Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

📉 Is a Fed Rate Cut on the Horizon Before the Elections?

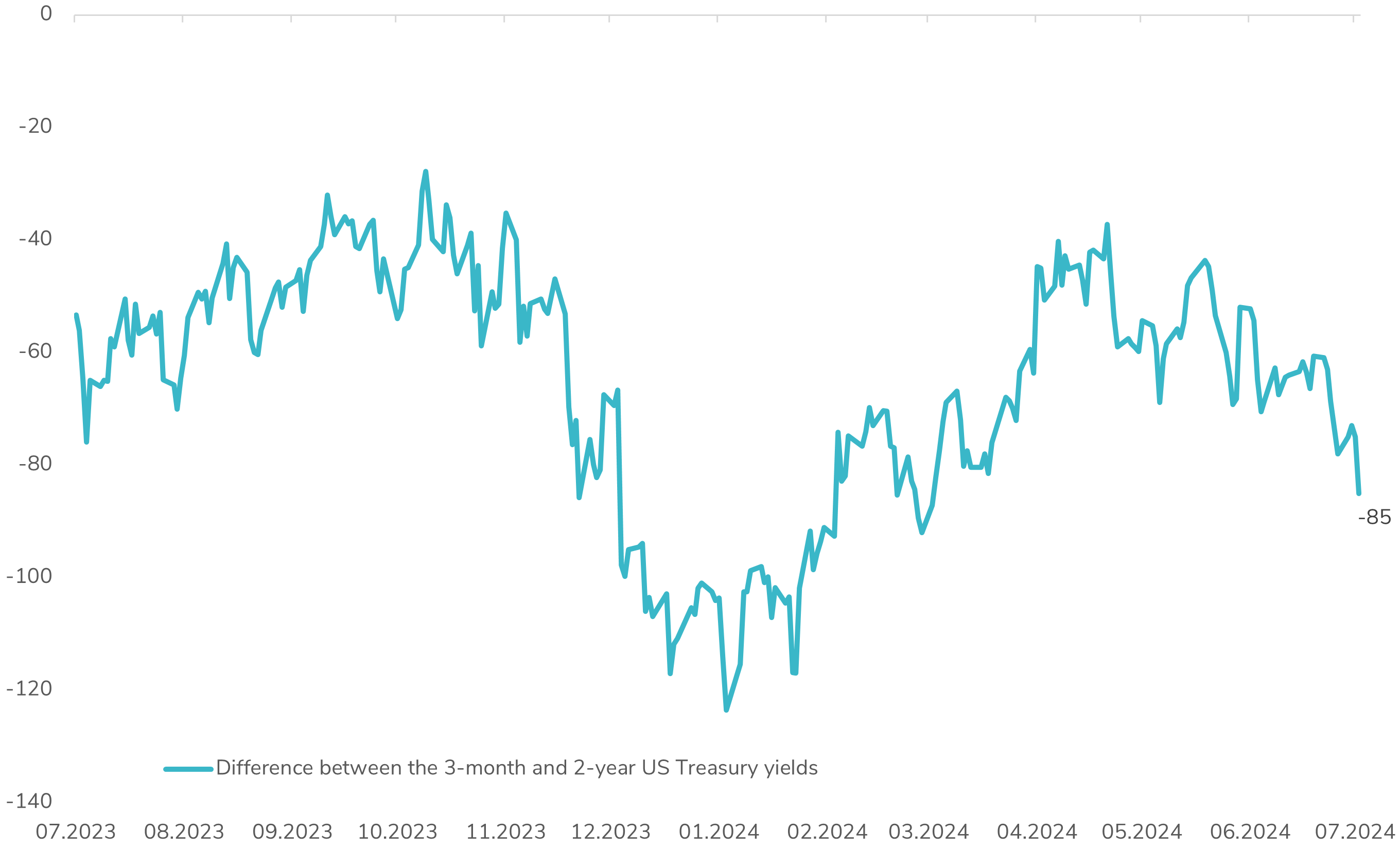

Recent economic data, especially in the job market, has underperformed, and Fed Chairman Jerome Powell's dovish remarks at the Sintra Forum have shifted market expectations. Reinforcing this sentiment, the just-released US Core CPI came in below expectations at 3.3%. Investors are now buzzing about a potential rate cut as early as the Fed’s September meeting, right before the US Presidential Elections. This is clearly reflected in the yield curve, with the spread between the 3-month and 2-year US Treasury yields dropping sharply from -60 bps to -85 bps over the past three days. This significant drop indicates an 85% probability that the market is pricing in a rate cut by September. The critical question remains: Will the US macroeconomic landscape deteriorate enough to prompt the Fed to start normalizing its monetary policy before the elections? #Fed #MonetaryPolicy #InterestRates #EconomicOutlook #Investing #FinancialMarkets #SyzGroup

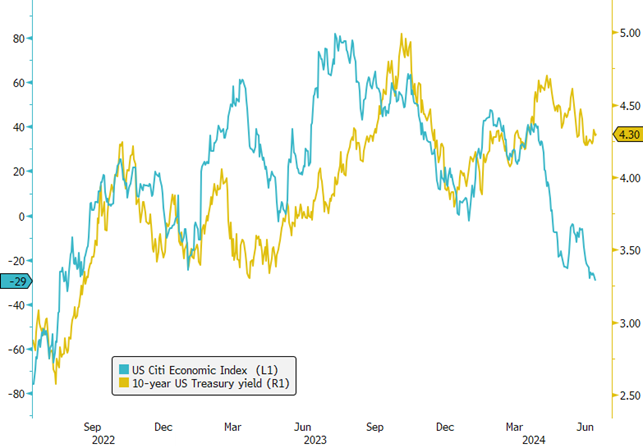

Q2 Fixed Income Review Chart: US Treasury Yields Resilient Amid Mixed Economic Signals!

As the second quarter of 2024 unfolded, a noticeable normalization of the US economy became evident, marked by a significant downturn in the US Citi Economic Index from 33 to -29, reaching its lowest level in nearly two years. Despite these economic headwinds, the 10-year US Treasury yields closed the quarter slightly higher at 4.30%, a 10-basis point increase. This apparent contradiction between economic normalization and rising yields can be largely attributed to substantial US Treasury issuances, necessary to fund the expansive US fiscal deficit. Furthermore, persistent inflationary pressures have prompted the central bank to delay the anticipated rate cut from July to November 2024, adjusting expectations amid changing economic conditions. As we approach a typically low-liquidity summer period, any shifts in interest rates could be magnified. Additionally, with the US presidential election on the horizon, market sentiments could be further influenced by electoral outcomes. The looming question is: Which will have a greater impact on third-quarter rates—the slowdown in the US economy, the ongoing inflationary and supply pressures, or the unfolding political landscape? #Finance #Economy #TreasuryYields #EconomicIndicators #Inflation #FiscalPolicy #InterestRates #USPresidentialElection #MarketAnalysis Source: Bloomberg

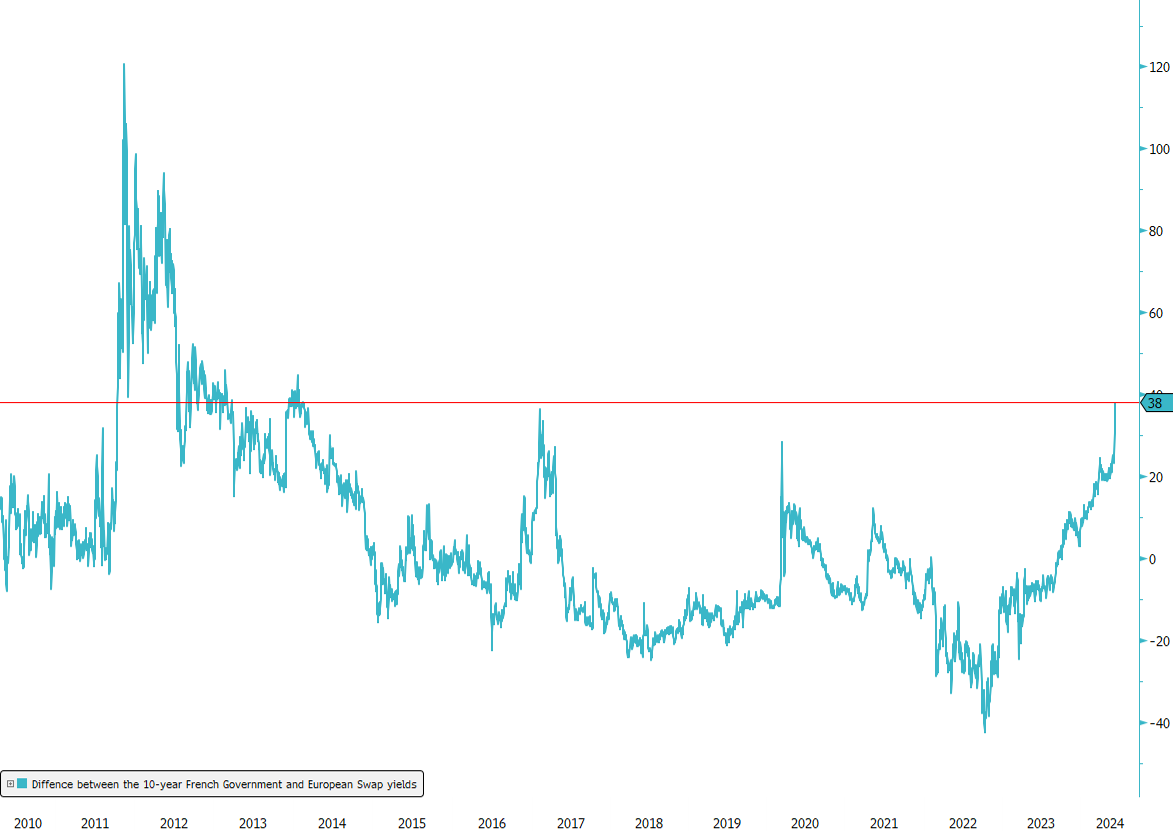

France's 10-Year Borrowing Costs Surge Against European Benchmarks!

The gap between the 10-year French government bond yield and the 10-year EUR Swap rate, a key benchmark for borrowing costs in Europe, has significantly widened since the recent European elections in France The trend was already "en marche" since S&P recently downgraded France’s credit rating from AA to AA-, following a similar downgrade by Fitch last year. Moody’s has also indicated that the current situation might lead to another downgrade. While other countries like Ireland and Spain have seen their financial health improve, France seems to be facing more challenges. Political uncertainty and reliance on international investors might cause money to leave France, pushing borrowing costs even higher. Higher interest rates on French bonds mean that investors want bigger returns because they see more risk in lending money to France. Japanese investors, who own a lot of French bonds, might start investing more in their own country due to rising interest rates there, reducing demand for French bonds. Additionally, some hedge funds are betting against European government bonds, showing a lack of confidence in the stability of European economies, including France. This trend underscores the growing concerns about France’s economic and political stability in the broader European context. Source: Bloomberg

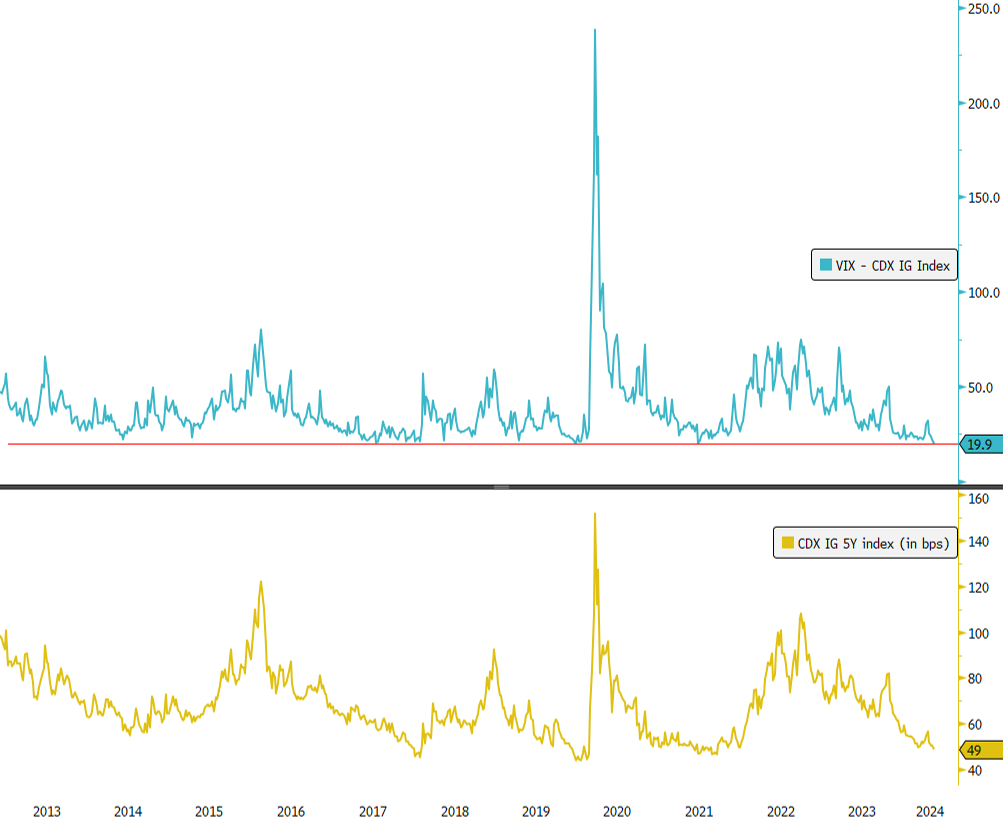

Volatility in US Investment Grade Corporate Bond Market Hits All-Time Low!

📉 Trend Alert: The 1-month volatility of the CDX North America Investment Grade index, a basket of 125 equally weighted credit default swaps on investment-grade issuers, has dropped to its lowest level since the index was launched in 2012. 📊 What’s Driving This Trend? Resilient Economy: The US economy is demonstrating strong resilience, which supports narrower credit spreads. Stable Equities: Low volatility in the US equity markets indicates investor confidence, further stabilizing the bond market. Strong Corporate Health: Robust fundamentals of US companies are contributing to lower credit risk perceptions. 📈 Interest Rates & Credit Spreads: Negative Correlation: There's a current negative correlation between US interest rates and credit spreads. This means that as interest rates rise, credit spreads tend to narrow, and vice versa. Positive Impact: This trend has led to US corporate bonds significantly outperforming US Treasuries, marking the biggest relative outperformance since the pandemic crisis in March 2020. ❓ Future Considerations: How long can we expect this low volatility and narrow spreads to continue? Watch the credit market closely for any signs of weakness. Source: Bloomberg

🚀 Chart of the Week: Japan's Yield Curve is Steepening Again! 📈

Big moves in the Japanese bond market! The Japanese yield curve, which tracks the difference between 2-year and 10-year yields, has dramatically steepened since late March and surged even more in May. It's now at 63 bps, a level we haven't seen since January! 📊 10-year and 30-year Japanese yields are hitting decade highs, approaching 1% and surpassing 2%, respectively. As the Yen weakens, the Bank of Japan stepped in to support the JPY and recently cut its bond-buying program for the first time this year. What’s next? The BOJ might sell off its US Treasuries holdings, potentially driving US Treasury yields up in the coming months. Higher Japanese yields also mean US Treasuries are less attractive to Japanese investors, who are key players in the US market. Last summer, a sharp steepening of the Japanese yield curve coincided with a major sell-off in US Treasuries...🤔 #Finance #Investing #Bonds #JapaneseEconomy #GlobalMarkets #Economics #Investors #FinancialMarkets #BankofJapan #USTreasuries Source: Bloomberg

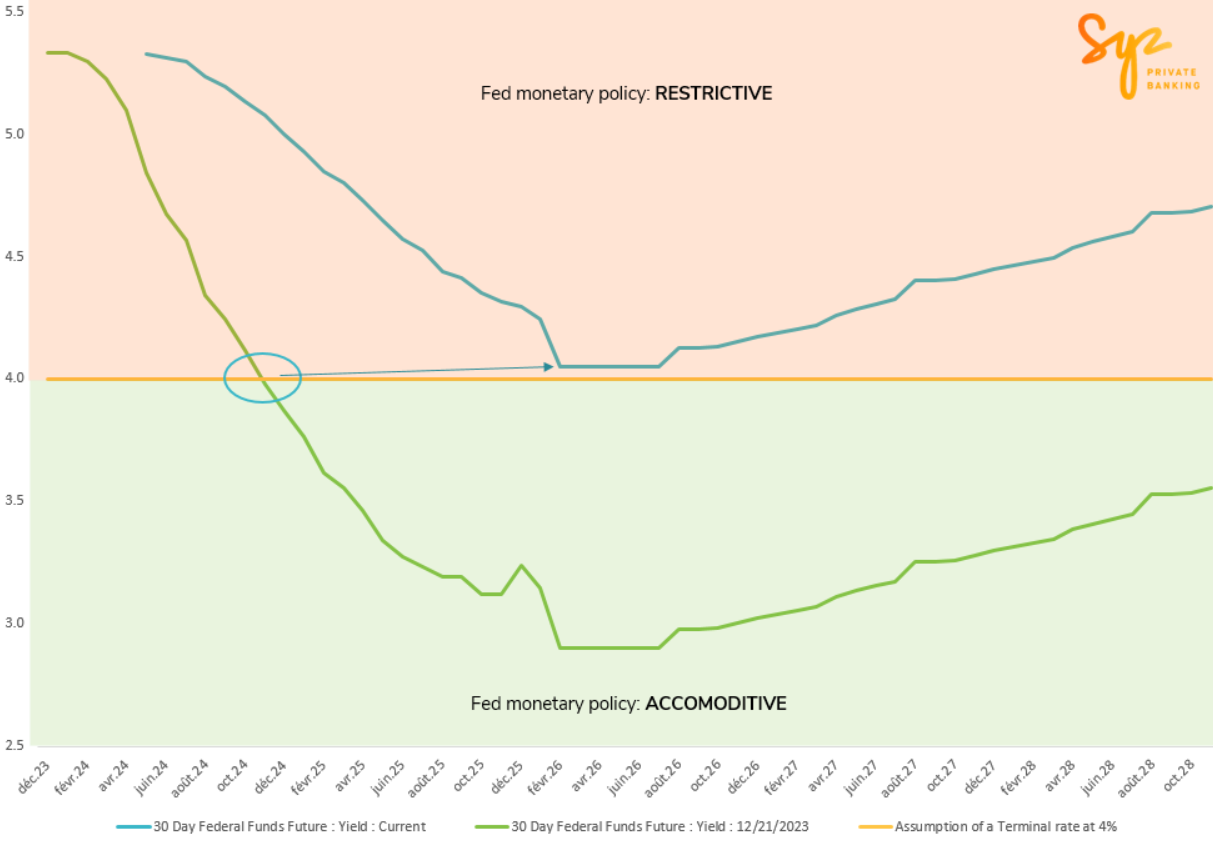

'Higher for Longer' — The Fed Fund Future Market Takes Heed!

The market has notably adjusted its expectations for the Federal Reserve's monetary policy over the coming years. Initially, an aggressive trajectory toward a terminal rate of around 3% was projected at the start of the year, indicating a return to a Neutral rate adjusted for inflation. However, current forecasts now suggest a more cautious normalization, with a significantly higher terminal rate of 4%. Intriguingly, the market anticipates further tightening by mid-2026, which some analysts believe could echo the inflation resurgence patterns of the 1970s. The Neutral rate (R*), long considered to be around 0.5%, is now hotly debated and estimated to be between 1.5% and 2.0% in the United States. The Fed Funds Futures market appears to have already factored in the impacts of enduring fiscal deficits, improved productivity, and deglobalization trends. How will these elements continue to influence Fed policy amid shifting global economic dynamics? Source: Bloomberg

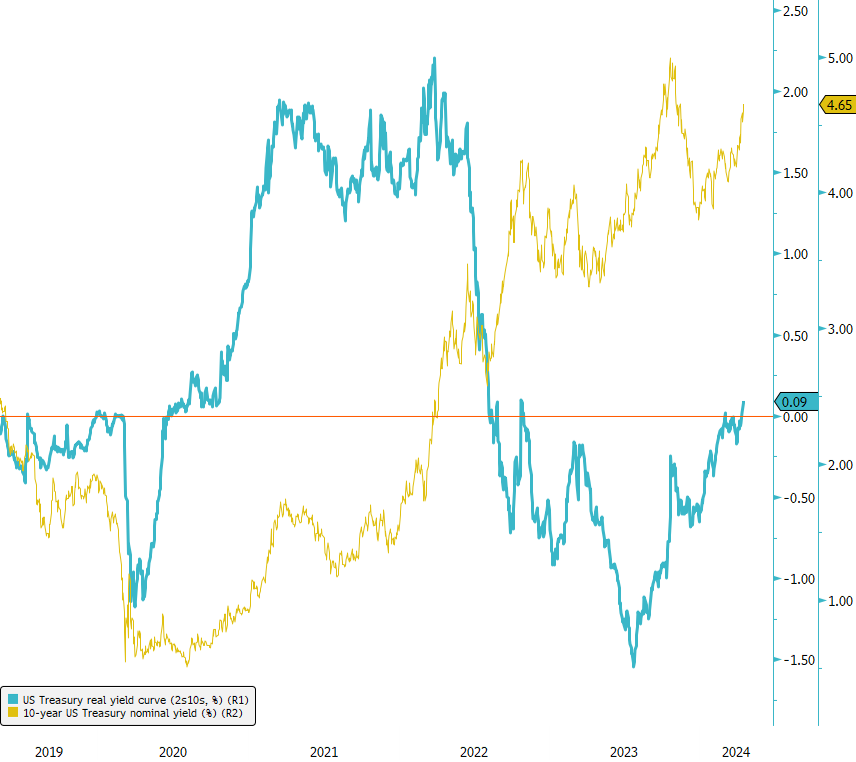

US Treasury Real Yield Curve Returns to Positive Territory!

The US Treasury real yield curve (2s10s) has shifted back into positive territory for the first time since 2022. This comes on the heels of a pronounced steepening trend that has unfolded since the beginning of the year. While this development is certainly noteworthy, it's essential to note that the current real yield curve level still trails its historical average, hovering around 0.6%. The recent uptick in interest rates, combined with the steepening of the real yield curve, raises questions about the potential implications for risky assets. Indeed, we're already witnessing some early signals in the High Yield market. The CDX HY index, which monitors single CDS of US HY companies, has shown notable widening from 310bps to 370bps over the past few weeks, indicating heightened risk perceptions among investors. With this in mind, how might further increases in interest rates, combined with a steeper real yield curve, impact risky assets moving forward? Source: Bloomberg

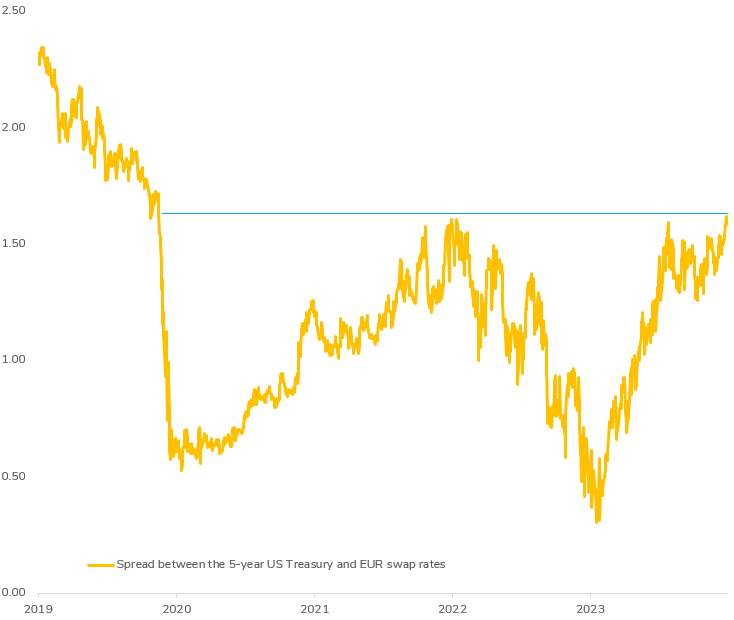

A Pivotal Moment Between the ECB and the Fed?

This week unfolds as a critical juncture for the interest rate disparity between the US and Europe. As the spread between the 5-year US Treasury and EUR swap yields hits its highest level since the pandemic, the upcoming release of US CPI data and the ECB meeting carry the potential to reshape this landscape once again. All eyes are on ECB President Lagarde as she navigates the challenge of maintaining ECB independence from the Fed, especially amidst differing inflation dynamics across the Atlantic. The implications for currency exchange rates, interest rates, and monetary policy are captivating areas to watch closely in the coming days.

Investing with intelligence

Our latest research, commentary and market outlooks