Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

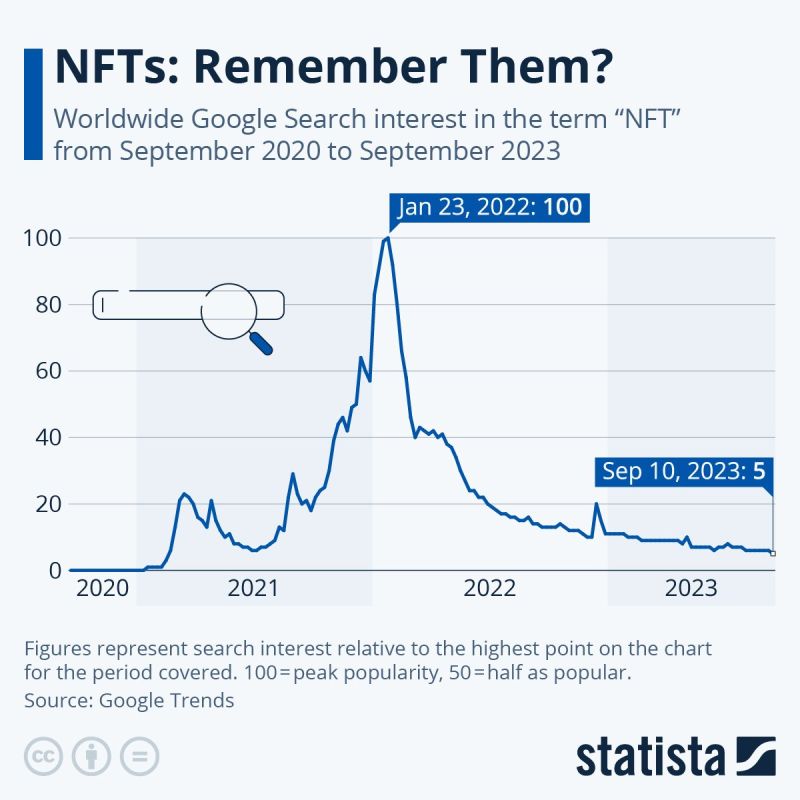

- Crypto

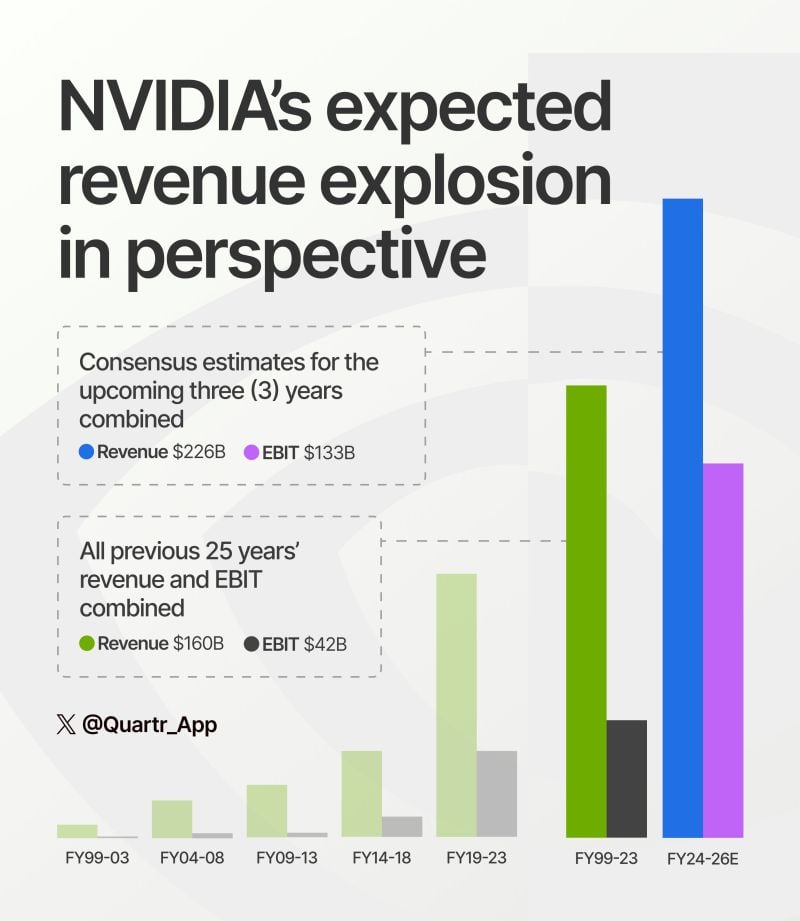

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

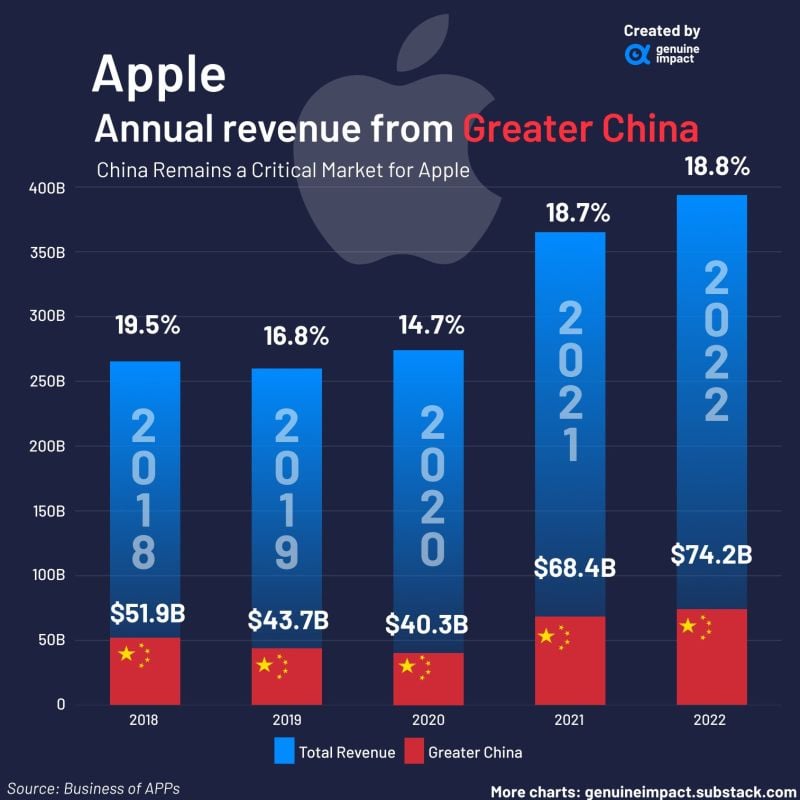

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

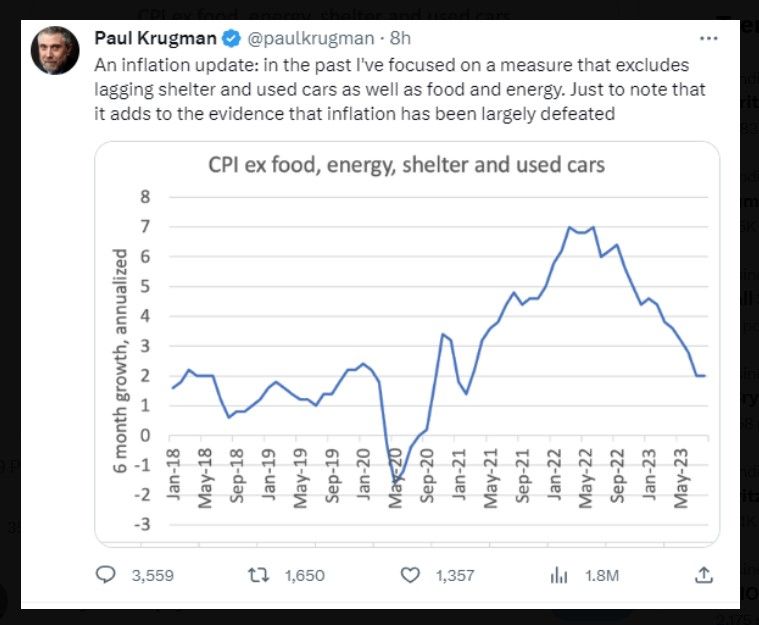

Translation: If you exclude everything you need in life, inflation has been vanquished!

Source: Barchart

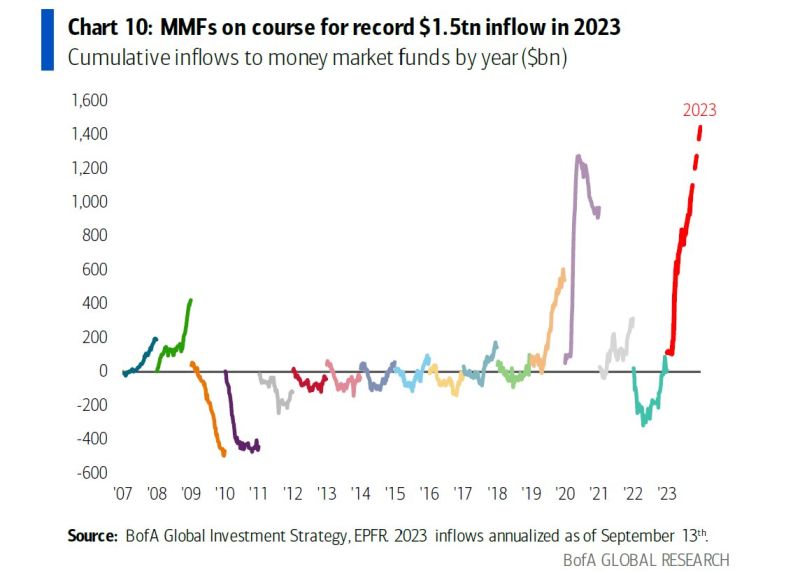

Money markets are on track for a record $1.5 trillion inflow in 2023

Source: BofA

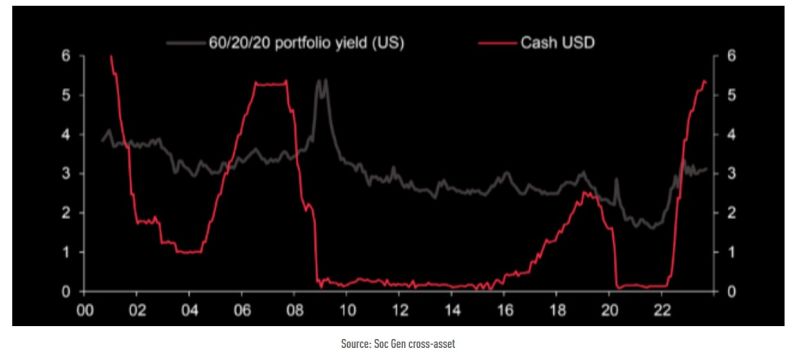

The attractiveness of cash in a multi-asset portfolio (%)

Source: SG, TME

Investing with intelligence

Our latest research, commentary and market outlooks