Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- technical analysis

- geopolitics

- gold

- Crypto

- AI

- Commodities

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- banking

- oil

- Volatility

- magnificent-7

- energy

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- assetmanagement

- Middle East

- amazon

- russia

- ethereum

- microsoft

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

This could be a problem for sugar prices which already hit 12-year highs back in May

Source: Barchart

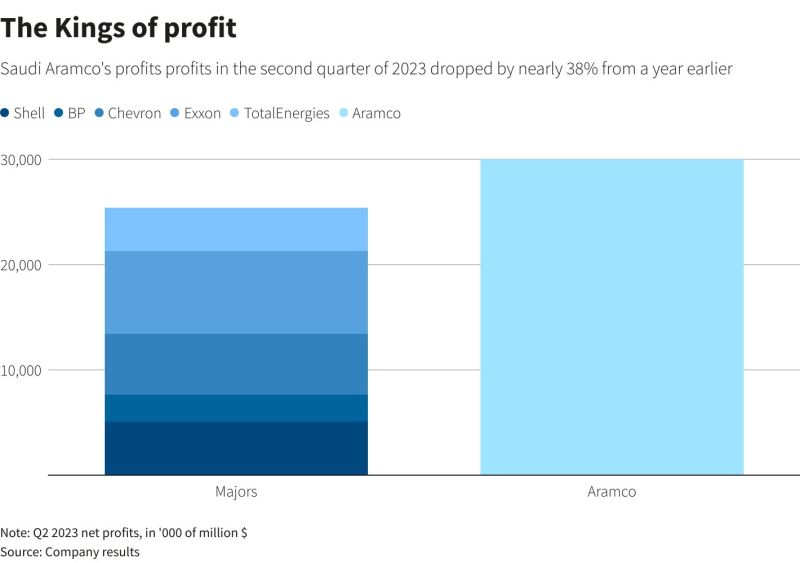

Saudi Aramco 2Q 2023 profit vs. profits of the Majors

Source: company results

Market-implied inflation expectations over the next 5-10 years have risen to the highest levels in more than a year

Traders are starting to game out a future with sustainably higher inflation and higher long-term bond yields. Source: Bloomberg, Lisa Abramowiz

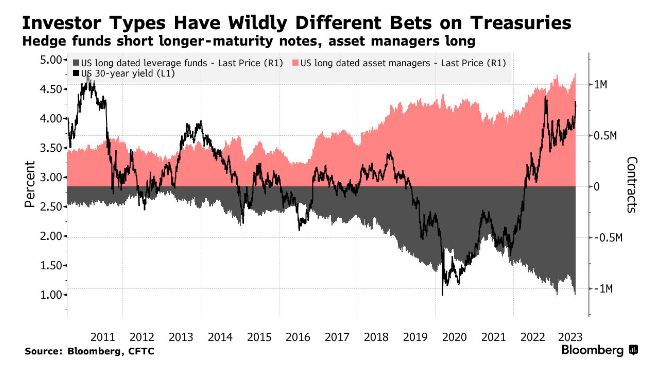

One asset class - two different bets => hedge funds are shorting US treasuries at historic levels while asset managers are doing the exact opposite 👀

Source: Barchart, Bloomberg

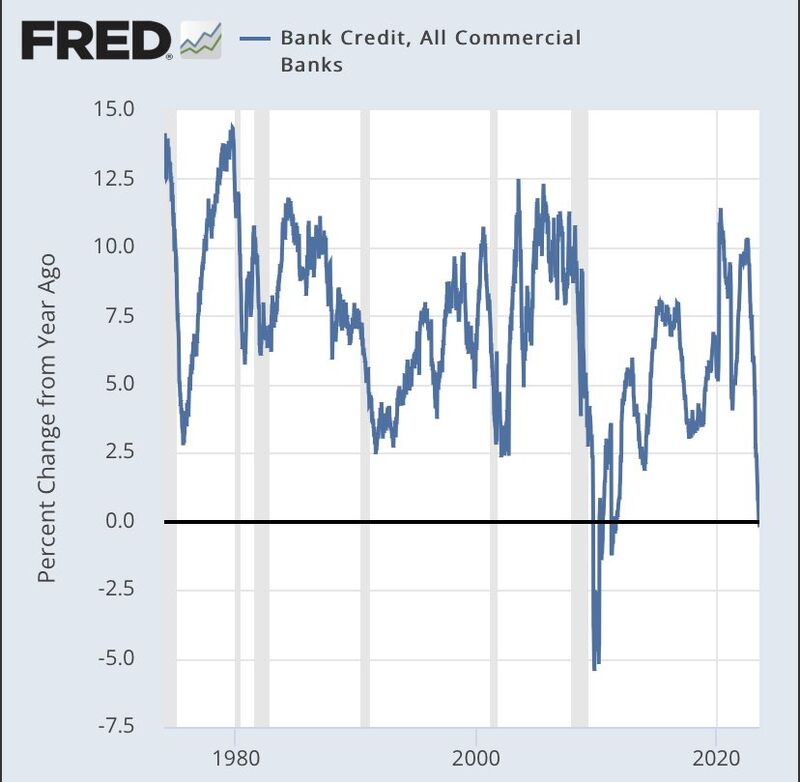

The lagging effects of higher interest rates ?

Yellow Corp. filed for bankruptcy and will remain shuttered after the trucking firm’s long-running financial woes (rising bond & loan payments) were compounded by a dispute with its labor force (wage inflation). The firm closes after nearly 100 years and leaves 30k employees jobless (this will likely be reflected in a lower payroll print for August). Source: Bloomberg

US Bank credit YoY is now -0.2% YoY. First time negative since 08 (Keep in mind that in the US about 25% of credit is securities and the other 75% loans)

Source: FRED, Adem Tumerkan

Investing with intelligence

Our latest research, commentary and market outlooks