Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

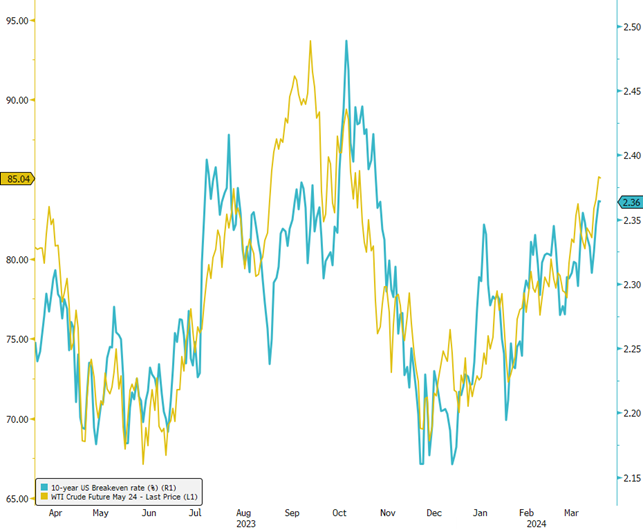

Impact of Higher Oil Prices on US Breakeven Rates 🛢️

📈 In recent months, the surge in oil prices has played a pivotal role in the noticeable increase in US Long Term breakeven rates, with a significant rise of 20 bps since the end of December. This trend underscores the nuanced dynamics that influence US Treasury nominal rates, which are comprised of the sum of real yields and inflation expectations (as captured by breakeven rates), alongside the impact of the term premium on longer maturities. Traditionally, long-term US breakeven rates have closely mirrored the Federal Reserve's inflation target of 2%, maintaining a 25-year average of 2.05%. This long-term alignment has served as a benchmark for inflation expectations and a guide for monetary policy. However, the aftermath of the pandemic has ushered in an era of elevated breakeven rates, with the 10-year US Breakeven rate averaging 2.33% since September 2020. This elevation signals market anticipations of persistently higher inflation over the next decade, influenced by factors such as deglobalization trends, sustained supply chain challenges, and increased commodity prices, notably oil. The correlation between rising oil prices and the uptick in US Long Term breakeven rates is stark, highlighting how energy costs can act as a bellwether for inflation expectations. The accompanying chart illustrates this relationship, with oil prices' sharp rebound since December propelling breakeven rates upwards, suggesting a potential for continued increases. This resurgence in oil prices coincides with a broader recovery in global economic activity, posing significant considerations for the Federal Reserve's approach to monetary policy. The crucial question now is whether the Fed will adjust its easing policy plan in response to these inflationary signals. Source: Bloomberg

#ChartOfTheDay: European High Yield Faces CCC-Rated Headwinds 📊

European High Yield markets encountered headwinds last week, particularly among the weakest issuers with CCC ratings, which experienced a notable decline of -0.7%. This downturn was fueled by renewed credit concerns, exemplified by significant drops (-30 points) in the senior unsecured debt of Altice France following debt restructuring announcements, and Ardagh Packaging exploring its debt structure. These incidents follow the recent Intrum crisis, where debt collector bonds plummeted by 20 points amid restructuring talks. These developments have erased the year-to-date gains of CCC-rated bonds in Europe, which stood at +6% before last week's events. This serves as a stark reminder of how quickly circumstances can change, especially in today's volatile interest rate environment! Stay informed and vigilant in navigating the ever-changing landscape of high yield markets. #HighYield #CreditConcerns #MarketVolatility 📉

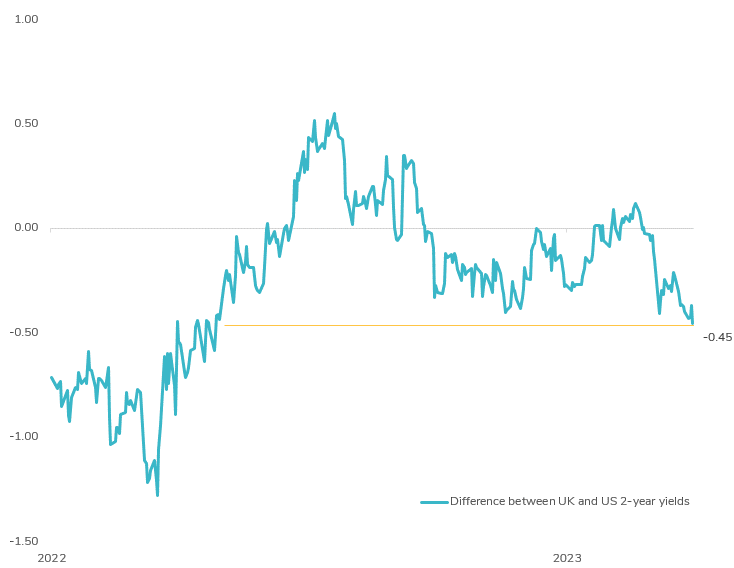

UK Yields Extend Divergence from US Yields Post-BOE Meeting 📊

The Bank of England's today meeting took a more dovish turn than anticipated. Despite holding key rates steady at 5.25%, not a single BOE member voted for a hike for the first time since September 2021. Market sentiment is swiftly adjusting, with expectations shifting from a previously anticipated rate cut in August to now eyeing possibilities in June (70% chance) and even May (15% chance). The news triggered a significant rally in UK government bonds, driving the differential between 2-year UK and US yields to its lowest level in a year! This divergence underscores the evolving dynamics in global markets. Following the surprising interest rate cut by the Swiss National Bank, central banks worldwide appear to be reassessing their strategies. Source: Bloomberg

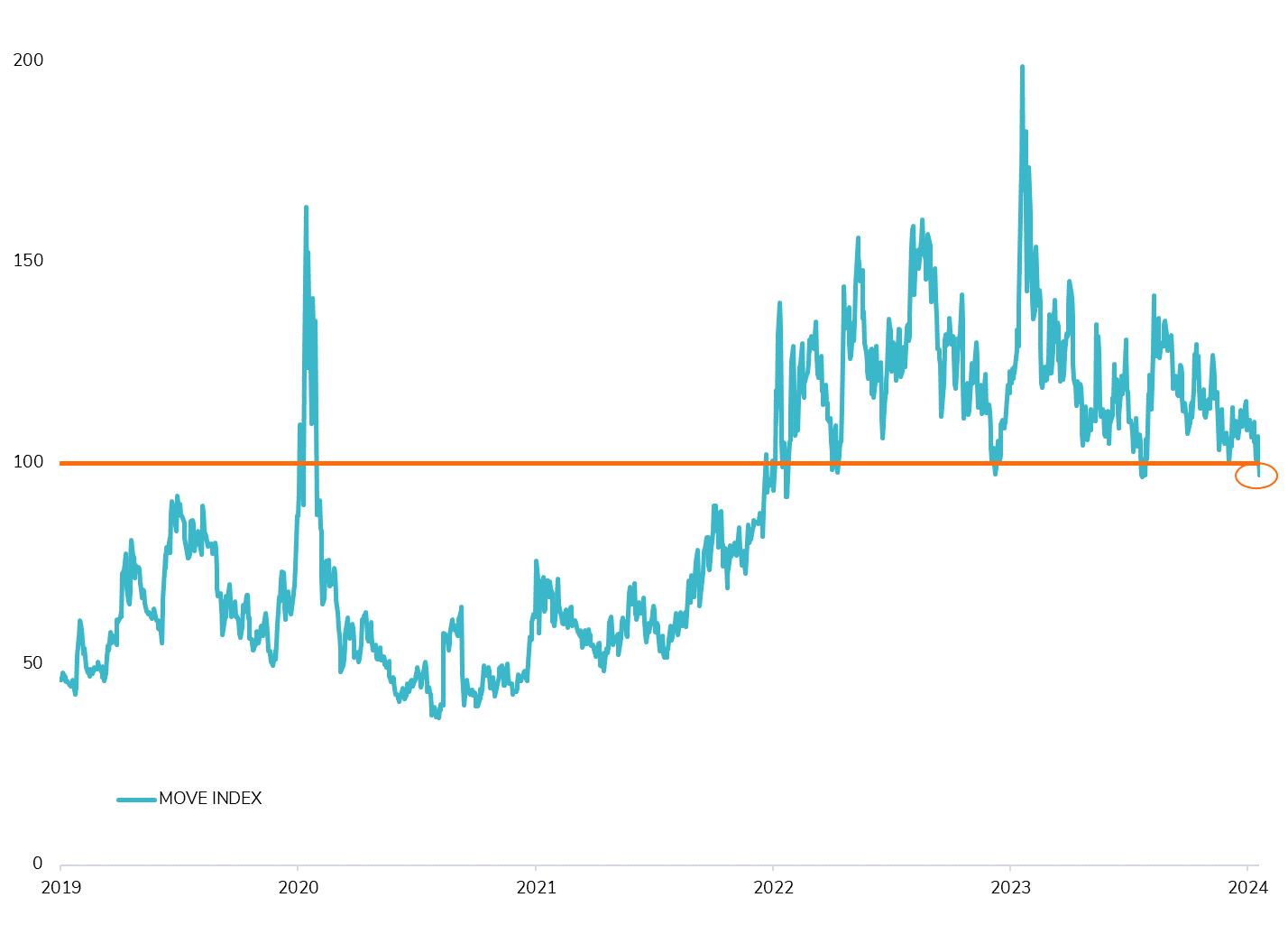

Interest Rate Volatility Drops Below 100 for the First Time in 6 Months!

The #MOVE index, a key measure of US #interestrate #volatility, has dropped below 100 for the first time since September 2023. This marks a significant shift in market dynamics. While attempts to breach this threshold have been made three times since early 2022, they were short-lived, with volatility bouncing back above 100 each time. For the past two years, the #government #bond market has been in a high volatility regime, making investing in long-term US #Treasuries challenging due to relatively low adjusted yield to volatility. The question now is whether this high volatility regime is coming to an end or if it's just another false alarm. Several indicators suggest that this could be another false signal. Growing uncertainty surrounding #inflation in the US may prompt the #Fed to adjust its monetary policy, potentially implementing a reverse operation twist (and thus steepen the yield curve). Additionally, there's still a positive #carry from #shorting bonds. However, signs of improvement are emerging as well. Recent #auctions have shown that the market is absorbing the supply effectively, and the #correlation between bonds and equities is turning negative again. Could this be a pivotal moment in the US Treasuries market? Let's keep a close eye on how things unfold. Source: Bloomberg #fixedincome #bond

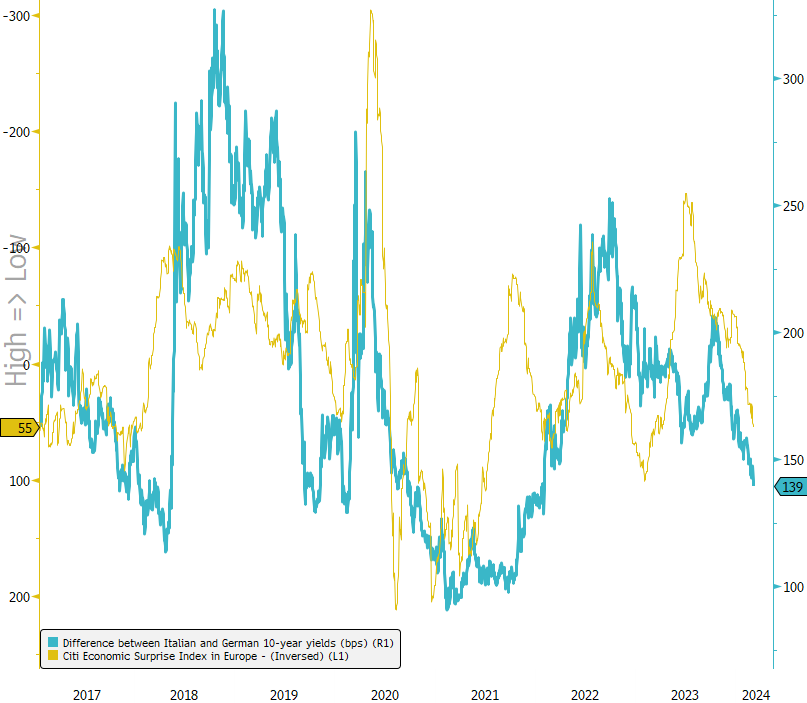

Italian 10-Year Spread Hits Lowest Level in Two Years!

The surge in investor confidence has propelled Italian spreads to their lowest point in two years. The gap between Italian and German 10-year yields dipped below 140 basis points for the first time since early 2022. The rebound in Citi's European Economic Surprise Index has undoubtedly contributed to this trend. In a reflection of the credit market, peripheral bonds are demonstrating strong outperformance compared to core government bonds. However, amidst this optimism, questions linger: Is this downward trajectory sustainable? #ItalianBonds #MarketTrends #InvestmentOpportunities 🇮🇹💼

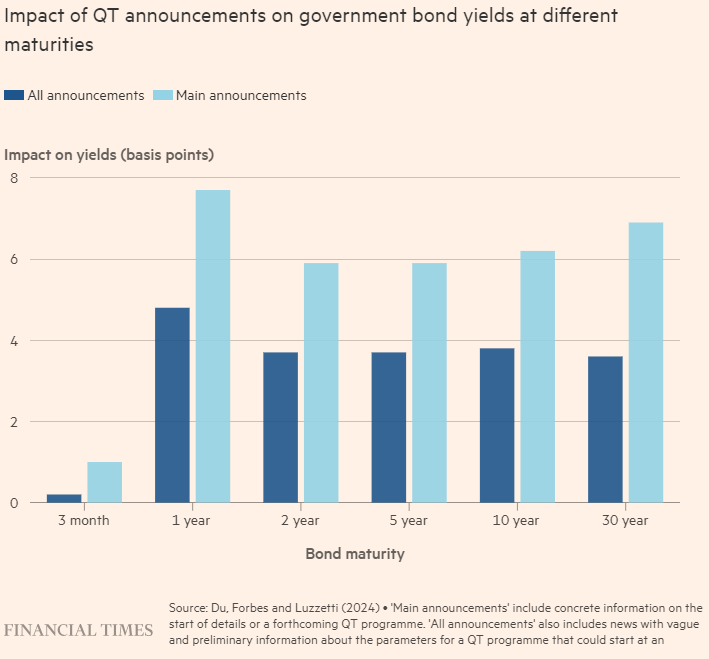

Unveiling the Impact of Quantitative Tightening: Intersting Insights from FT

🌟 Delving into recent insights from the Financial Times sheds light on the impact of Quantitative Tightening (QT) and its implications for financial markets. Let's break it down: 📊 QT's Functionality: Recent evidence from a study involving seven central banks, including the Fed's earlier QT efforts from 2017-2019, reveals that QT operates "in the background," subtly supporting central banks' endeavors to tighten financial conditions without significantly disrupting market functioning or liquidity. 💼 Market Reaction: Announcements of QT's commencement have led to slight increases in government bond yields. However, the actual implementation of QT, including outright bond sales, has had minimal disruptive effects on market dynamics and liquidity. 🔄 Passive vs. Active QT: The distinction between passive and active QT strategies is crucial. While passive QT (letting bonds mature) impacts short-end yields, active QT (outright sales) tends to steepen the yield curve, highlighting the nuanced effects of different QT approaches. 🤝 Market Support: The smooth adjustments observed in response to QT can be attributed partly to domestic nonbanks and, to a lesser extent, foreign investors stepping in to purchase securities as central banks reduce their holdings, maintaining market stability amidst changes in monetary policy. 💡 Navigating Future Challenges: What strategies will central banks employ to navigate the looming challenges posed by high government debt issuance and absorbed pandemic-era liquidity, in light of the insights gleaned from recent evidence on quantitative tightening's impact? #QuantitativeTightening #FinancialMarkets #CentralBanks #EconomicInsights

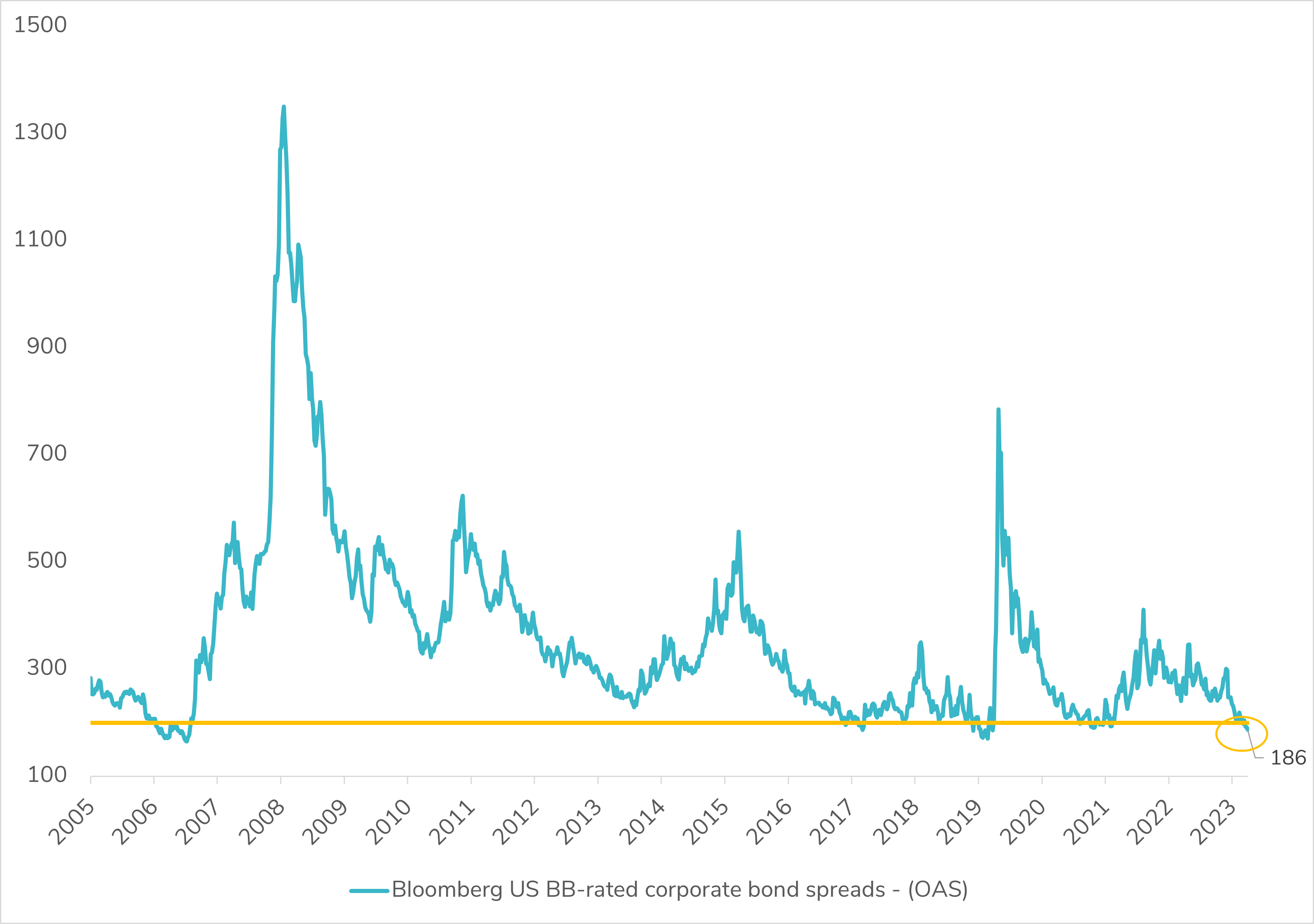

📉 US High-Yield Corporate Bond Spreads Hit Historic Lows!

In February, US credit markets surged ahead of US Treasuries as spreads tightened significantly, reflecting the resilience of the US economy and robust corporate fundamentals, highlighted by strong Q4 2023 earnings. The spread of the Bloomberg US BB-rated corporate bonds index dipped below the 200 basis points mark, entering unprecedented territory. 💼 But with spreads at historic lows, the burning question emerges: Is this move sustainable, and for how long? As investors, should we prioritize absolute yield or relative yield in this environment? 🤔 With tightening credit spreads, it's imperative to carefully weigh the options. Remember, as spreads narrow, the risk of wider credit spreads increases, leaving less room for error. Source: Bloomberg #CreditMarkets #CorporateBonds #FinanceNews

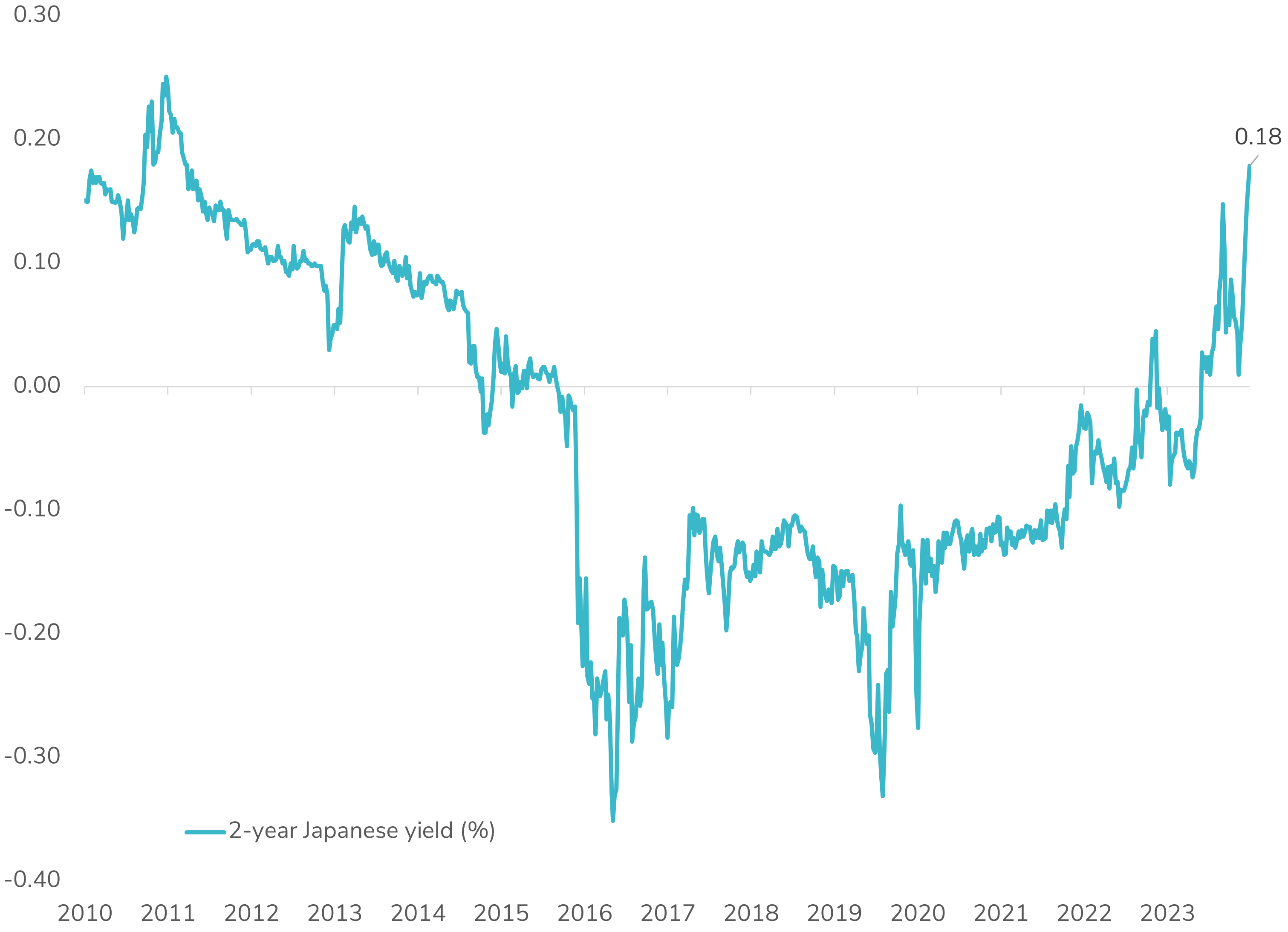

📈 Japanese 2-Year Yield Surges to 14-Year High!

Japanese government bond yields are on the rise across the curve, triggered by Bank of Japan Board Member Hajime Takata's comments hinting at a potential end to the negative interest rate policy. Takata cited progress towards achieving the price target, indicating a possible rate hike—the country's first since 2007—expected in March or April. The front end of the Japanese yield curve is particularly influenced by the BOJ's monetary policy and continues to reprice higher rates. The market anticipates a 0.25% rate hike for the full 2024 year. It appears that Japan will gradually transition away from the negative interest rate monetary policy. 🇯🇵💼 #JapanEconomy #BOJ #MonetaryPolicy #YieldCurve #FinanceNews

Investing with intelligence

Our latest research, commentary and market outlooks