Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Dassault Systemes at a very interesting level

Dassault Systemes (DSY FP) is back on a very interesting level. After May breakout and a 3 months consolidation (13% down since June high), stock is testing October uptrend support. Keep an eye at this zone 35.75-36.25. Source : Bloomberg

Gold breaking double support

Gold (XAU) is breaking June support 1907 and 200 days Moving Average at 1905. Next support levels are 1856 (minor) and 1807 (major). Source : Bloomberg

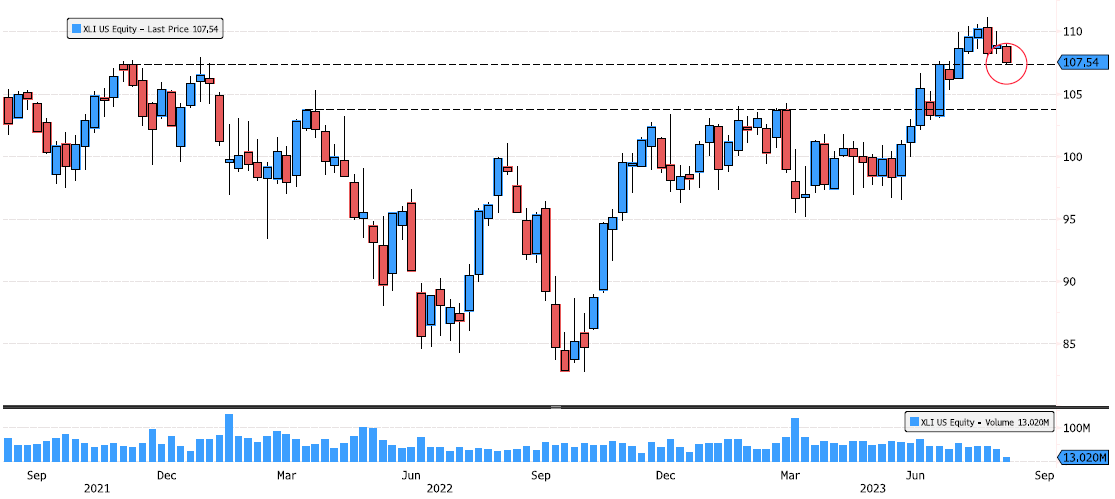

Industrial Sector retesting recent breakout

Industrial Sector (XLI US) is retesting July's breakout level. Keep an if it can hold. Next major support level is 103-104 zone. Source : Bloomberg

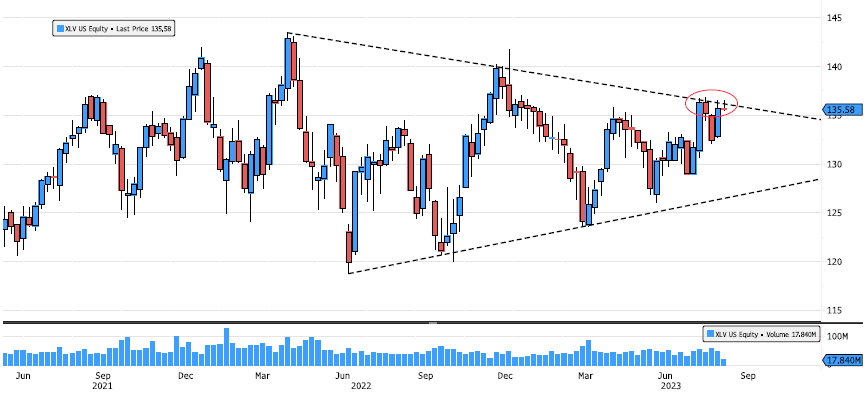

Health Care Sector pennant weekly pattern

Health Care Sector (XLV US) is in a consolidation pennant pattern since April 2022 ! Since 5 weeks, it's trying to breakout on the upside. Keep an eye on this level. Source : Bloomberg

Materials sector retesting important level

Materials sector (XLB US) is retesting April 2022 resistance downtrend level. Keep an eye at this level for breakout confirmation. Source : Bloomberg

SMI Index on lower end of trend channel

SMI Index (SMI) is testing the lower end of September 2022 bullish trend channel. Will market have enough strenght to rebound from here ? Next support levels are 10'850 and 10'600. Source : Bloomberg

Chevron breakout ?

Chevron (CVX US) is trying to breakout of massive triangle pattern. Will it be able to break ? Keep an eye on volume. Source : Bloomberg

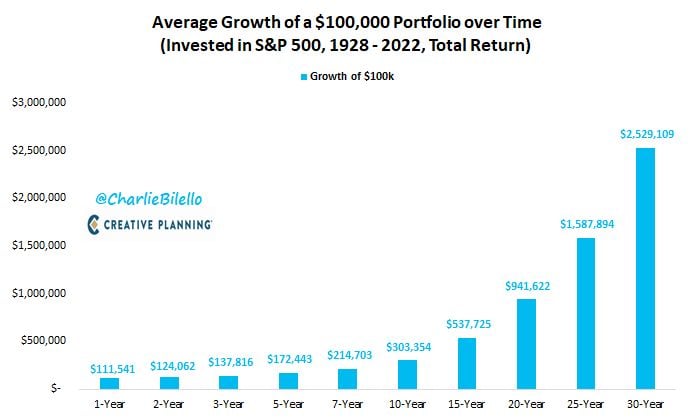

The biggest money in investing comes from patience and time

Your biggest edge as an individual investor comes from ignoring short-term fluctuations and playing the long game. Source: Peter Mallouk, Charlie Bilello

Investing with intelligence

Our latest research, commentary and market outlooks