Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Yesterday: Michael Burry shutting down hedge fund

April 7: Tom Lee issues apology to investors Signs of time? 🤔 Source: The Market Stats @TheMarketStats

It seems that Michael Burry closing his fund DOES NOT mean he is done

He is planning something massive on Nov 25th...

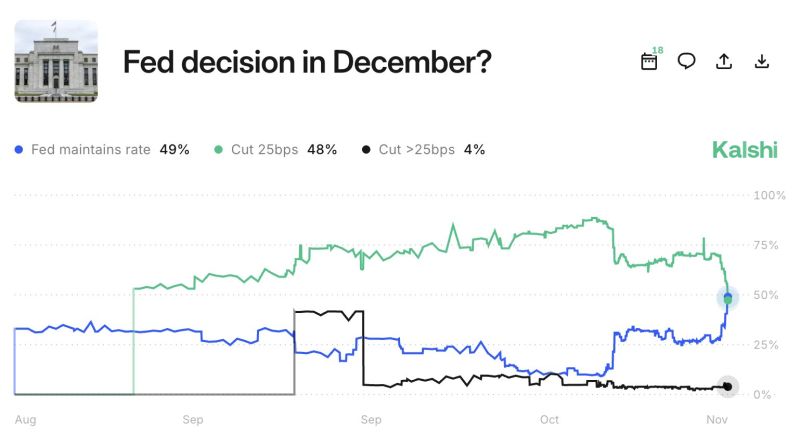

"NO CUTS" IS NOW MORE LIKELY THAN 25 BPS CUT IN DECEMBER

Mid-October, it was almost a done deal Source: Kalshi @Kalshi

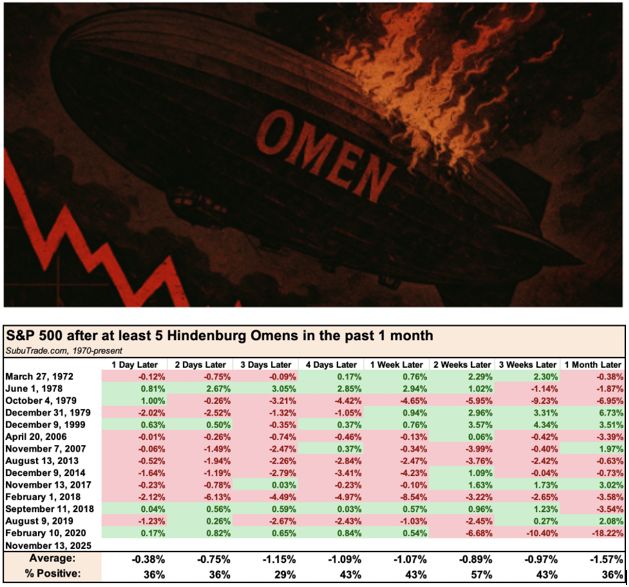

🔴 Stock Market Crash "Hindenburg Omen" Triggered 🚨

The Hindenburg Omen, an indicator that correctly detected the 1987 and 2008 stock market crashes, has been triggered for the 5th time over the last month 👻😱 ➡️ What is a Hindenburg Open? The Hindenburg Omen is a technical stock-market indicator that attempts to predict increased probability of a market crash. It triggers when several conditions occur at the same time on a stock exchange (usually the NYSE), such as: A high number of new 52-week highs and 52-week lows on the same day A rising 50-day moving average Worsening market breadth Other internal market divergences It’s named after the Hindenburg disaster because it is meant to signal potential “market instability.” Source: Barchart

Nvdia stock is down 10% since the SoftBank story but still gets some brokers upgrades

Source: @StockMKTNewsz on X

We have a deal!

Among the $200B Swiss investment pledges, the US representative cites pharmaceuticals, the gold industry, and even the railway sector.

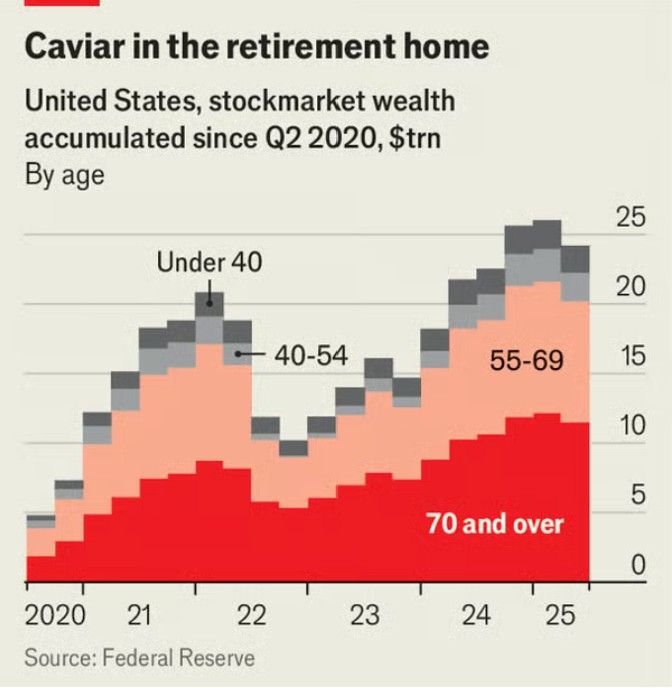

From @TheEconomist thru Mo El Erian on X:

"America’s surging stockmarket has been driven, most of all, by old investors.... Americans aged 70 and above now own 39% of all stocks and mutual funds (which mostly invest in equities), almost twice as much as was common from 1989 to 2009. The trend reflects a shift in outlook. Elderly Americans’ risk tolerance has shot up."

Investing with intelligence

Our latest research, commentary and market outlooks