Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

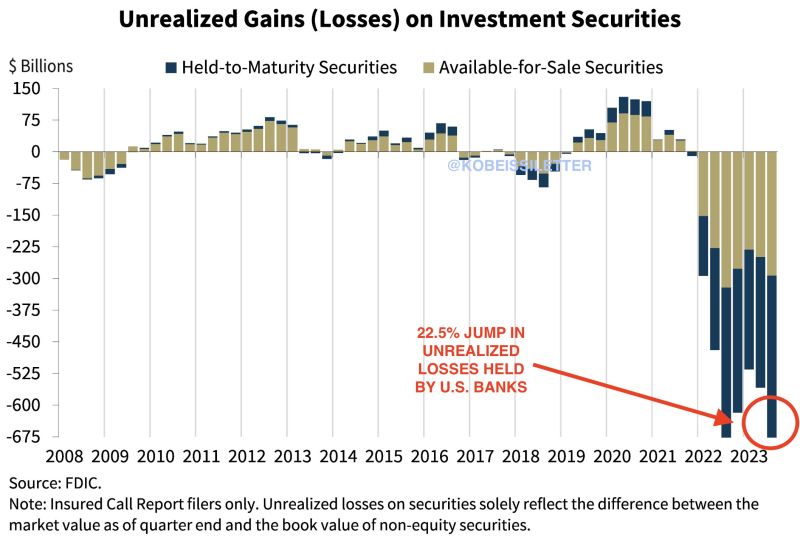

Is the US banking crisis really over?

Unrealized losses on investment securities held by US banks hit $684 billion in Q3, according to the FDIC. This marks a 22.5% jump compared to unrealized losses seen last year. The jump was primarily driven by rising mortgages rates reducing the value of mortgage-backed securities held by banks. Despite these challenges, the FDIC states that banks remain "well capitalized." This comes as usage of the Fed's emergency funding facility for banks hit another record high of $114 billion. Source: The Kobeissi Letter

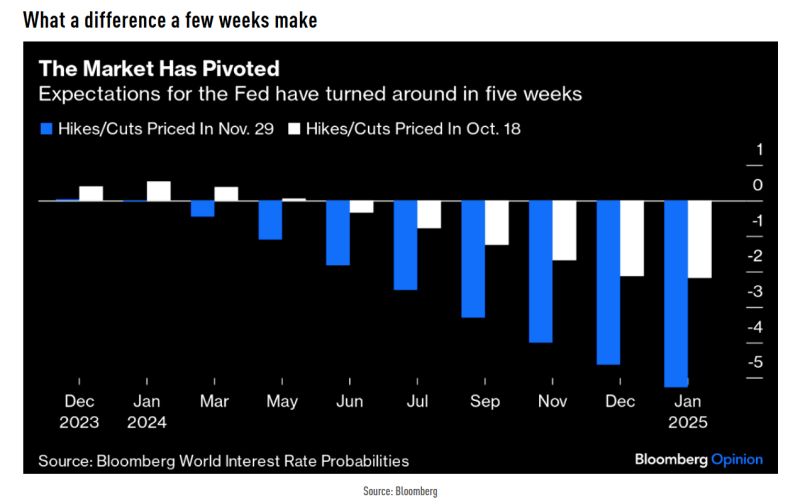

Massive change over the past 5 weeks when it comes to what the market is pricing from FED

Source: TME, Bloomberg

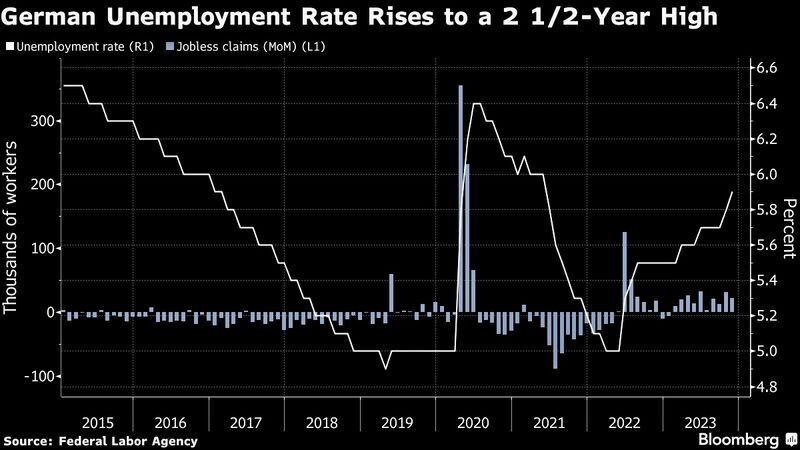

The German labor market is now sending out alarm signals despite the shortage of skilled workers

Germany’s unemployment rate unexpectedly rose to 5.9% in November, the highest level in 2.5 years. Joblessness increased by 22k. Source: Bloomberg, HolgerZ

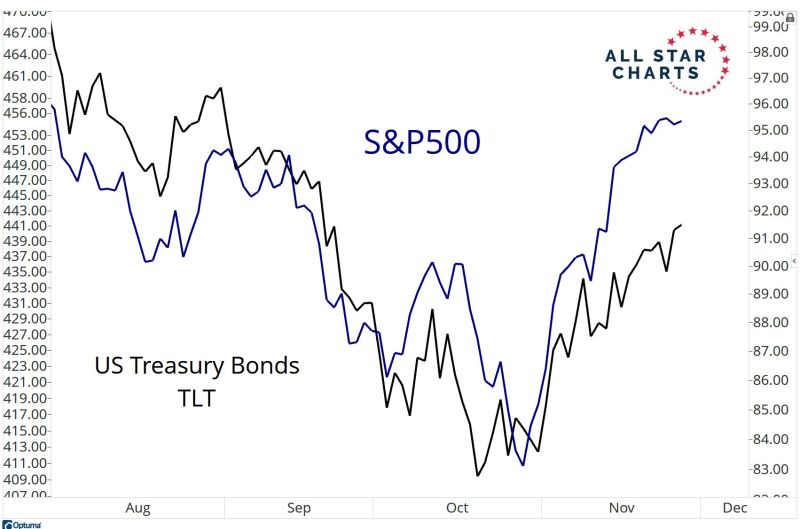

This chart shows that correlation between stocks and long duration bonds remain quite high

This is a regime change from previous decade and has implications for portfolio construction. Source: J-C Parets

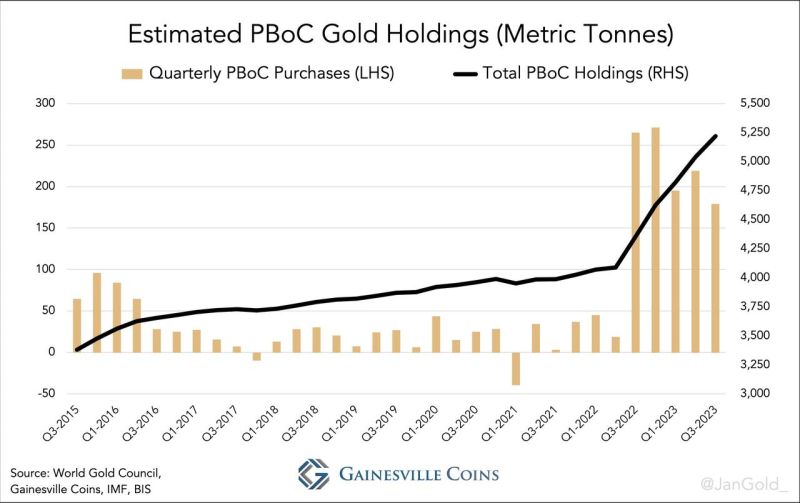

Is massive buying by China the main reason for the current gold rally?

Gold trading above $2,000 despite real fund rates above 2% and the strong dollar is one of the main surprises of 2023. One theory is that China's "Massive Accumulation Of Gold" is behind Gold resilience this year. Indeed, according to unofficial tallies - such as that kept by Gainesville Coins analyst Jan Nieuwenhuijs - total gold purchases by the Chinese central bank (reported and unreported) are significantly bigger than what has been officially disclosed, and in Q3 alone, China purchased 179 tonnes of physical; year-to-date the PBoC bought 593 tonnes, which is 80% more than what it bought in the first three quarters last year. As such, China's total estimated gold holdings are 5,220 tonnes, more than twice what’s officially disclosed at 2,192 tonnes... Source: www.zerohedge.com

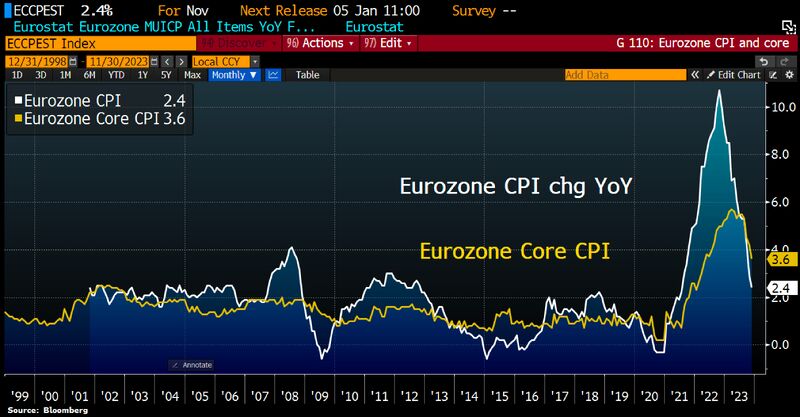

Eurozone inflation cooled more than expected, putting 2% target in sight:

Headline CPI rose 2.4% YoY in November down from 2.9% in October. Core CPI, which excludes volatile components like fuel & food, moderated for a 4th month to 3.6% from 4.2% in October. Markets are now pricing 1st ECB rate cut to take place at the April meeting. Source: HolgerZ, Bloomberg

Buying a home is now 52% more expensive than renting, the highest premium on record (note: the premium peaked at 33% during the last housing bubble in 2006)

Source: Charlie Bilello

Investing with intelligence

Our latest research, commentary and market outlooks