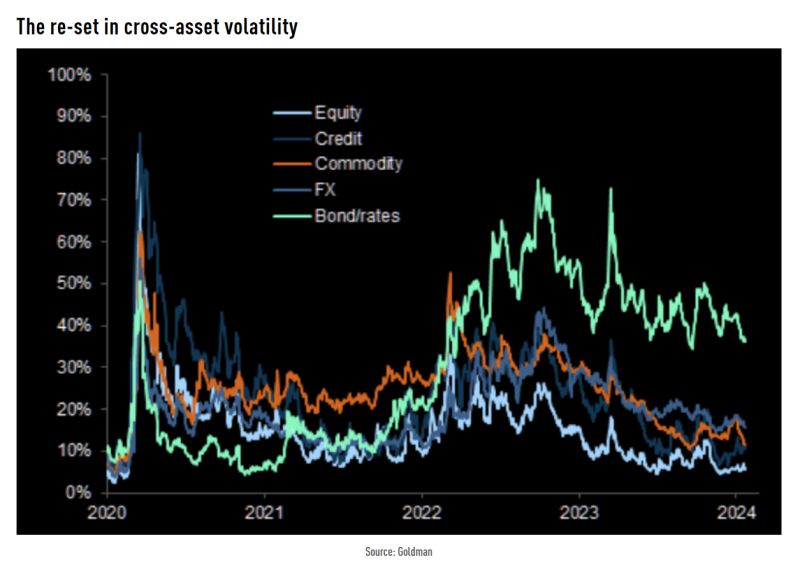

Average 3-month ATM implied volatility (max/min range since 2008)

.

Investing with intelligence

Our latest research, commentary and market outlooks