Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- technical analysis

- gold

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- russia

- ethereum

- microsoft

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

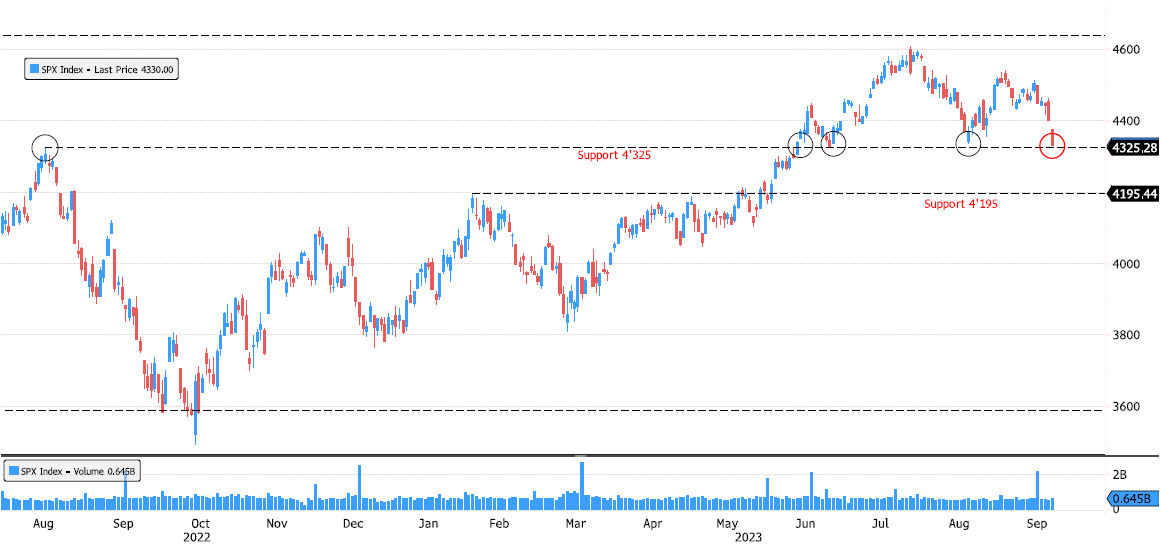

S&P 500 Index back on major support 4'325

S&P 500 Index (SPX) is back once again on major support 4'325. Keep an eye on this important level. Next support at 4'195. Source : Bloomberg

BOJ Update

Japan | BOJ left its monetary settings unchanged and offered no clear sign of a shift in its policy stance, putting a damper on market speculation over the prospects for a near-term interest rate hike and adding pressure on the yen. The Bank of Japan kept its negative interest rate and the parameters of its yield curve control program intact on Friday in an outcome predicted by all 46 economists surveyed by Bloomberg. It also maintained a pledge to add to its stimulus without hesitation if needed, a vow that offers yen bears a reason to keep betting against it. Japan’s currency weakened as much as 0.4% after the decision to around the 148.20 mark against the dollar. This helped stocks, which trimmed about half of their losses for the day. The benchmark 10-year bond yield was down half a basis point from Thursday’s closing level at 0.74%. Source: Bloomberg

Yields pushing higher

US 2Y yields hit their highest since July 2006 US 5Y yields highest since Aug 2007 US 10Y highest since Nov 2007 US 30Y highest since April 2011 Source: Bloomberg, www.zerohedge.com

Inflation fear is NOT the driver of rising yields

Indeed, 10y real yields (10y nominal yields - 10y inflation expectations) jumped to 2.11%, the highest since 2009. In other words, investors are demanding higher REAL yields in the face of political chaos in Washington and high debt. Source: Bloomberg, HolgerZ

The longest duration bond ETF is now down 60% from its peak in March 2020

How is that possible? The 30-Year Treasury yield has moved from an all-time low of 0.8% in March 2020 up to 4.6% today. Long duration + Rising interest rates from extremely low levels = Pain $ZROZ Source: Charlie Bilello

In case you missed it...

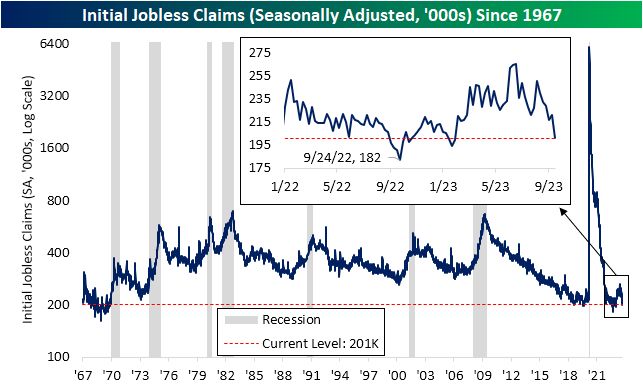

US Jobless Claims Fall to 201,000, Lowest Level Since January...There haven't been many times in the last 50+ years that #us initial jobless claims have been lower. Source: Bespoke

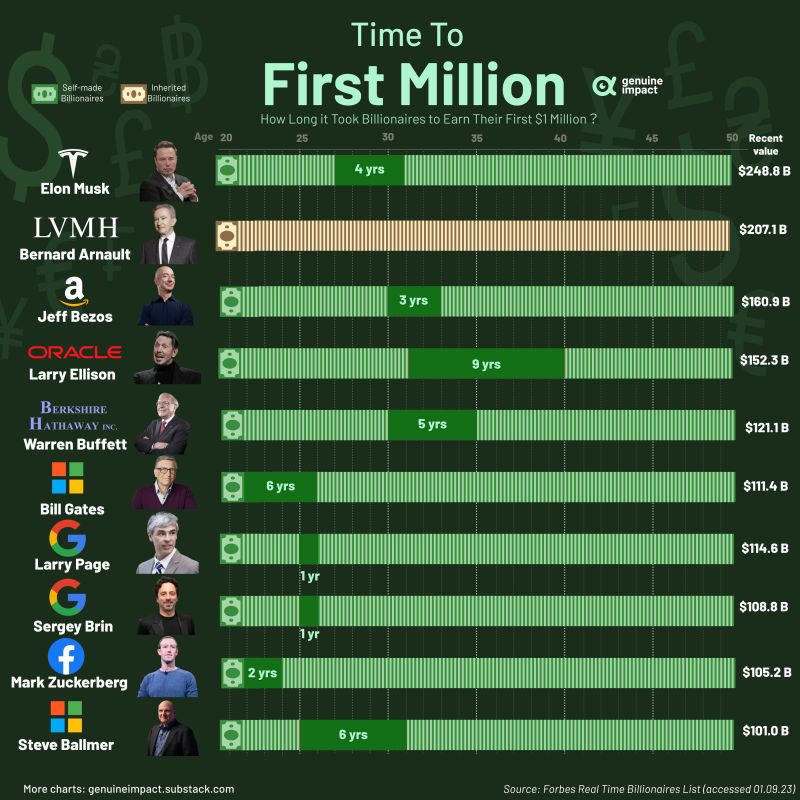

How long it took to Billionaires to earn their first $1 million?

Source: Genuine Impact, Forbes

Turkey CenBank raised main interest rate to 30% from 25%, but w/inflation at ~60%, real rates are still very heavily negative

The hike continues what many see as a return to more orthodox monetary policy under Governor Hafize Gaye Erkan, a former executive of First Republic Bank & Goldman Sachs, who was appointed in June after President Recep Tayyip Erdogan won a close-fought re-election. Erkan now hiked rates by a cumulative 2150bps. Source: Bloomberg, HolgerZ

Investing with intelligence

Our latest research, commentary and market outlooks