Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

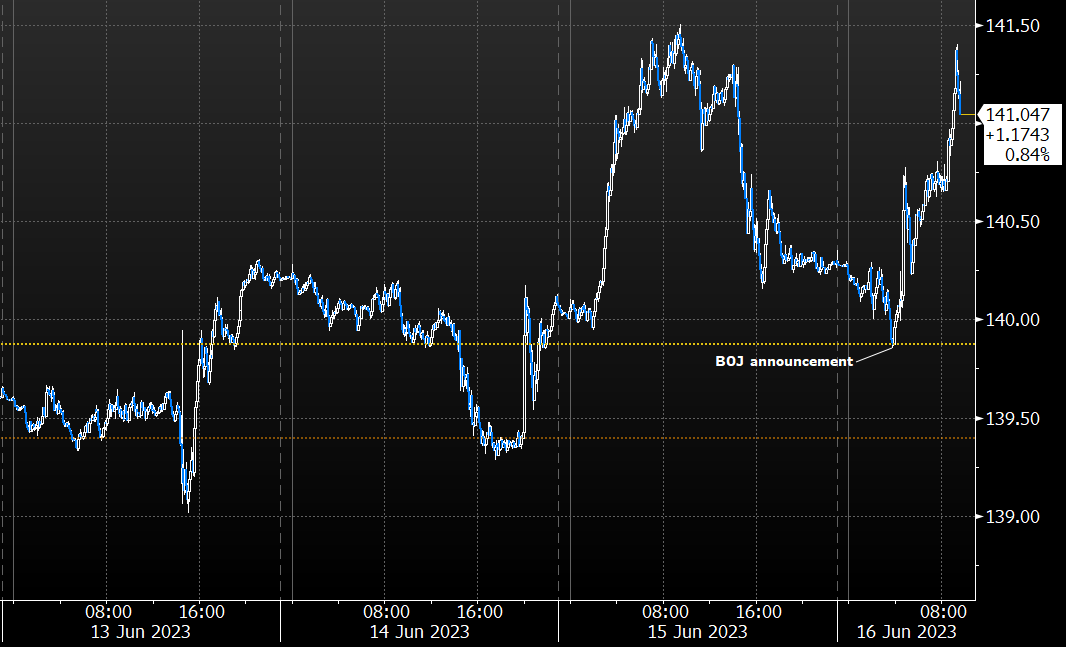

Yen declines as BOJ sticks with super easy policy unlike peers

The Bank of Japan continued to defy global central bank trends by sticking with stimulus as it waits for signs of more sustainable inflation while its peers signal the need to raise interest rates further to rein in prices.

Governor Kazuo Ueda and his fellow board members left their negative interest rate and yield curve control program unchanged at the end of a two-day gathering and maintained their view that inflation will slow over the coming months, according to a statement Friday.

The yen declined after the decision, falling to around 141.40 per dollar. It had hit a seven-month low of 141.50 on Thursday.

Source: Bloomberg

Fed left interest rates unchanged but suggest further hikes

Federal Reserve officials paused their series of interest-rate hikes but projected borrowing costs will go higher than previously expected.

Powell, speaking to reporters in a press conference Wednesday, faced the challenging task of explaining two possibly contradictory policies: deciding to leave rates unchanged following 10 straight hikes while also indicating that at least two more increases might be necessary this year, possibly as soon as July.

Source: Bloomberg

Federal Reserve to skip a rate hike

A gauge of dollar strength held near a one-month low on speculation the Federal Reserve will skip an interest-rate hike at a policy meeting ending Wednesday.

While US CPI data has cemented bets on a Fed pause, it also suggests that we might see more tightening later, which will ultimately slow the US economy.

Source: Bloomberg

Bank of Canada raises key rate by 25 bps to 4.75% vs. 4.5% est.

The Bank of Canada defied expectations by restarting its interest-rate tightening campaign, saying the economy is running too hot.

Source: Bloomberg

Falling inflation expectations could allow Norges Bank to hike further

In the medium term, we observe that the EUR/NOK direction tends to follow relative consumer confidence between the Euro-area and Norway. In the current economic context, this indicator is linked to inflation pessimism, and the recent positive inflection in Norway could signal the end of FX losses. In a survey published this week, households in Norway now expect inflation at 4% in one year, from 6% one quarter ago.

Falling inflation expectations could allow Norges Bank to hike further, and importantly, the revival of consumer confidence could eventually help NOK to recover.

Source: FxStreet & Société Générale

EUR/USD resumes decline, approaches the 1.0900 level

EUR/USD has resumed its slide early in the American session and is on its way to challenging the 1.0900 figure. Risk aversion leads financial markets, with stocks in sell-off mode, hinting at further US Dollar gains.

Support levels: 1.0890 1.0830 1.0785

Resistance levels: 1.0955 1.1000 1.1050

Source: FxStreet

Investing with intelligence

Our latest research, commentary and market outlooks

.jpg)