Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

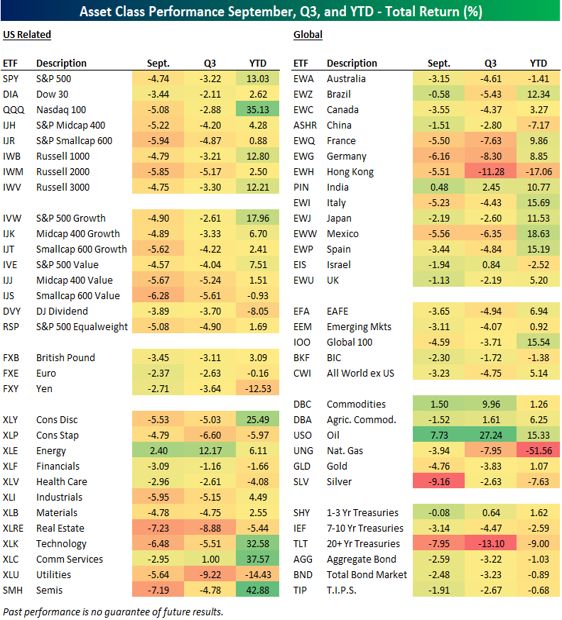

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Is the golden era of 60/40s coming to an end?

And if equities / bonds correlation stay positive, which asset classes should be added to portfolios? hard assets and commodities? alternatives (private debt, private equities, etc.)? cash on an opportunistic basis? Source chart: Tavi Costa, Bloomberg

Congress Averts US Government Shutdown Hours Before Deadline – Bloomberg

The US narrowly averted a disruptive and costly shutdown of federal agencies as Congress passed compromise legislation to keep the government running until Nov. 17. The legislation, passed in both chambers Saturday just hours before a midnight deadline, buys Democrats and Republicans time to negotiate longer-term federal funding. It doesn’t include new funding for Ukraine. President Joe Biden signed the bill late Saturday night, capping an extraordinary day in Washington that began with the country careening to what appeared to be an inevitable and prolonged federal funding lapse.

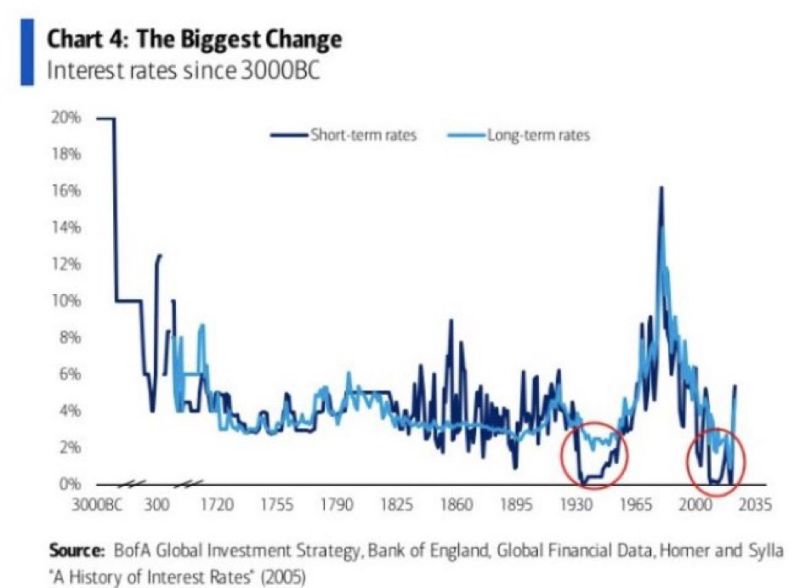

The longest time period chart on US interest rates you will ever find...

Source: BofA

Last month returns for the sp500 constituents in one chart

Source: Trading View

While mega-caps tech stocks are recording huge returns on their cash pile thanks to the rise of interest rates, this is not the case for the rest of the market

Small cap companies are paying the most interest expense ever recorded and unfortunately their interest income is not keeping pace. This will become an even larger problem when small companies are forced to refinance at significantly higher rates. Source: FT, barchart

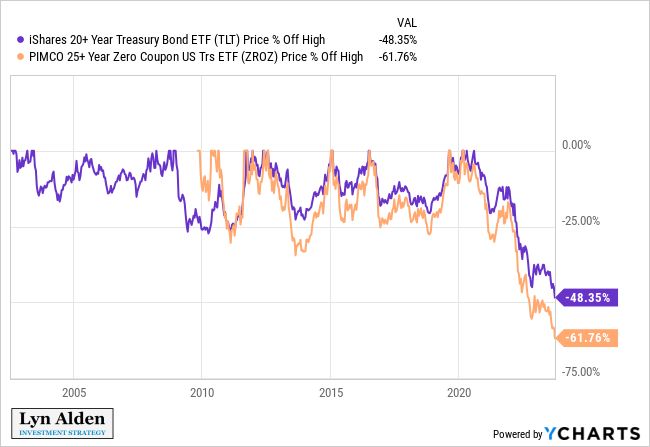

Yes you can lose a lot of money with bonds...

The Pimco 25+ Year Zero Coupon US Treasury ETF is off more than 60% from its high

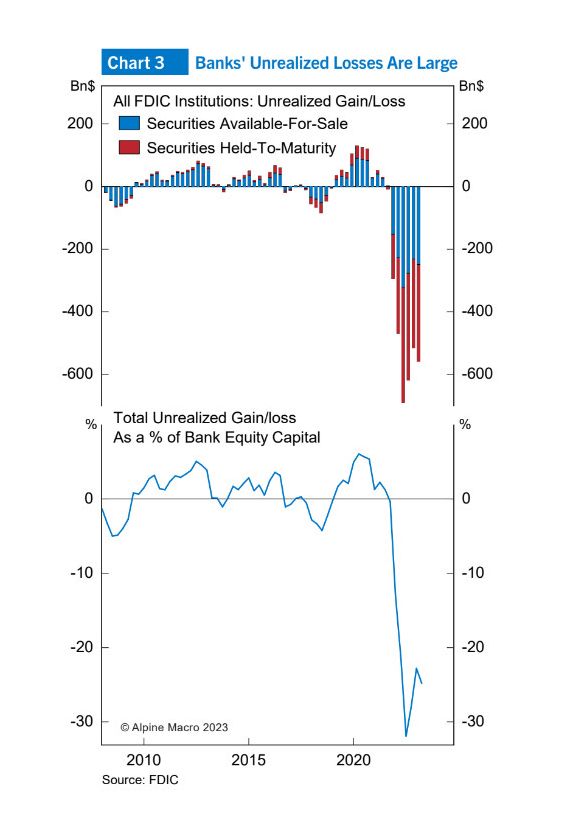

U.S. Banks are facing roughly $600 billion of unrealized losses which accounts for roughly 25% of total banking capital, near the highest levels in history

Source: Barchart, FDIC, Alpine Macro

Investing with intelligence

Our latest research, commentary and market outlooks