Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- technical analysis

- gold

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

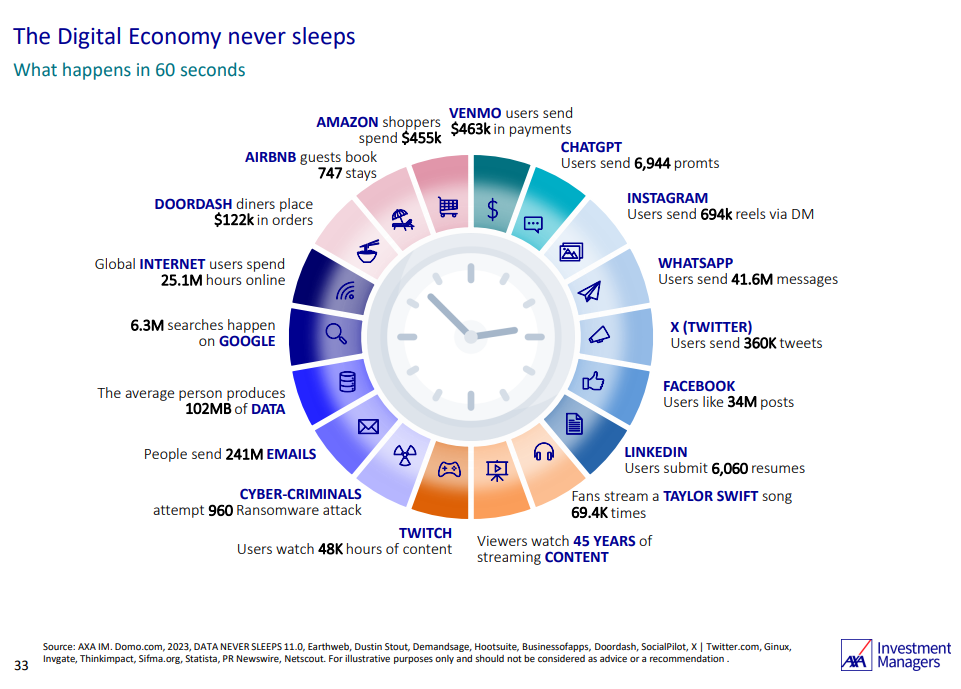

The digital Economy never sleeps

Source: AXA Investment Managers (2023 numbers)

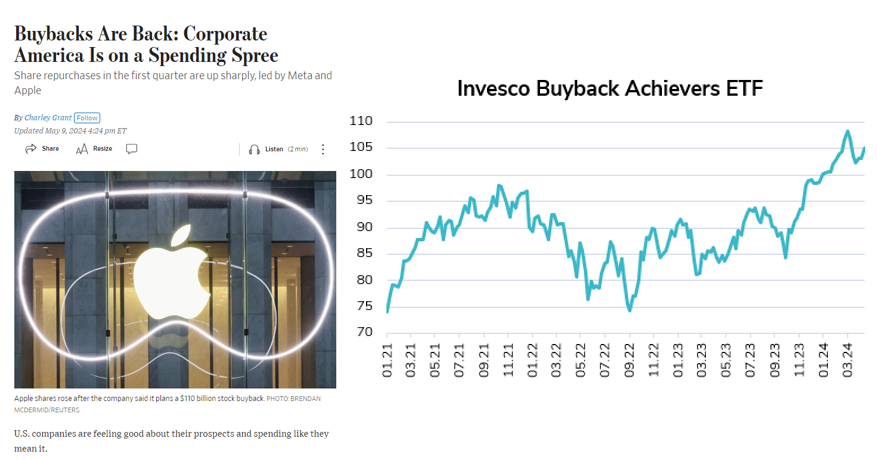

Goldman Sachs and HSBC are saying that funds and global investors are rotating out of US and Japanese stocks

To reposition on the Hong Kong stock market which appears to offer significantly better opportunity. Hong Kong listed companies mainly do business across Asia with limited interference from the Chinese government. Source: Bloomberg

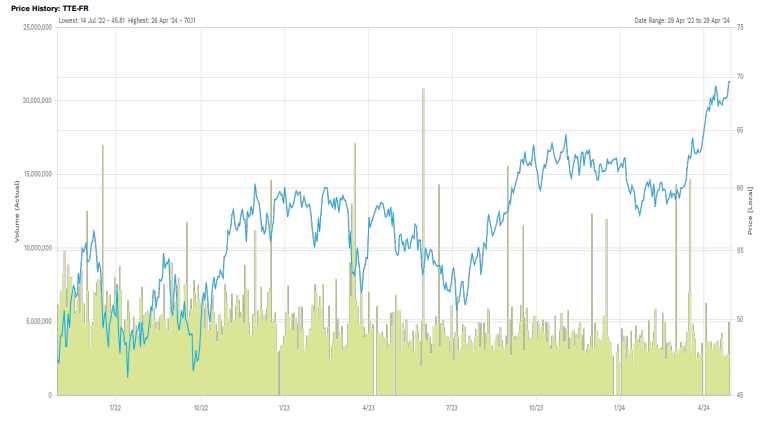

TotalEnergies is assessing to move its primary listing to the US.

On Friday, TotalEnergies’ CEO Patrick Pouyanné declared that the company’s board is considering moving its primary listing to the US as the European shareholder base now holds a minority position in the company’s capital mainly due to the strict European ESG standards that discourage investments in fossil fuels. The American shareholder base, on the other hand, represents over 45% of Total’s capital. Source: FactSet

BHP Billiton approached Anglo American to create the world's largest copper producer.

Yesterday, mining giant BHP Billiton has offered to buy rival Anglo American (ex-its South African iron ore and platinum assets) for USD 39 bn. According to Bloomberg, if the deal proves successful, “BHP-Anglo could control 11% of the mined copper supply”. This deal highlights copper’s dominance as the primary metal in the energy transition and underscores the significant consequences of the recent disruptive events affecting global supply. Copper’s upward trajectory is accelerating.

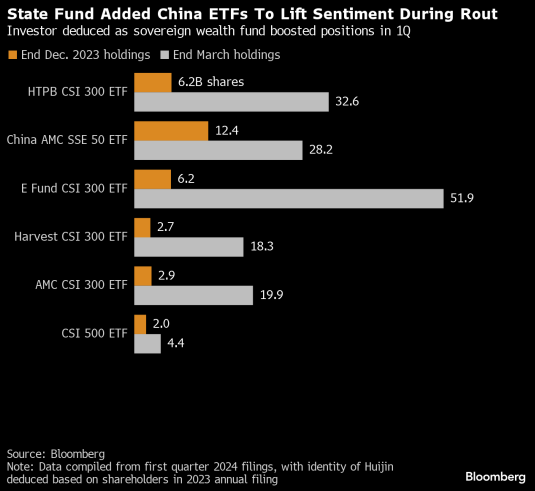

State Fund added China ETFs to lift sentiment during rout

According to Bloomberg, China’s sovereign wealth fund has “likely bought at least USD 43 bn of onshore exchange-traded funds in the first quarter” vs. USD 6.8 bn in the second half of 2023. The extent of the buying provides insight into the government willingness to stabilize the markets during challenging periods.

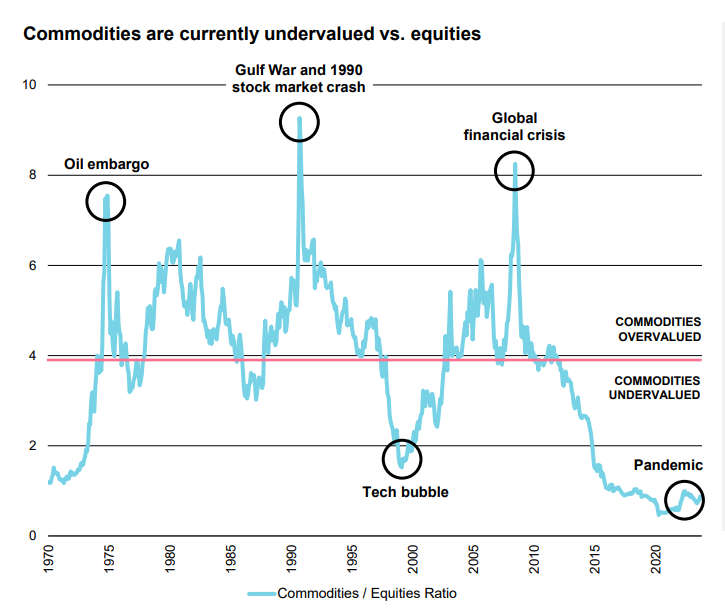

Commodities are currently undervalued vs. equities

Source: Vontobel

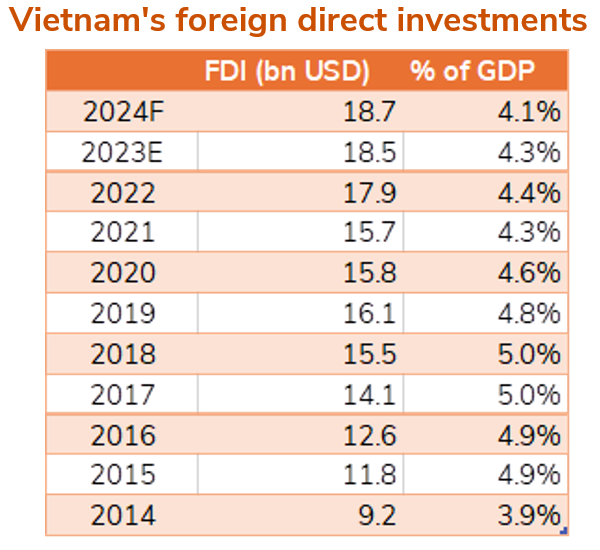

Despite facing the typical challenges of a frontier market, Vietnam offers many attractive characteristics contributing to its rapid economic growth.

Thanks to its young and well-educated workforce and its competitive labor costs, the country has emerged as one the main beneficiaries of the “China+1” trend; it is one of the preferred destinations of global manufacturers looking to diversify their supply chains away from China. Source: Lumen Vietnam Fund

Investing with intelligence

Our latest research, commentary and market outlooks