Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Far-right lawmaker Geert Wilders, who wants a referendum on leaving the EU, is on course to win the most votes in parliamentary elections in the Netherlands

However, according to an exit poll, Wilders’s Freedom Party is projected to win 35 seats, substantially less than the 76 required to secure an outright majority. Source: FT

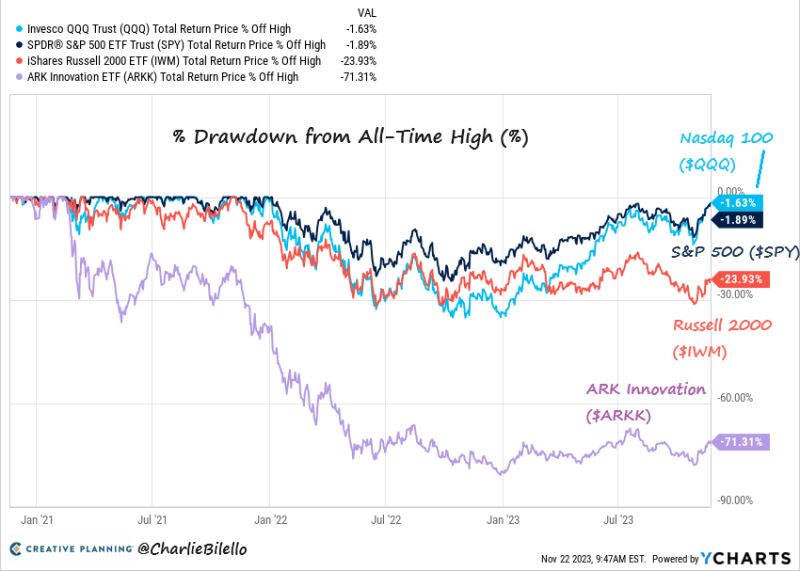

The Nasdaq 100 and S&P 500 ETFs are now less than 2% below their all-time high while the Russell 2000 ETF (small caps) is 24% below its high and the ARK Innovation ETF is 71% below its high

Source: Charlie Bilello

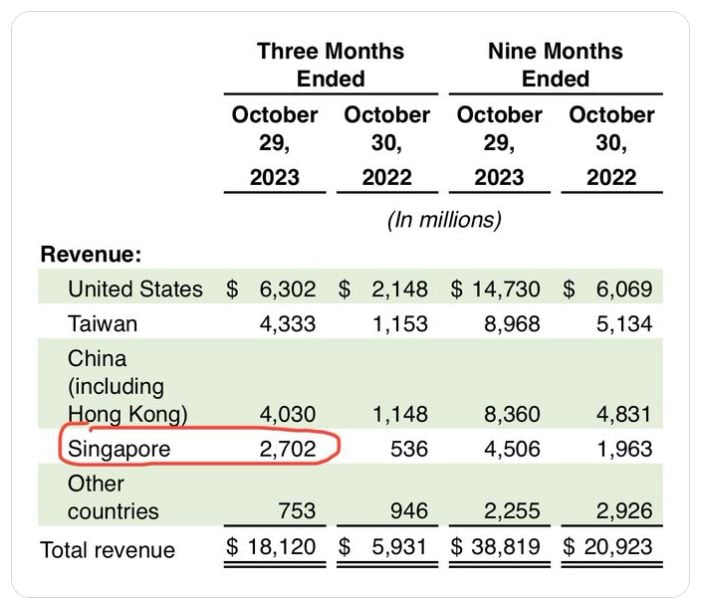

$NVDA Apparently, somebody is buying a lot of chips in Singapore

That country now represents 15% of total sales, up from 9% last year. Chinese sanction evasion for higher powered chips? Source: Jaguar Analytics

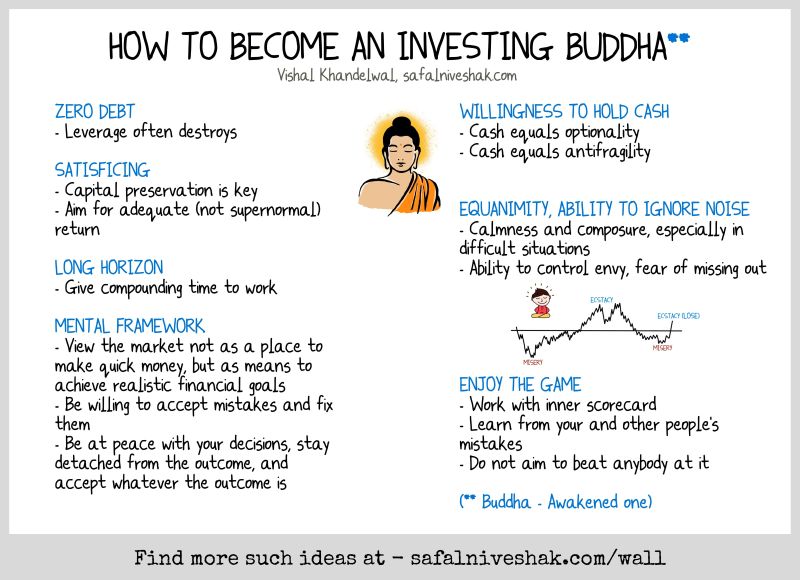

How to become an investing Budha

Source: Vishal Khandelwal, Safal Niveshak

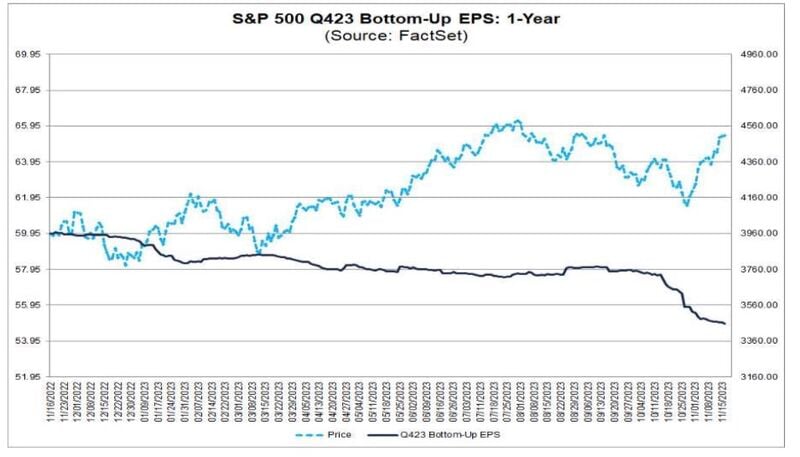

The rally in US stocks in recent weeks has taken attention away from what looks like a pretty concerning forward picture from earnings releases

Q4 earnings expectations have come down considerably in recent weeks, in contrast with equity market strength. Source: Bob Elliott, Factset

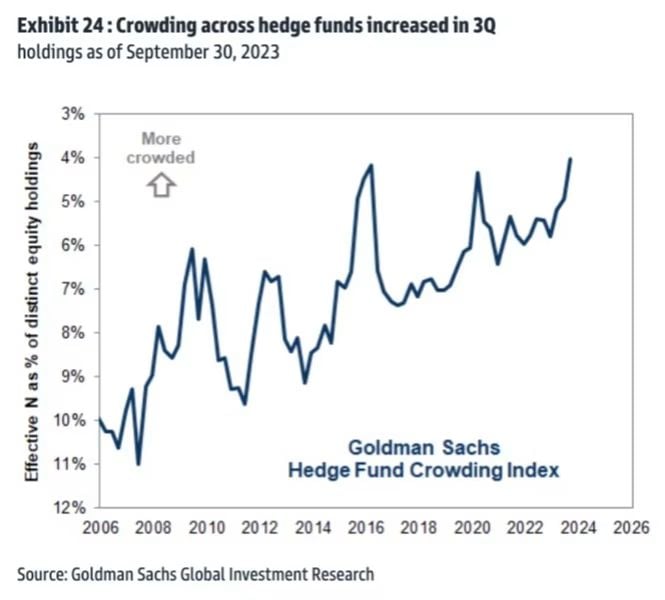

Hedge Fund Position Concentration hits all-time high 🚨 i.e. everyone chasing the same trades - Mag 7

Source: Barchart, Goldman Sachs

Investing with intelligence

Our latest research, commentary and market outlooks