Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Georg Fischer reached major support

Georg Fischer (GF SW) is now down 35% since March ! Stock just tested major support 45.86, this was July and September 2022 lows. Keep an eye at the close. Source : Bloomberg

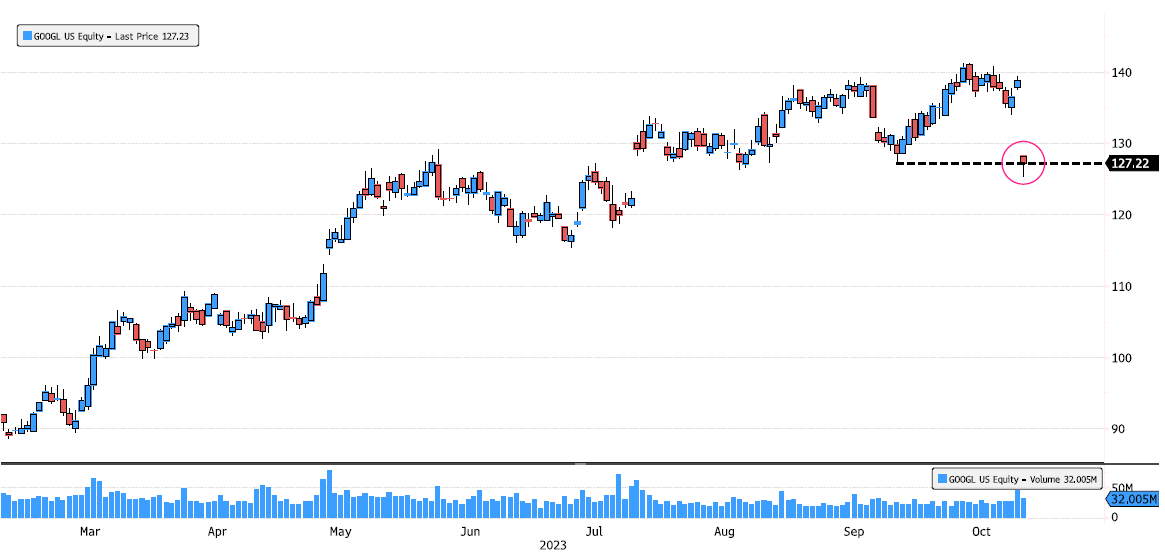

Alphabet under pressure after earnings

Alphabet (GOOGL US) is down more than 8% after earnings. Stock is testing support 127.22 (latest swing low). Keep an eye at the closing price. Source : Bloomberg

Dassault Systemes trying to breakout resistance

Dassault Systemes (DSY FP) trying to break resistance 37.29. Recently false breakdown of October uptrend on probably a liquidity grab. Keep an eye. Source : Bloomberg

Siegfried retesting May 2021 downtrend support

Siegfried (SFZN SW) broke out in May 2023 the 2021 downtrend. It is now retesting the downtrend support. Keep an eye at this key level. Source : Bloomberg

S&P 500 Index back on major support 4195

S&P 500 Index (SPX) is back on major support 4195. Keep an eye to see if it holds. Source : Bloomberg

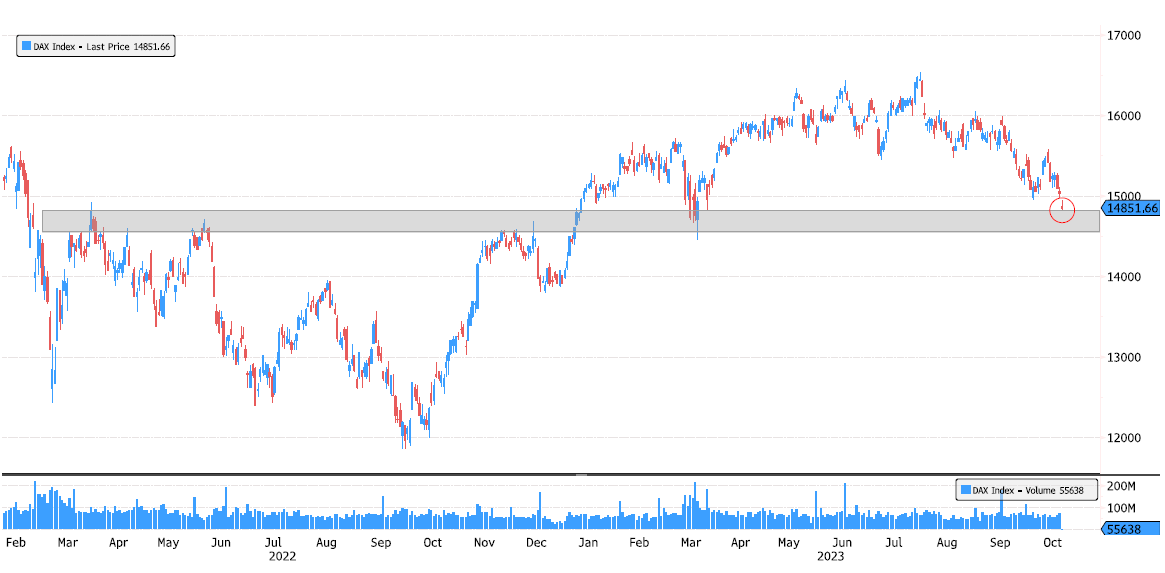

Dax Index reaching major support zone

Dax Index is approaching major support zone 14'620-14'820. Keep an eye at this zone. Source : Bloomberg

CAC 40 Index back on major support

CAC 40 Index has consolidated 10% since April and is now testing major support zone. Keep an eye if this level holds. Source : Bloomberg

SGS reaching important levels

SGS (SGSN SW) is reaching March 2020 lows. It is also on the lower end of March 2022 triangle. Keep an eye. Source : Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks