Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

UK 20-Year Bond Auction: A Strong Start to 2024!

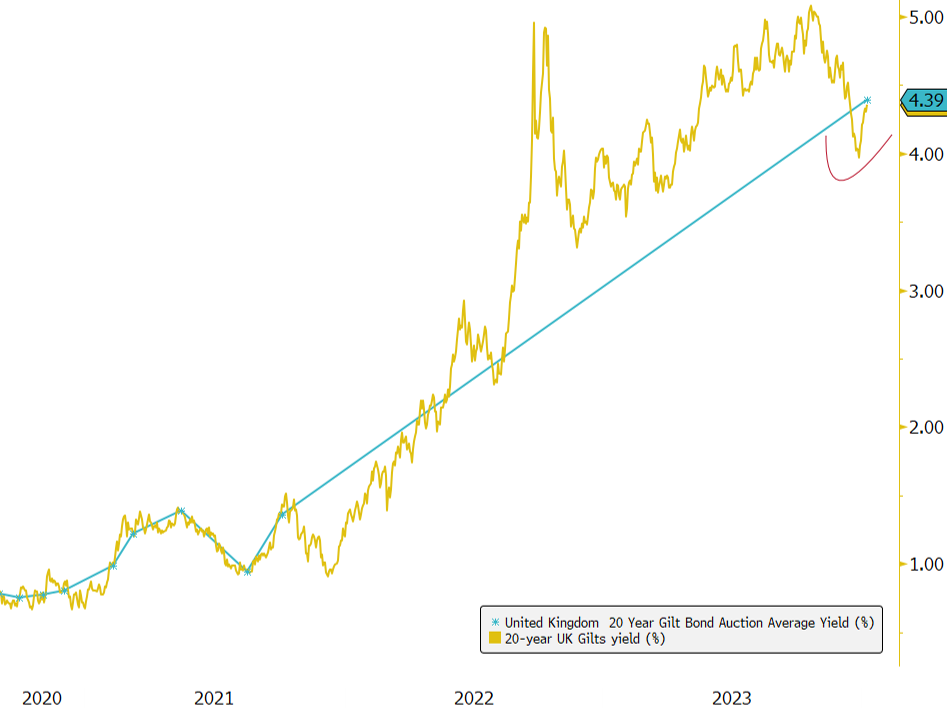

Today's successful auction of the UK 4.75% 2043 bonds, raising GBP 2.25 billion at a yield of 4.391%, represents a significant rise from the 1.36% yield in the previous auction in October 2021. 📈 Highlighting investor confidence, the auction achieved a strong bid-to-cover ratio of 3.6. Notably, the 20-year UK Gilt has climbed nearly 40bps from its late 2023 low. 🔍 With core inflation trends showing signs of stabilization, market participants are keenly awaiting signals from upcoming wage and inflation data. We are observing keen interest in how the yield curve will react, particularly with the anticipated new 30Y gilt syndication on the horizon. More steepening could be on the cards. 💷 Considering the estimated £76 billion gilt supply for Q1 2024, a key question emerges: Can today's robust auction mitigate the recent selloff, primarily driven by substantial global duration issuance and reassessment of aggressive rate cut expectations? Source: Bloomberg

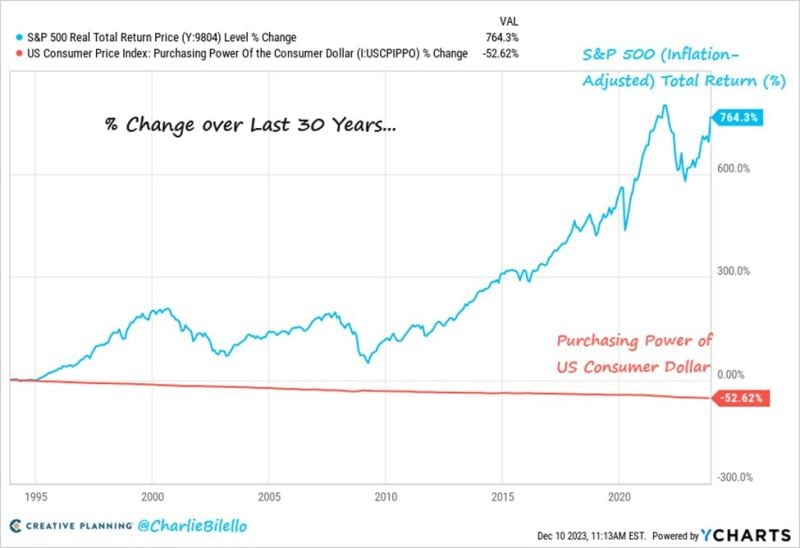

Investing in stocks is one of the best options available to protect your wealth against money debasement

Over time, the purchasing power of the dollar declines, while the stock market increases. That means you need more dollars to buy the same things. If you want to protect your purchasing power, invest in stocks for the long run. Source: Charlie Bilello thru Peter Mallouk

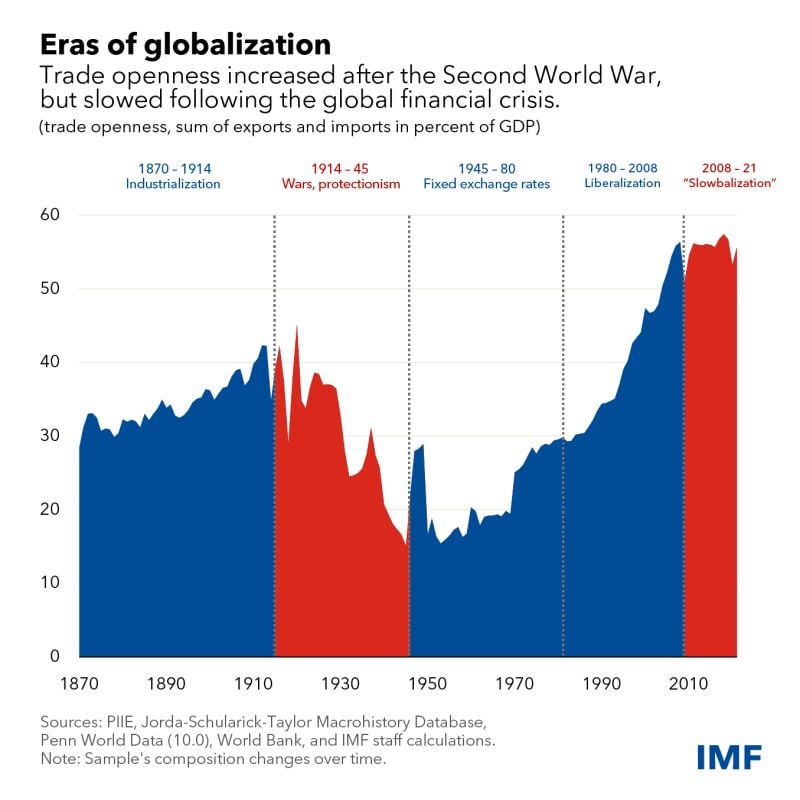

Net effect of slowbalization is growing stagflation risk

Update "slowbalization" chart by IMF.

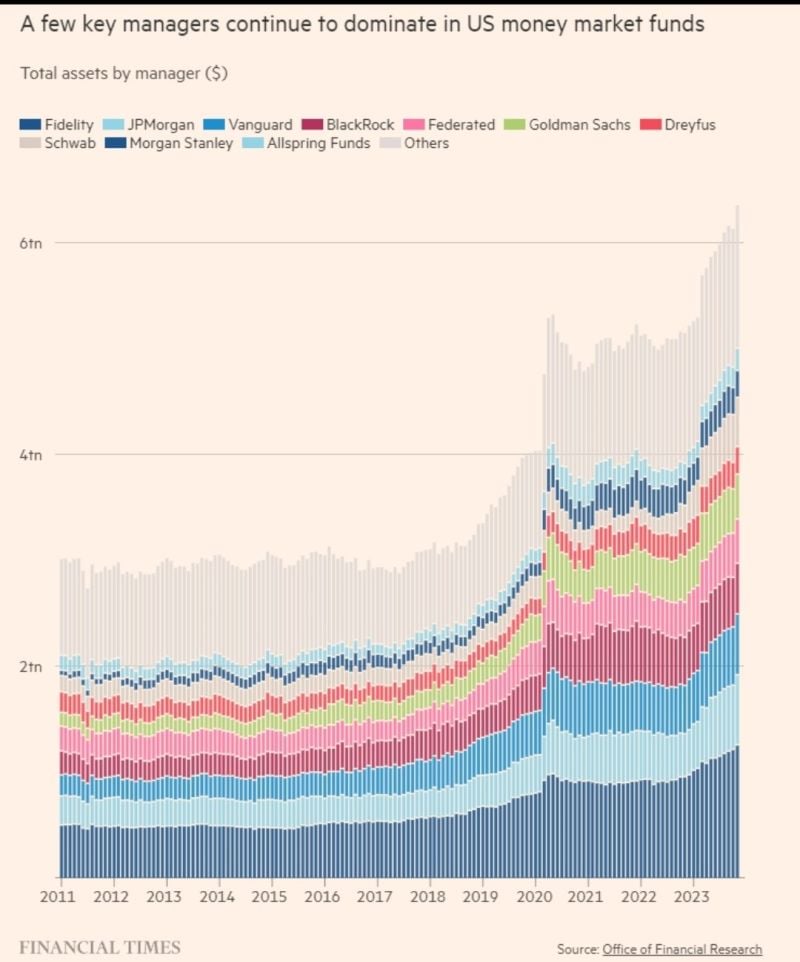

All-Time High $6.3 Trillion sitting in U.S. Money Market Funds

Source: Win Smart, CFA, FT

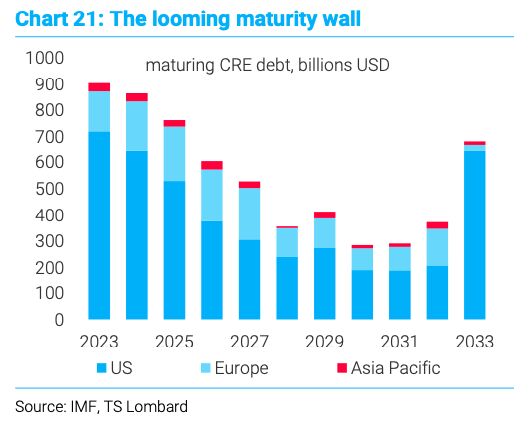

Billions of commercial real estate debt mature this year

Unlike US home loans, CRE debt is almost entirely interest-only. Borrowers tend to have low monthly payments but face a balloon payment equal to original loan on maturity. Source: Dabiel Baeza, TS Lombard

Investing with intelligence

Our latest research, commentary and market outlooks