Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

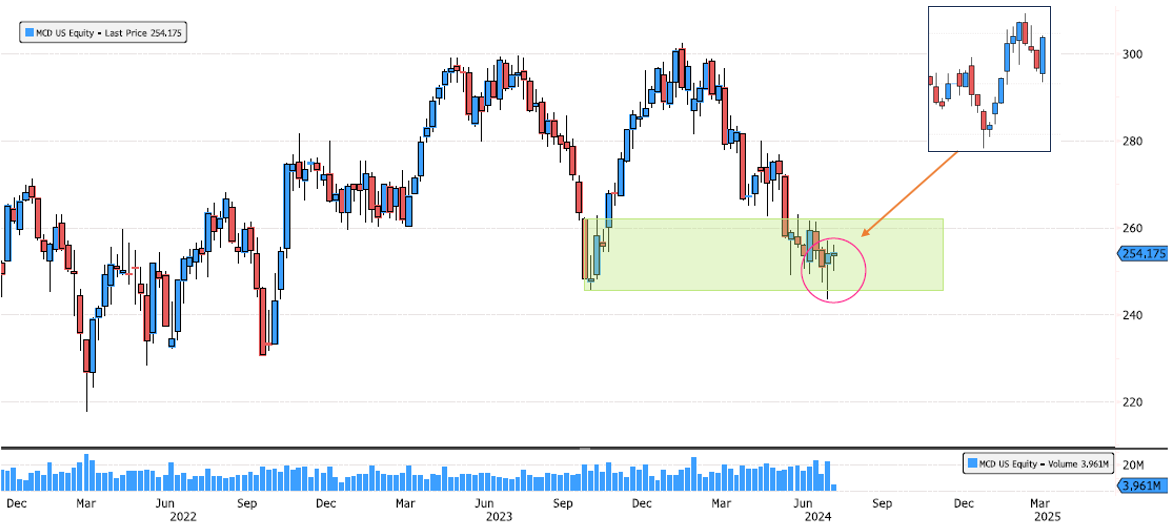

McDonald's Showing Bullish Momentum on Short Term

McDonald's (MCD US) has been in a support zone for 9 weeks! Last week, there was a false breakout below 245, but it managed to close above. On the short-term chart, there is growing bullish momentum. Keep an eye on it. Source: Bloomberg

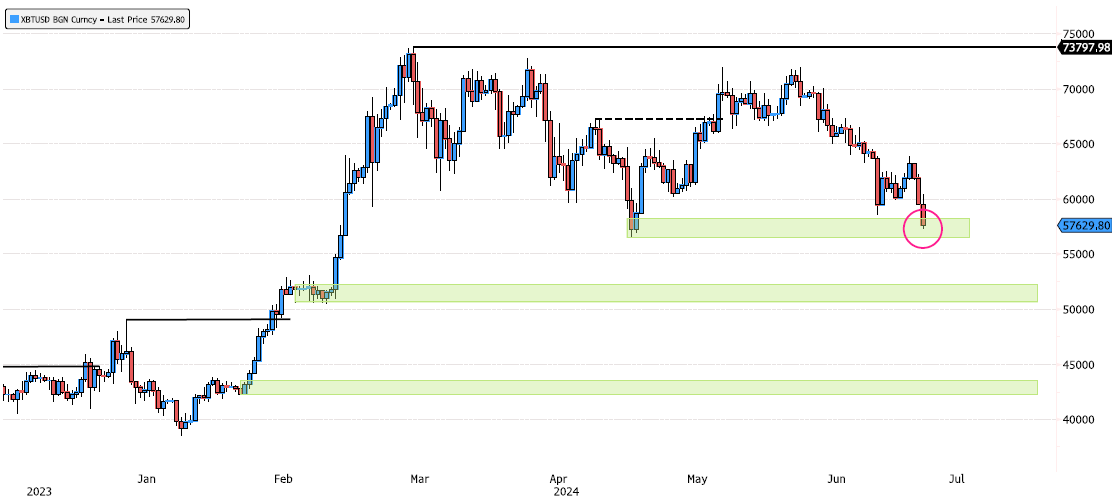

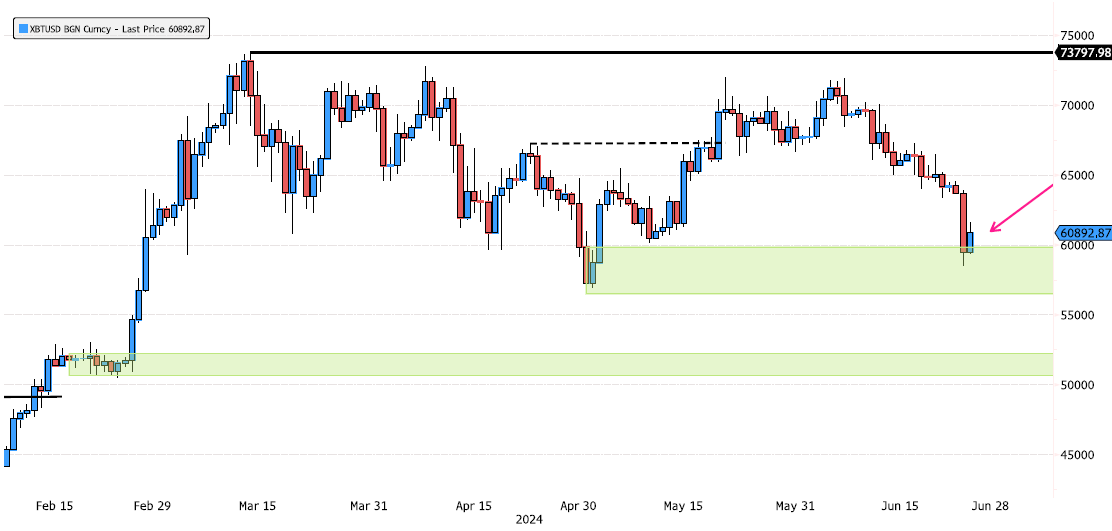

Bitcoin at Major Support Zone

Bitcoin (XBTUSD) is now testing the major support zone between 56,500-58,000. This zone is critical because if it breaks, the consolidation that started in March could become more complex and volatile. It would open the door for a test of the next support level at 50,700-52,250 or even the 45,000 levels. But for the time being, keep an eye out for a rebound at this level. Source: Bloomberg

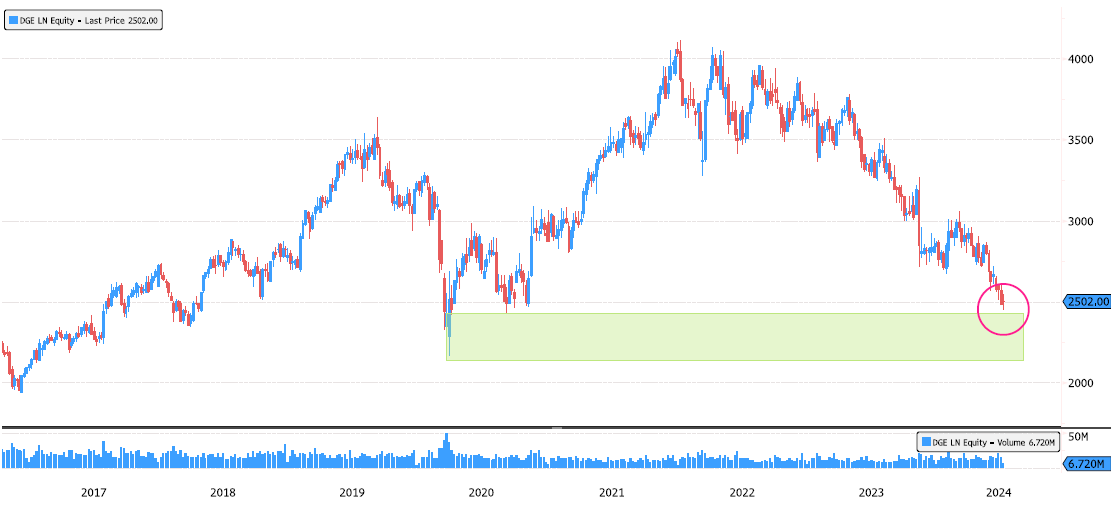

Diageo Reaching Major Support Zone

Diageo (DGE LN) is down 40% since January 2022! The long-term trend remains bullish. The stock is now reaching the 2020 major support zone between 2139-2427. Keep an eye on this level. Source: Bloomberg

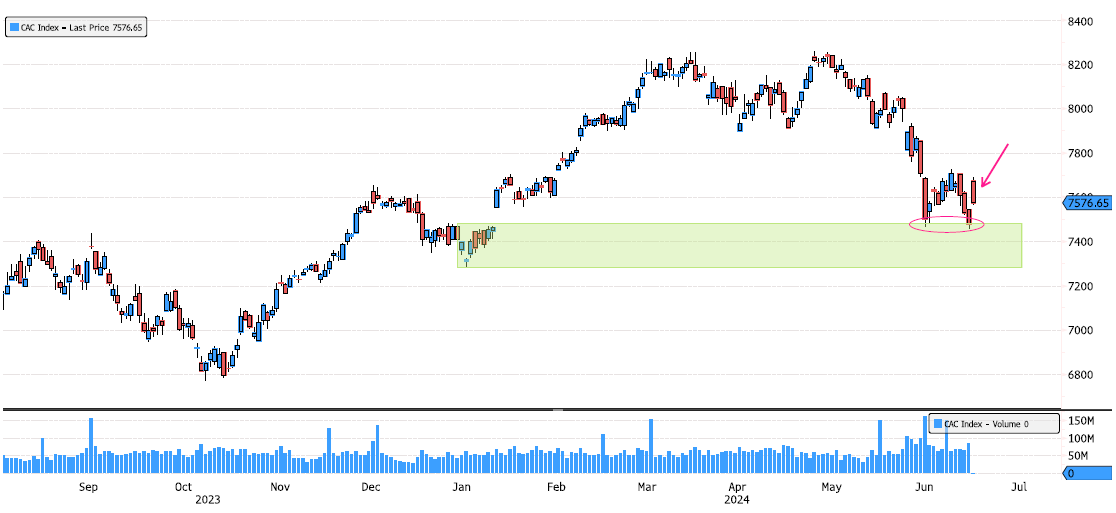

CAC 40 Index Rebounds on Major Support

The CAC 40 Index rebounded on the major support zone between 7285-7480 after posting a double bottom. It’s still a bit early to say that the consolidation is over, so keep an eye out for a close above 7725. Source: Bloomberg

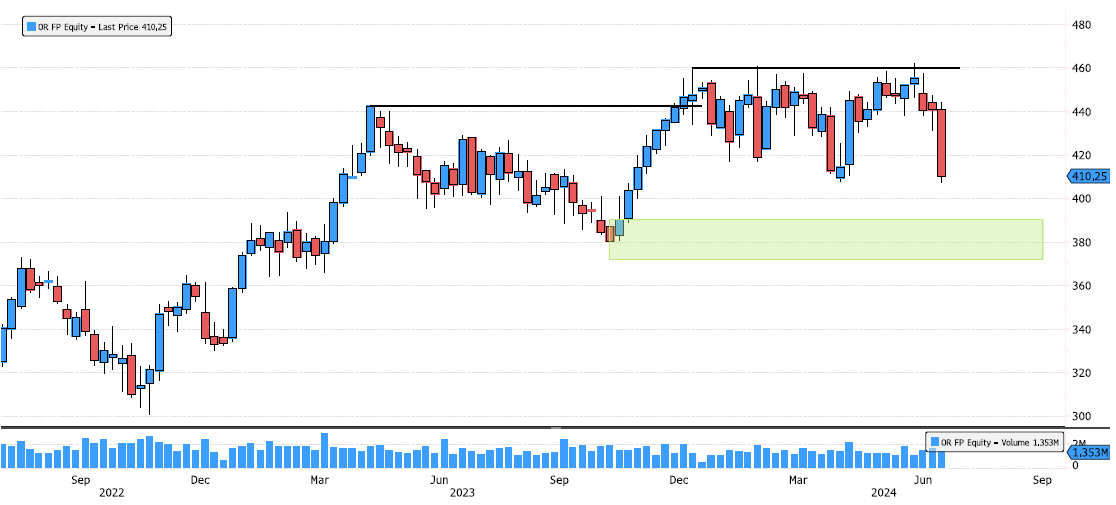

L'Oreal in a More Complex Consolidation Phase

L'Oreal remains in a bullish long-term trend! Unfortunately, it wasn't able to close above the 460 level and confirm a new swing. Therefore, the probability is growing for a break of minor support at 407.85 and a possible test of the major support zone between 372-390. Source: Bloomberg

Energy Sector Retracement After Breakout

The Energy sector (XLE US) broke out of an ascending triangle in March! This was good news for confirming the bullish trend. As with many breakouts, they are usually followed by a retracement. The market has just reached the 50% Fibonacci retracement. This is a very interesting level to keep an eye on. Source: Bloomberg

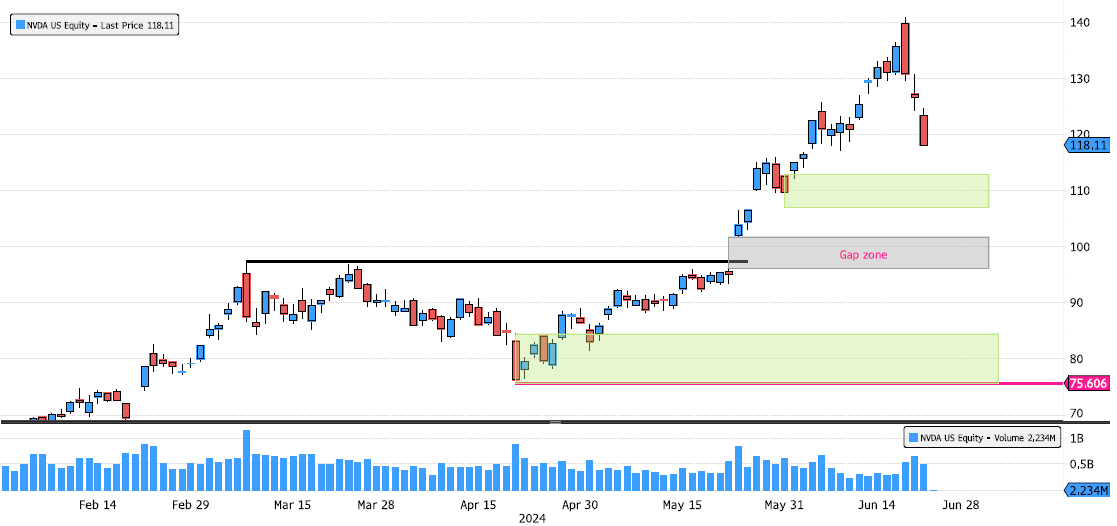

Nvidia Looking for Support

Nvidia (NVDA US) has started its consolidation. The first minor support is at 117. An interesting level to keep an eye on is the 107-112 zone, which also represents a 50% Fibonacci retracement. If all those levels break, there is the gap zone at 96-101.60 that could be filled and, of course, the major support zone at 75.60-84.35, but that seems so far away! Source: Bloomberg

Bitcoin at demand zone

Bitcoin (XBTUSD) showed positive signs in May with a break above the last swing high, suggesting that the consolidation could be over. Yesterday's sell-off (-8%) reached a strong demand zone. Keep an eye on this level. Source: Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks