Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

"The measure of intelligence is the ability to change" -Albert Einstein

Source: Yasin Arafeh

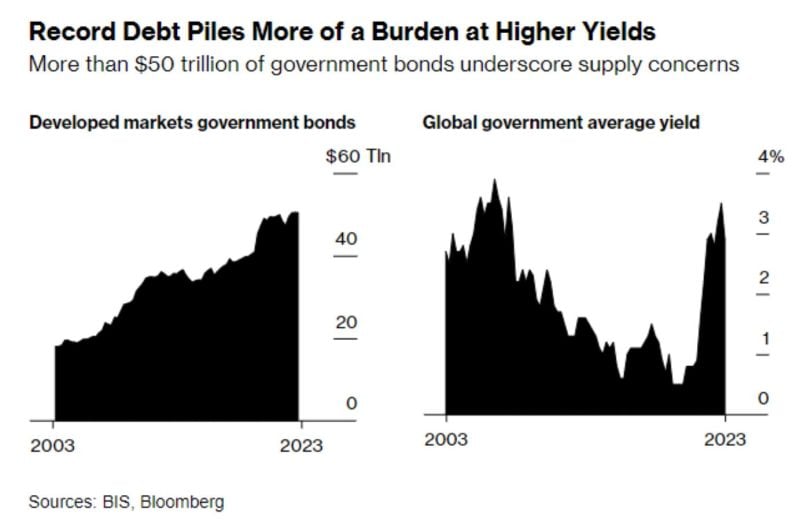

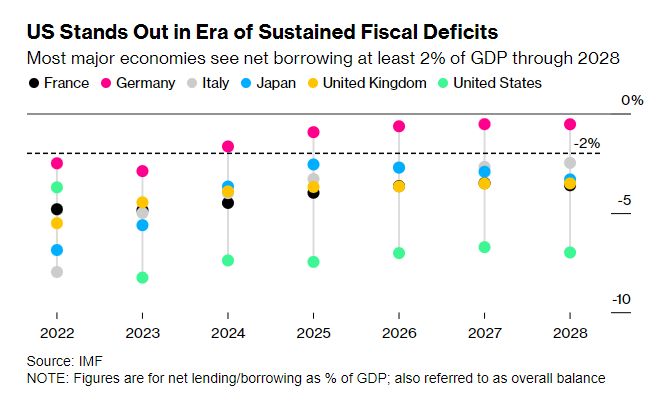

While G7 claims can offer short-term tactical opportunities, soaring G7 debt levels at the the of high yields mean that the long-term risk-reward remains unattractive.

Source chart: Bloomberg

Over the next several weeks, governments from the US, UK and the eurozone will start flooding the market with bonds at a clip rarely seen before

Saddled with the kind of bloated deficits that were once unthinkable, these countries — along with Japan — will sell a net $2.1 trillion of new bonds to finance their 2024 spending plans, a 7% increase from last year, according to estimates from Bloomberg Intelligence.

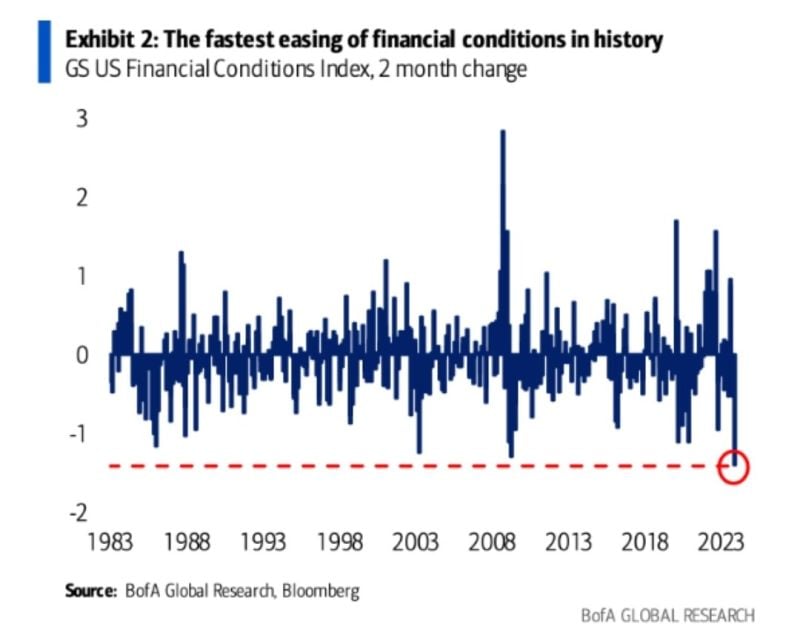

FASTEST easing of Financial Conditions in HISTORY

Source: WinSmart, BofA

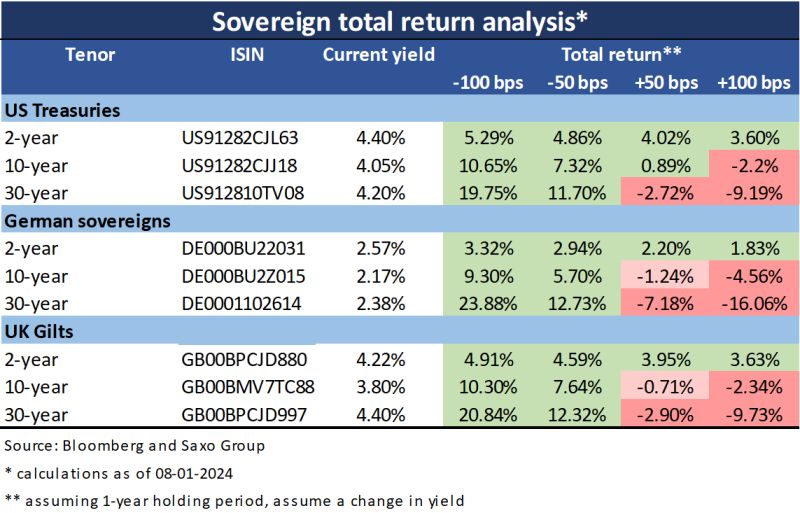

Total return bond analysis update

Source: Althea Spinozzi, Saxo, Bloomberg

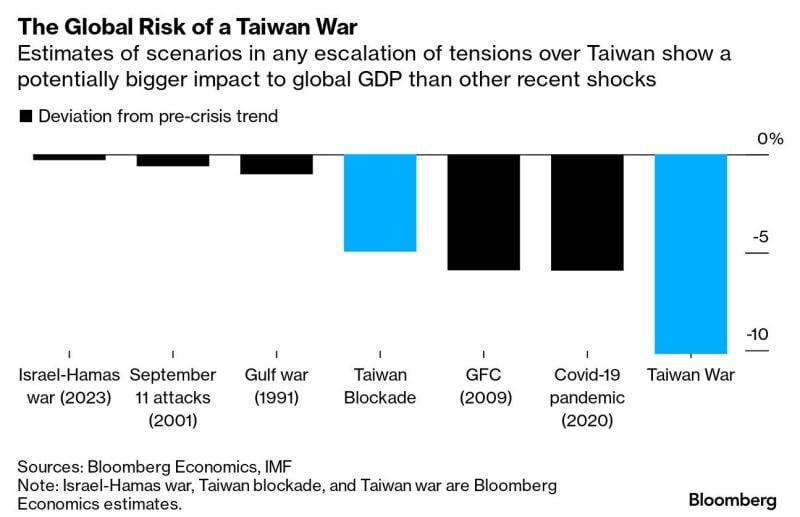

Is Taiwan risk the biggest risk for the economy and financial markets in 2024? See below a scary chart by Bloomberg

Source: Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks