Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

US Yields back at 4% for the first time since August

Monday 7th of october 2024 recent yields move US Treasury 2yrs and 10yrs

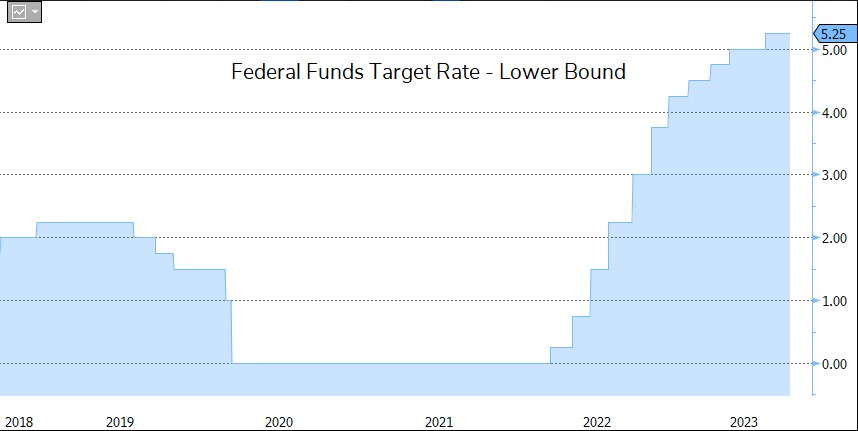

FED cuts rates by 50bp to 4.75%-5% range

The Federal Reserve lowered its benchmark interest rate by a half percentage point Wednesday, in an aggressive start to a policy shift aimed at bolstering the US labor market.Committee sees another half-point of cuts in rest of 2024Policymakers penciled in an additional percentage point of cuts in 2025, according to their median forecast.

Gold hit record high 2'135.39/oz in early trading hours

Gold surged to a new all-time high as growing expectations for US rate cuts early next year. This latest leg of gold's rally has been turbocharged by comments on Friday from Fed Chair Jerome Powell. Precious metal's strength has been underpinned buy other factors as purchases by governments and central banks as well as geopolitical uncertainty.

US 10-year Yield pullback from last week peak

US 10-year Yield pullback sharply from last week peak. After the Non-Farm Payrolls report on Friday, the US 10-year Govt Yield came close to hitting 4.9%. As of today, that Yield is down below 4.6%.

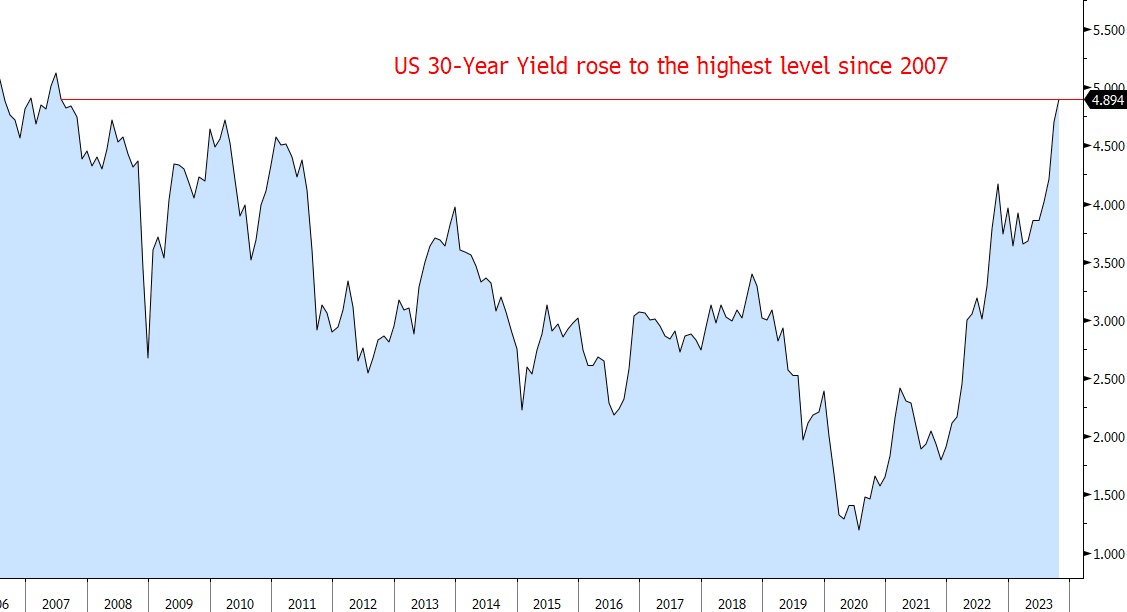

US 30Year Yield reaches 2007 High

The US 30-year yield rose to the highest level since 2007. This week's Treasury selloff came after US lawmakers managed to avert a government shutdown, prompting traders to increase bets that the Federal Reserve will raise rates in November.

S&P 500 Index breaches 4400 level

The SPX Index breaches down its 4'400 Level and testing the 100 days Moving Averaged. Market continues yesterday downtrend after the Fed signaled it will keep rates higher for longer.

FED leaves rates unchanged, signals one more hike this year

The Federal Reserve left its benchmark interest rate unchanged while signaling one more hike this year. FOMC repeated language saying officials will determine the “extent of additional policy firming that may be appropriate.” The FOMC held its target range for the federal funds rate at 5.25% to 5.5%, while projections showed 12 of 19 officials favored another rate hike in 2023.

China asks some Funds to avoid net equity sales as Markets sink

Chinese authorities asked some investment funds this week to avoid being net sellers of equities, as a rout in the nation’s financial markets deepened. Stock exchanges issued the so-called window guidance to several large mutual fund houses, telling them to refrain for a day from selling more onshore shares.

Investing with intelligence

Our latest research, commentary and market outlooks