Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

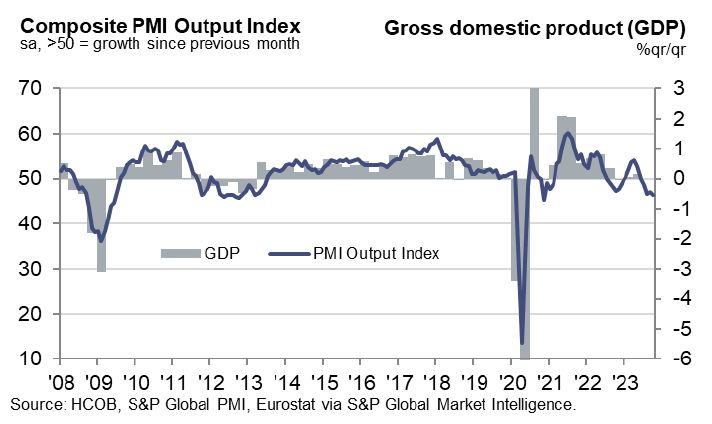

The European composite PMI output index pointed to the sharpest decline in nearly three years

October's data also showed firms in the region cutting staff on a net basis for the first time since early 2021 The region is quite likely to go into a recession. Source: Markets Mayhem

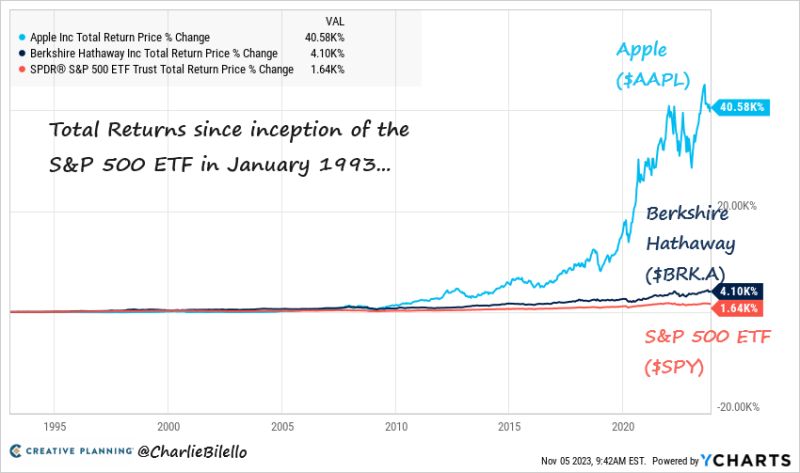

Total Returns since inception of the S&P 500 ETF in January 1993...

S&P 500 ETF $SPY: +1,640% Berkshire Hathaway $BRK.A: +4,100% Apple $AAPL: +40,580% Source: Charlie Bilello

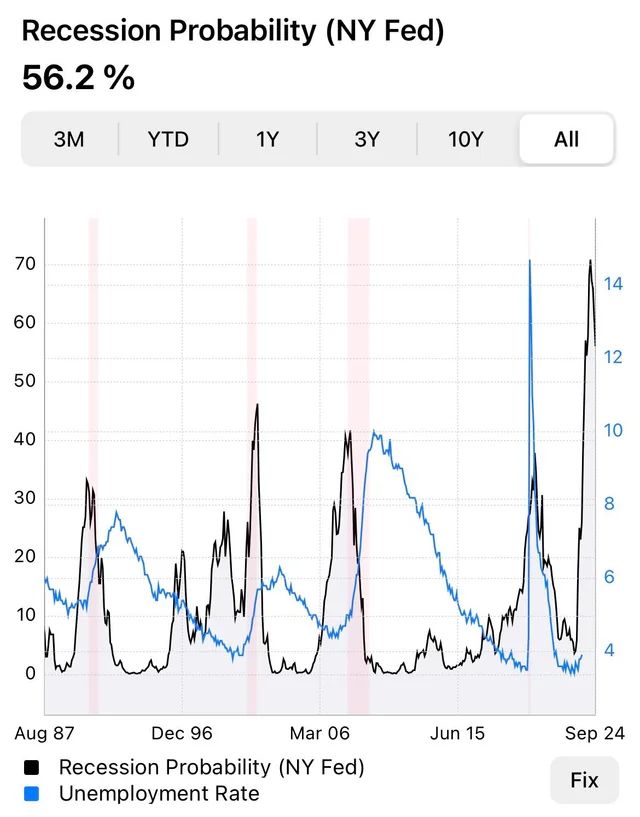

NY FED recession probability is on highs

Unemployment is going up. Similar pattern was right before most previous recessions. Source: Wall Street Silver

One year before US elections...

President Biden’s approval rating is the lowest out of every president one year out from the election since Jimmy Carter. The news comes as a new swing state poll from The New York Times shows Donald Trump defeating Biden in a 2024 matchup. According to the poll, if the election were held today, Trump would beat Biden in Nevada, Georgia, Arizona, Michigan and Pennsylvania. Biden’s approval rating is sitting at 37% one year out from the election. Trump and Obama were at 43% at this same point in their presidency while Jimmy Carter was at 32%. Source: Collin Rugg

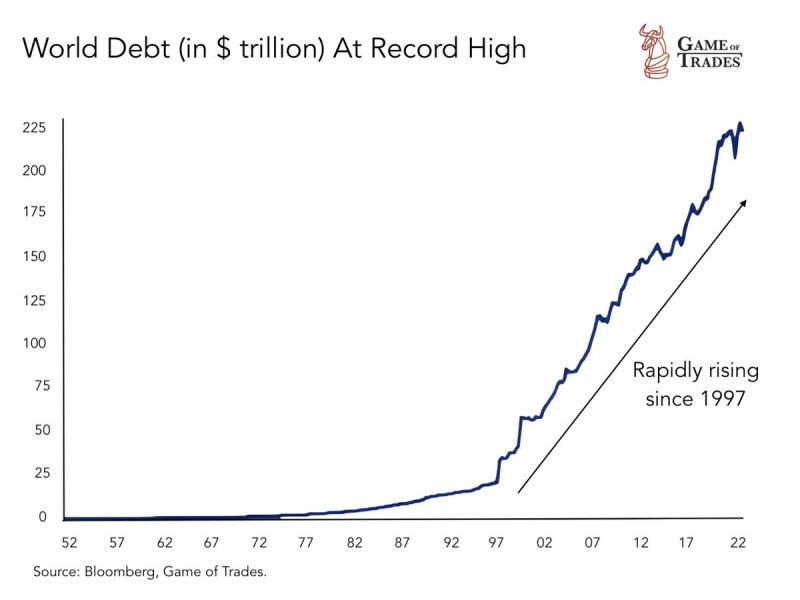

World debt has rapidly increased since 1997. And is now around $225 trillion. Is it sustainable?

Source: Game of Trades

Even with gold near ATHs, central banks are still buying record tonnage of yellow metal...

Source: FT

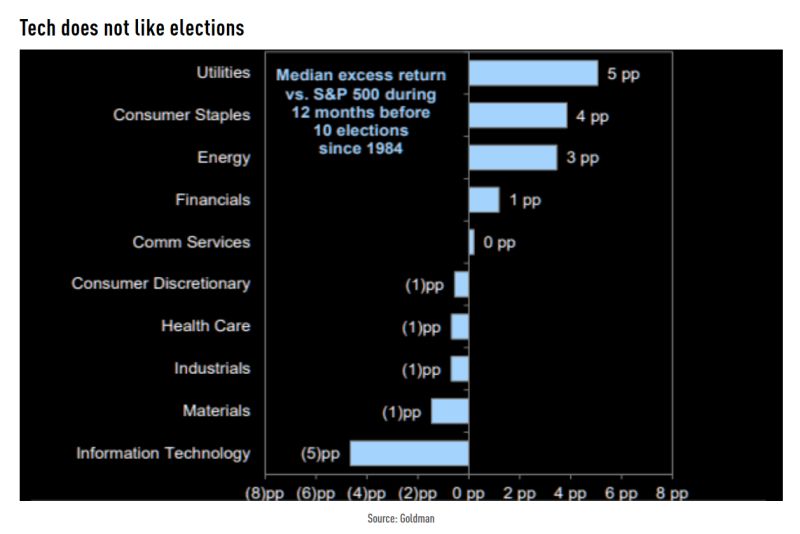

Median sector returns in the year before Election Day: Tech does not like elections

Source: TME, GS

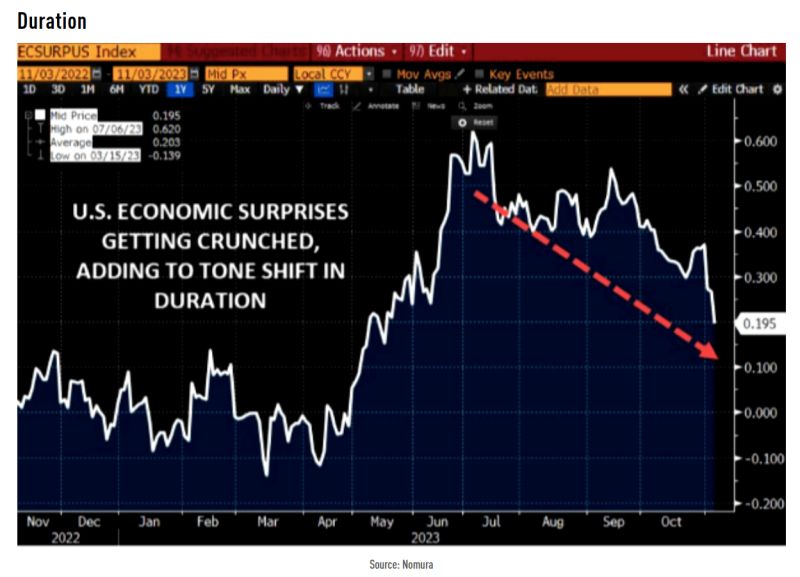

The sudden deterioration of US economic surprises is among the factors behind the recent decline in long duration bonds

Source: Bloomberg, Nomura, TME

Investing with intelligence

Our latest research, commentary and market outlooks