Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

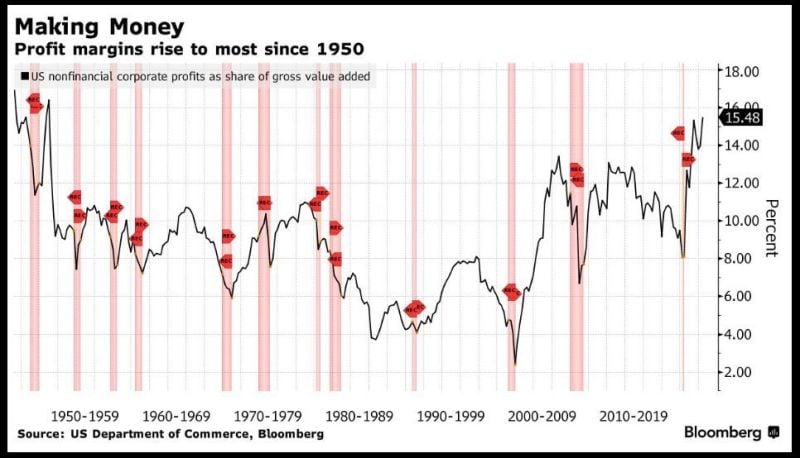

Corporate profit margins jump to highest level in 73 years 👀

Source: Bloomberg, Barchart

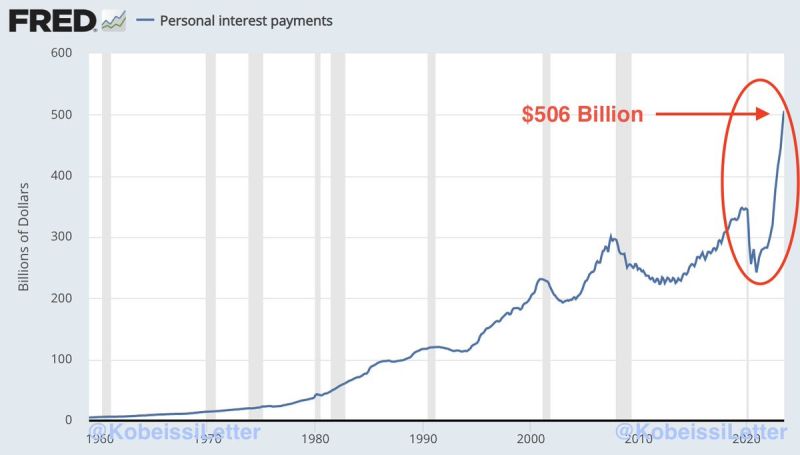

JUST IN: Personal interest payments in the US hit a record $506 BILLION in July

During the first 7 months of 2023, Americans paid a total of $3.3 TRILLION in personal interest. This is up a staggering 80% since 2021 and nearly above the entire 2022 total. The worst part? These numbers do NOT include interest on mortgage payments. Source: The Kobeissi Letter, FRED

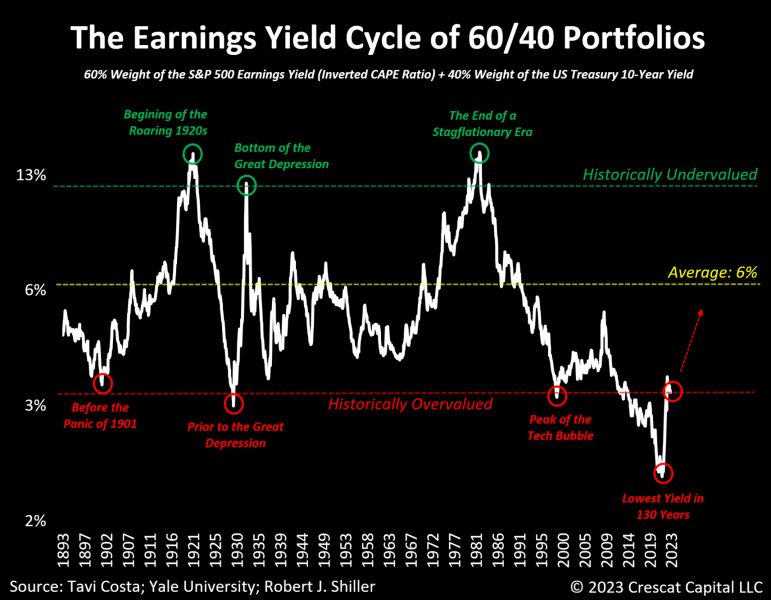

Is the 60/40 portfolio overvalued?

In August 2021, the combined valuation of overall equities and US Treasuries had reached its most expensive level in 130 years. To put the current valuation imbalance into perspective, its recent peak was a staggering 61% higher than its previous peak in the early 2000s. Although prices have corrected somewhat, particularly in the Treasury market, multiples are still elevated today. Source: Tavi Costa, Bloomberg

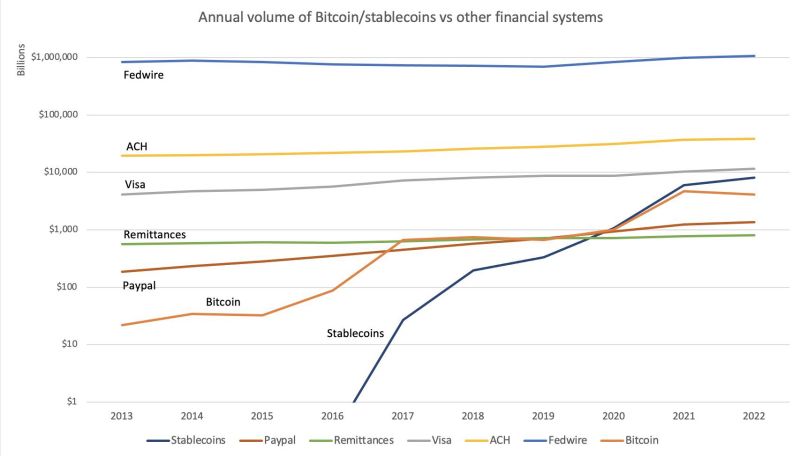

Money sent on the bitcoin blockchain this year has surpassed PayPal and is nearing Visa

Source: Documenting Bitcoin

Investing with intelligence

Our latest research, commentary and market outlooks