Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

CDS traders are sending default swaps on the big US BANKS sharply wider

- Deutsche Bank believes the rise in yields could propel Banks' Unrealized losses $140 Billion higher to a record $700 Billion. DB strategist Zeng warns the Q3 explosion in rates has no doubt widened the unrealized losses in US banks bond portfolios, which was already the catalyst for multiple bank failures this year at a time when #rates blew out to far more normal levels.

U.S. Mortgage Rates surpassed 8% this week for the first time in more than 23 years

Source: barchart

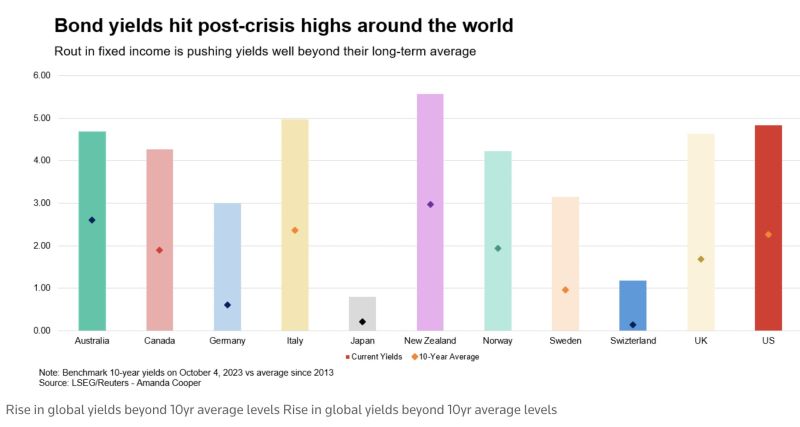

The global bond markets rout in one chart

The world's biggest bond markets hit by heavy selloff: Bond yileds hit post-crisis highs around the world: US 30y yields hit 5% before retreating. German bund yields hit 3%. Bond rout sounds alarm bells globally. Source: HolgerZ

Over the last 3 years, the US Money Supply (M2) has increased by 14%, US inflation (CPI) has increased by 18%, and National Debt has grown by 24%

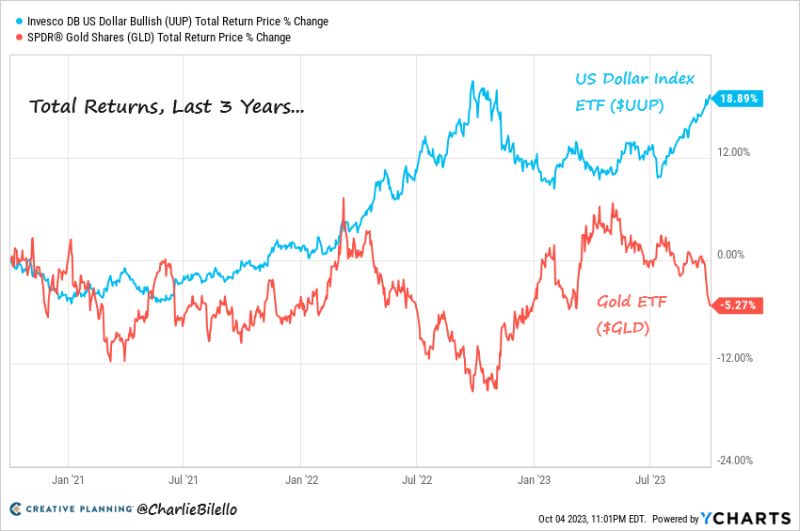

And over that time the US dollar Index ETF has gained 19% while the Gold ETF has lost 5%. As eveyone predicted... Source: Charlie Bilello

Looks like oil prices and bond yields have decoupled

Although the oil price has crashed sharply in the past 2 days, US 10y yields have fallen only slightly. Source: HolgerZ, Bloomberg

The construction sector in Germany is really crashing. The German PMI Construction Index fell to 39.3 in Sep from 41.5 in Aug, and the lowest level since statistics began

Source: HolgerZ, Bloomberg

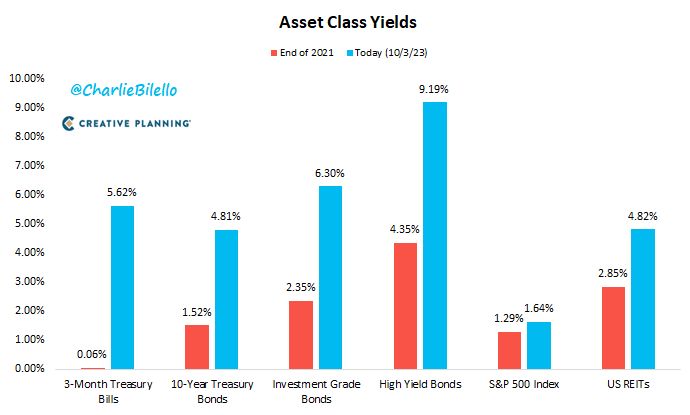

A lot has changed over the last two years...

Source: Charlie Bilello

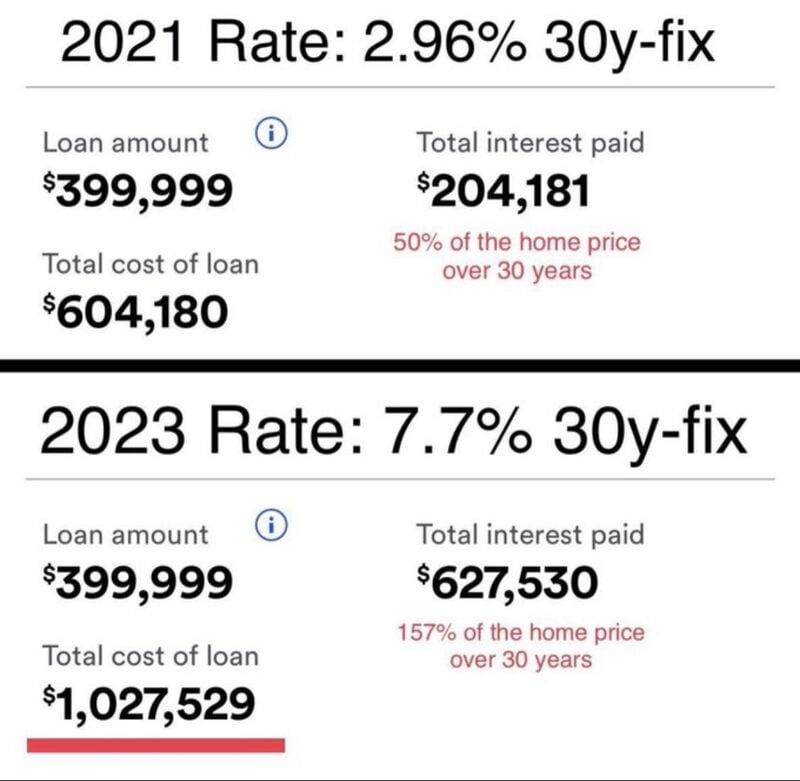

The impacts of rising interest rates on the costs of your mortgage over the life of the loan

In the US, A $400,000 house now costs over $1,000,000, with interest rates now at 7.7% from 3%. Source: WallStreet Sliver

Investing with intelligence

Our latest research, commentary and market outlooks