Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

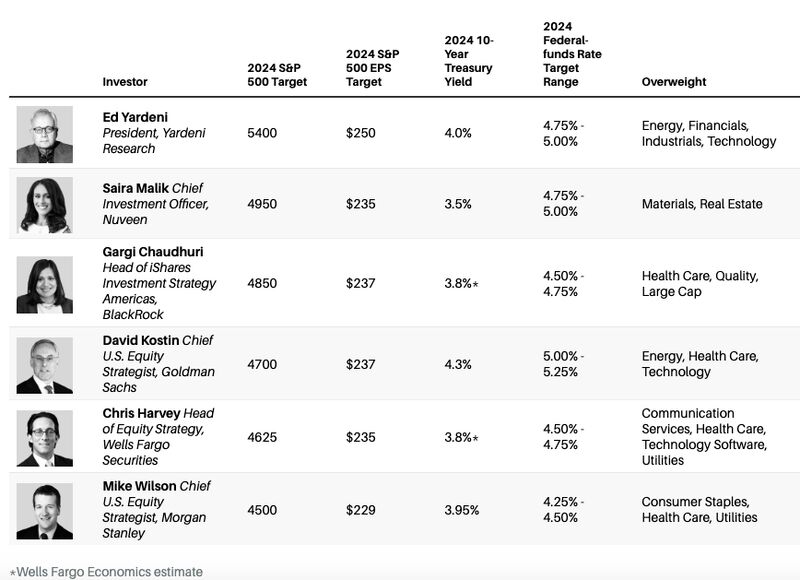

The average market strategist's 2024E S&P 500 target is 4837 with EPS of $237 for a return of 2.5% (excluding dividends) and a P/E of 20.4

Source: Julian Klymochko

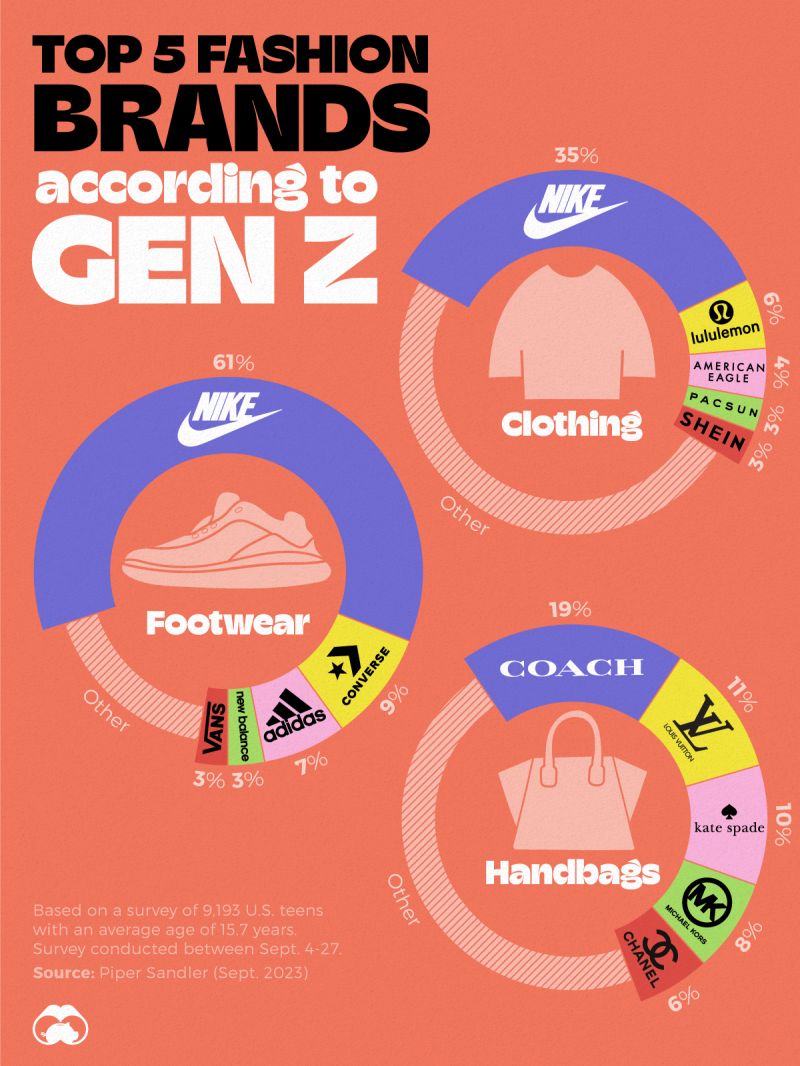

Gen Z’s Favorite Brands in 2023 by Visual Capitalist

People have a lot of choice when it comes to shopping brands, but Gen Z’s favorite brands may surprise you.

No one is thinking about you as much as you think

Stop comparing yourself to others, don’t worry about what other people think and focus on your goals. Source: Peter Mallouk

Quartr just created this infographic that illustrates the 12 largest luxury companies by market cap

Four fun facts: → $LVMH's market cap is 50% larger than the bottom 10 companies *combined*. → $RMS is by far the largest single-brand company on the list, 3.5x the size of $RACE for example. → Despite owning 10+ brands including iconic maisons such as Gucci, Saint Laurent, and Bottega Veneta, $KER's revenue is "only" ~€20B, compared to Hermès' >€13B. → Tiffany & Co. got acquired by LVMH during the pandemic at a $16B valuation, which would place them at #7 on this list. Source: Quartr Activate to view larger image,

The pain trade in one chart: Most shorted US stocks gained 11.3% this week. Performance YTD now on par w/S&P 500

Source: Bloomberg, HolgerZ

BREAKING >>>New York Fed President John Williams CNBC interview: The Fed "isn't really" talking about rate cuts right now

Mr. Williams said: - The Fed "isn't really" talking about rate cuts right now. - Committee members submit projections regarding path of interest rates. Inflation and economy is still uncertain, but base cases are looking pretty good. - Policy focused on getting inflation down to 2%. - Market reaction to all news events have been larger than normal. - Fed should be ready to hike again if needed. - Fed is at or near right place for monetary policy. - The policy restraints should be dialed back slowly over the next three years.

Investing with intelligence

Our latest research, commentary and market outlooks