Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

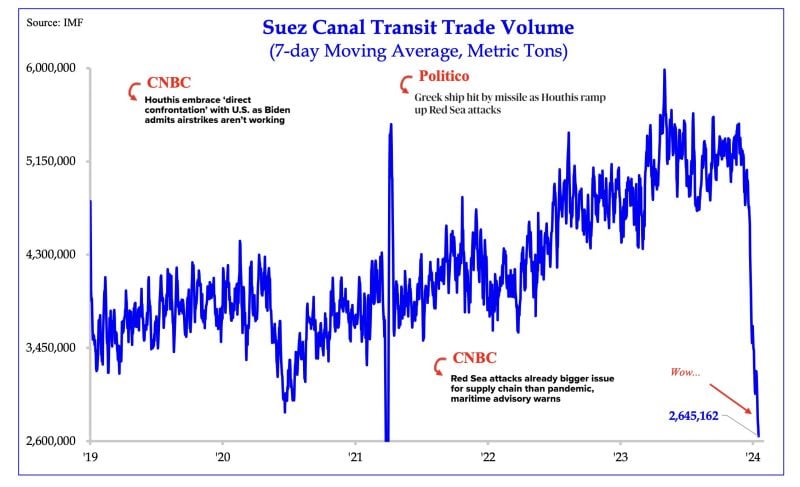

Suez Canal Transit Volume continues to plunge (Chart via SRP)

Source: HolgerZ

A tale of 2 markets: The sp500 closed at an all-time high. But the Russell 2000 is still in a bear market, down more than 20% from its high

That's never happened before. Source: Bloomberg, Jason Goepfert

This is true today more than ever.

Never forget: 🚨🚨🚨 Source: Wall Street Silver

CBOE Volatility Index $VIX jumps to highest level in more than 2 months

Source: Barchart

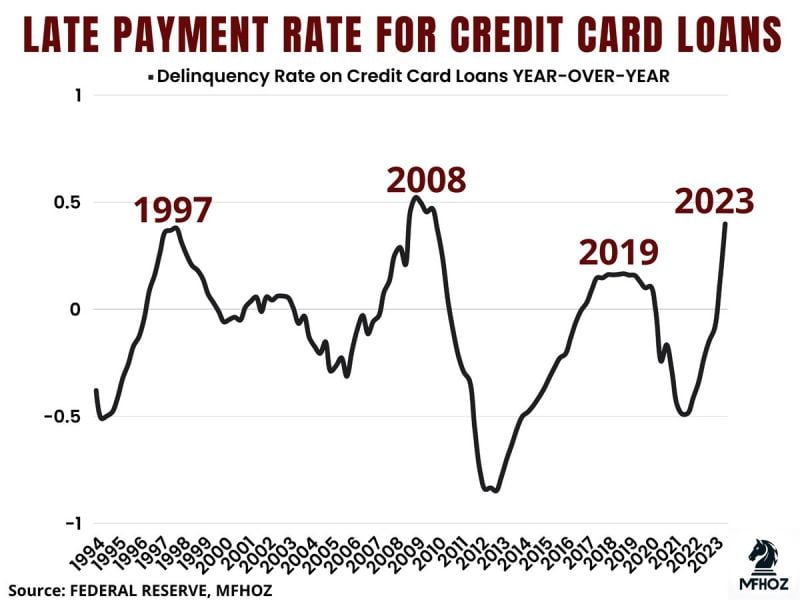

🟥 The delinquency rate for credit card loans in 2023 has risen sharply

Which, based on historical patterns, suggests that the economy might be heading towards a recession.

You've probably heard Chinese stocks are cheap. This chart takes that to a whole new level.

The Hang Seng Index's P/E is now below the Nasdaq's P/B. Those two valuation ratios should not even be anywhere close one another. Source: David Ingles, Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks