Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

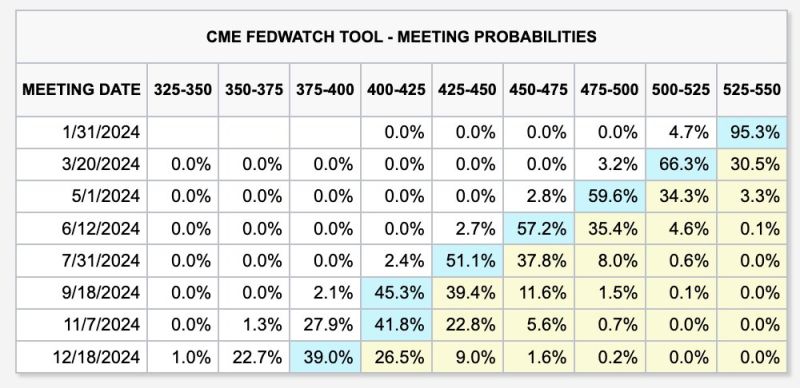

Fed member Bostic just said that he sees just 2 interest rate cuts in 2024 for a total of 50 basis points

As highlighted by the Kobeissi Letter -> This ONE THIRD the amount of rate cuts that futures are currently pricing-in. Bostic also said that he is "not comfortable declaring victory" against inflation at this point. Meanwhile, markets see a base case of 150 basis points in rate cuts in 2024. There is even a ~24% chance of 175 basis points in rate cuts. The Fed to market disconnect is widening. Source: The Kobeissi Letter

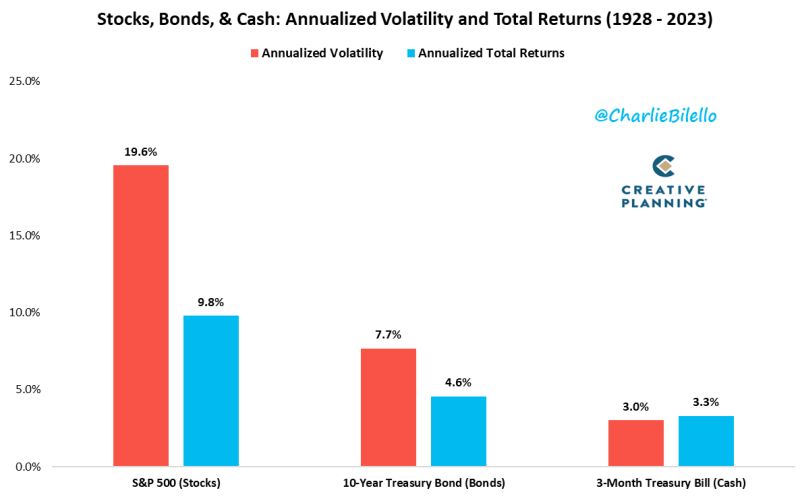

Why investors should embrace risk in one chart by Charlie Bilello:

Annualized Volatility since 1928... Stocks: 19.6% Bonds: 7.7% Cash: 3.0% Annualized Returns since 1928... Stocks: +9.8% Bonds: +4.6% Cash: +3.3%

Bank of America Corp. expects the Federal Reserve to announce plans to begin tapering the runoff of its Treasuries holdings in March, coinciding with its first 25 basis points interest-rate cut.

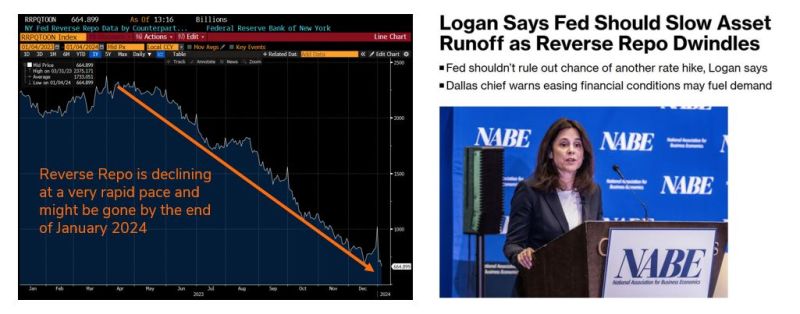

- The Reverse Repo ("RRP") is de facto QE-infinity $ printed during 2020-21 that was sitting dormant. It's now being used to buy up US Treasuries. Problem: it is declining at a very rapid pace and might be gone by the end of January 2024. - Something needs to be done to preserve QB / liquidity. - This is why the Fed is now thinking about slowing down the pace of QT. Over the week-end, Dallas Fed chief Logan said the Fed should slow Asset runoff as Reverse Repo dwindles - 2024 is an election year and we expect net liquidity to be supportive for the economy, bond markets and risk assets

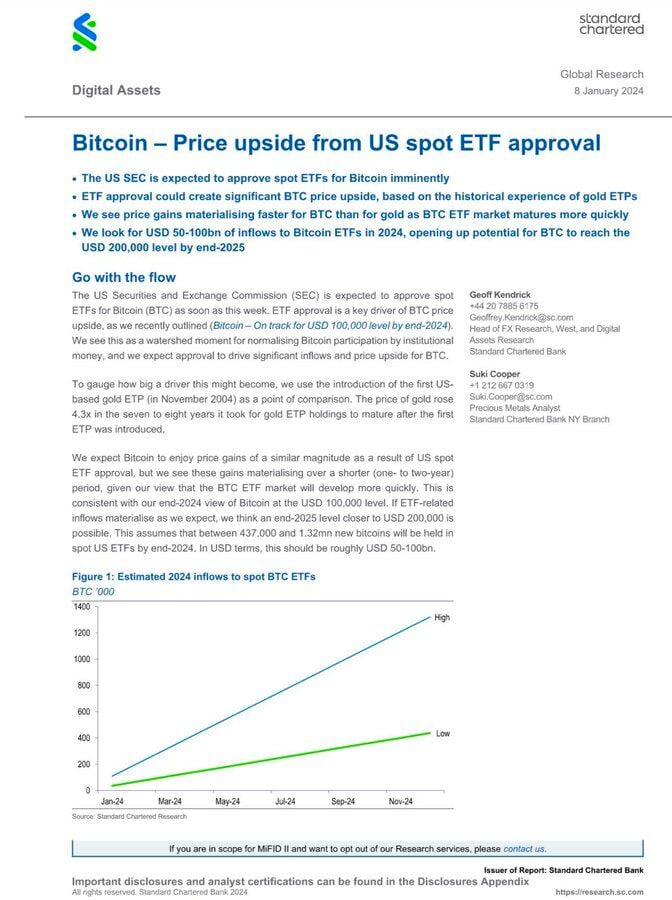

BREAKING bitcoin spot ETF: the fee war has begun

Bitcoin ETF applicants are filing last-minute amendments to lower their fees 👀 BlackRock's lowered to 0.30% 👀 ARK lowered lowered to 0.25% 👀 Wall Street is competing to offer cheap access to $BTC... Source: The Kobeissi Letter, Bitcoin Magazine

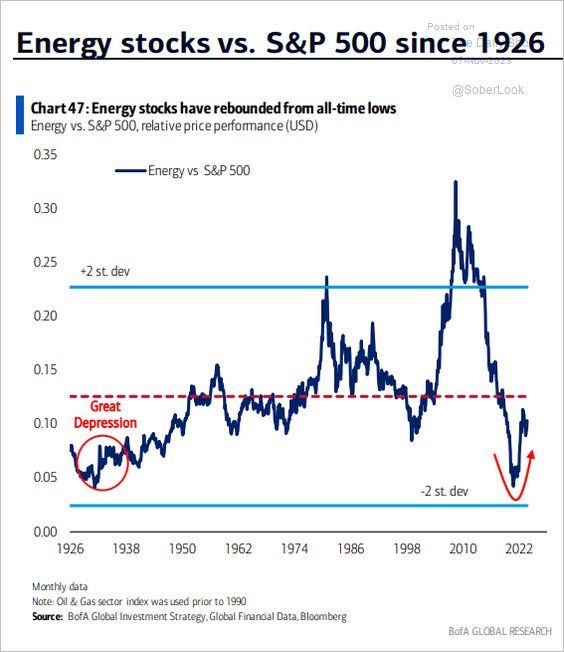

ENERGY STOCKS SINCE 1926 (relative to S&P)

Source: BofA, The Daily Shot

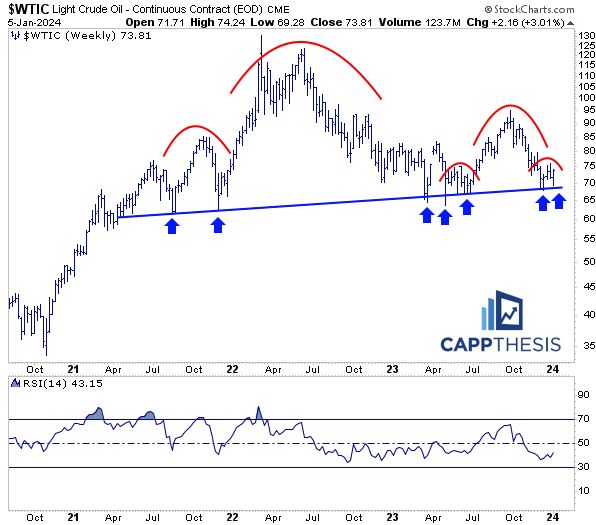

A topping pattern on crudeoil? Or simply finding support at a long-term trendline before a move higher? This one needs to be watched closely

A great chart from Frank Cappelleri thru Ryan Detrick, CMT.

The "multipolar world" will remain a major topic in 2024 as the rewiring of the global commerce system creates geopolitical risks & business model shifts that will last decades

The Dollar’s & Euro's share in global CenBank reserves dropped. Greenback accounted for 59.2% of globally allocated FX reserves in Q3 2023, down from a revised 59.4% in Q2, lowest since Q4 2022. Euro’s share in reserves also fell to 19.6% from 19.7%, while the participation of Japan's Yen rose to 5.5% from 5.3%. Source: HolgerZ, Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks