Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Tencent's stock crashes 16% in minutes after Beijing released draft guidelines aimed at curbing incentives that could lead to excessive gaming and spending

Tencent is China's largest public company and the drop erased ~$55 billion of market cap. This also marks the biggest one-day drop for the company since 2008. Note that NetEase sank by as much as 28% to HK$117.30, breaking briefly below a key technical support offered by a February low at around HK$120.70. In mid-afternoon trade, NetEase shares pared losses to trade down about 20% at HK$129. Source: The Kobeissi Letter, CNBC

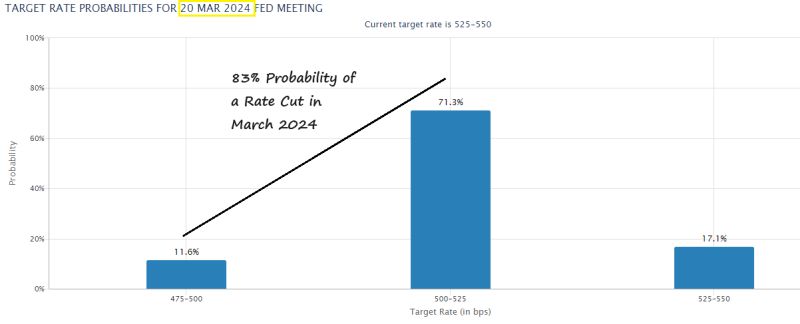

The probability of a Fed rate cut in March 2024 has jumped up to 83%. A month ago the odds were only 29%.

Source: Charlie Bilello

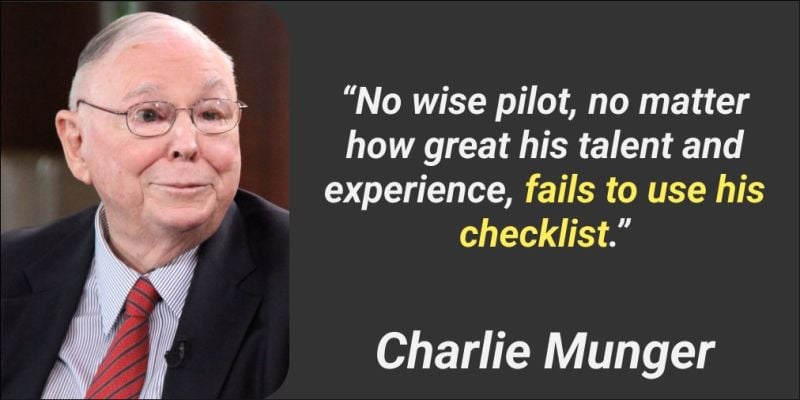

Buffett. Lynch. Munger. Fischer.

All of these investing legends use checklists. Source: Brian Feroldi

Bond trade looks a bit crowded: Record 62% of Fund Managers polled by BofA in December expect bond yields to be lower in 12 months’ time.

Source: BofA, HolgerZ

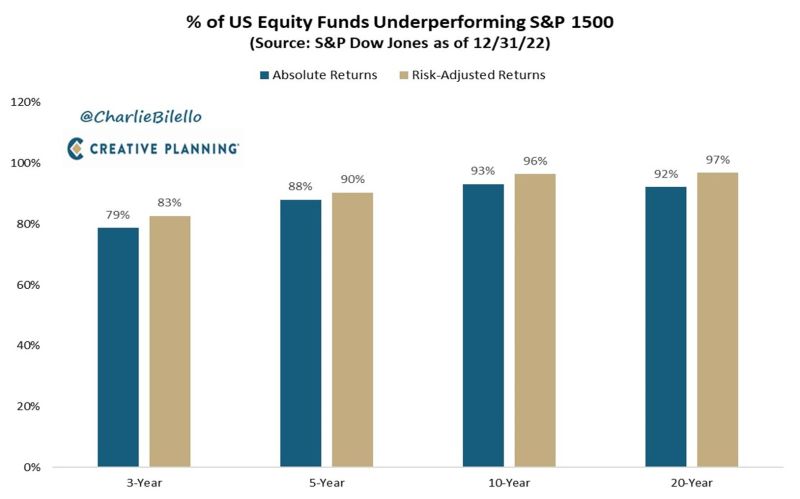

The longer you own an actively managed mutual fund, the more likely you are to underperform the market, especially on a risk-adjusted basis

Source: Peter Mallouk

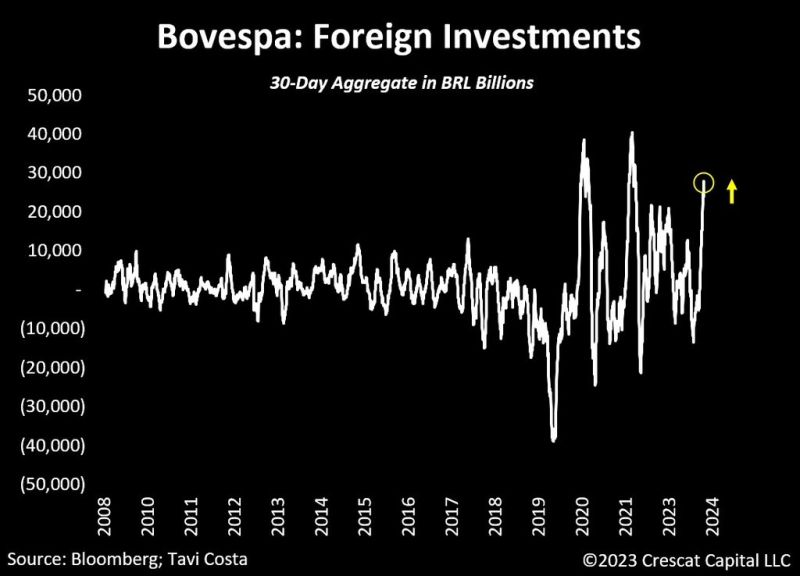

Tavi Costa -> Brazilian equity markets have experienced near-record foreign investments in the last month

Despite all the skepticism about $EWZ is outperforming the S&P 500 by 23 percentage points in the last 2 years. The aggregate market cap of Brazilian stocks relative to its overall money supply remains near historical lows. Source: Crescat Capital, Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks