Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

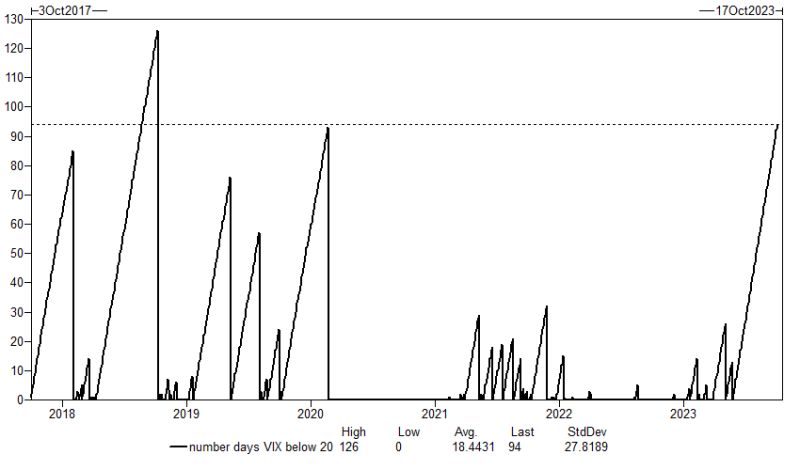

Since the VIX has so far failed to break above 20, we are now just shy of 100 sessions in which the VIX has closed below 20

The longest such stretch since October 2018 when, ironically, the market tumbled after the Fed realized it will need to be far more hawkish. Source: www.zerohedge.com

Have you ever played Microsoft's games?

Microsoft is the world's largest gaming company, with an astonishing market capitalization of $2,441 billion. Some of Microsoft's popular games include Call of Duty and World of Warcraft. Genuine Impact

A big short squeeze in the making?

GS data shows US CTA are now SHORT -$40B of SPX, the largest short in Goldman models history.

Ever heard of the PEG ratio?

It's Peter Lynch's go-to metric, shorthand for "price-to-earnings growth". Scores <1.0 hint at a bargain, while >2.0 might be a bit pricey -- let's take a look at where the 'Magnificent 7' stack up Shay Boloor via StockSavvyShay

In case you missed it:

Fed Balance sheet has dropped <$8tn for 1st time since Summer 2021 on QT. Fed's total assets are now equal to 29.4% of US's GDP vs ECB's 50.9%, SNB's 111.5%, or BoJ's 125.7%. Source: Bloomberg, HolgerZ

Investing with intelligence

Our latest research, commentary and market outlooks