Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

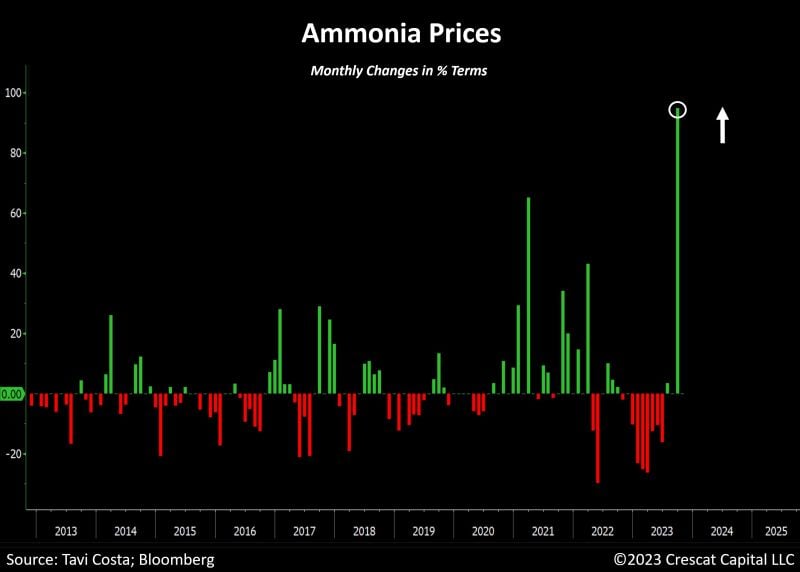

Chart by Tavi Costa -> Ammonia prices just had the steepest monthly increase on record.

Commodity cycles typically follow a rotational pattern, and these price spikes are not isolated incidents.Oil recently rallied, gasoline prices increased, natural gas started to rise, and now ammonia looks to be initiating its move. This is an inflationary era and an unmistakable one. Source: Tavi Costa, Bloomberg

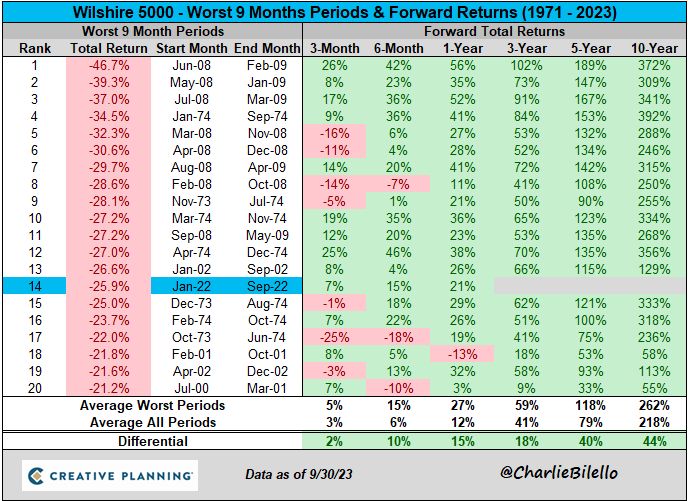

The longest duration bond ETF ($ZROZ) is down over 60% from its peak in 2020 and now has a negative return over the last 10 years. Bond ETF Returns...

Source: Charlie Bilello

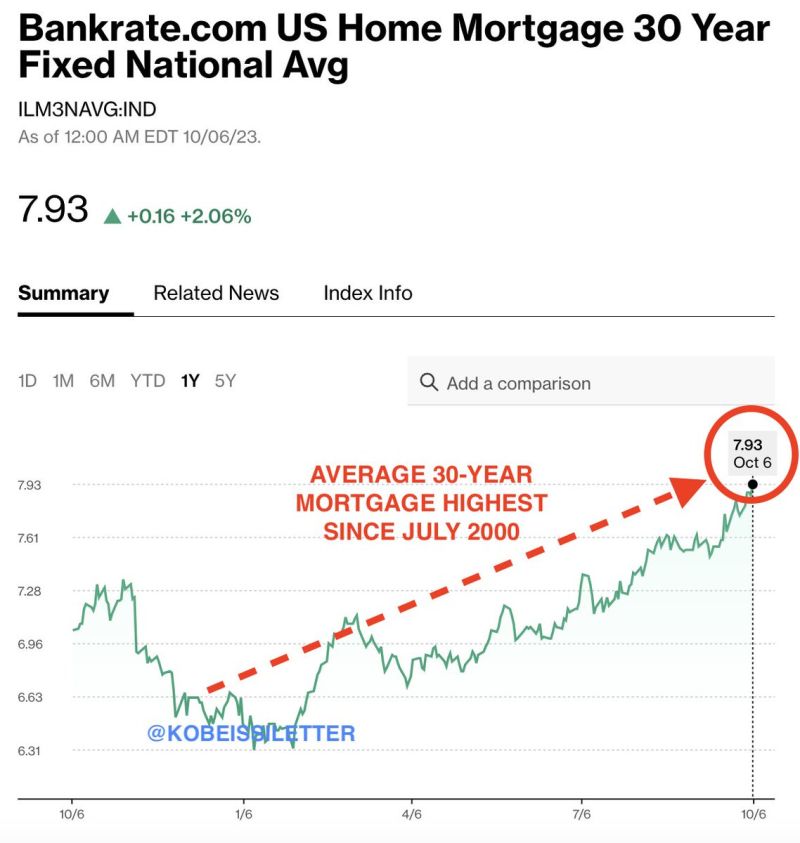

BREAKING: Average interest rate on a 30-year mortgage rises to 7.93%, its highest since July 2000

Since January 2021, less than 3 years ago, interest rates have gone from 2.65% to 7.93%. This means that homebuyers just 3 years ago would see their interest rate TRIPLE if they decided to move. This is exactly why existing home sales are at their lowest since 2010. The average new home is about to cost LESS than the average existing home for the first time since 2005. You know something is wrong when old costs more than new. Why sell if your mortgage rate triples? From The Kobeissi Letter

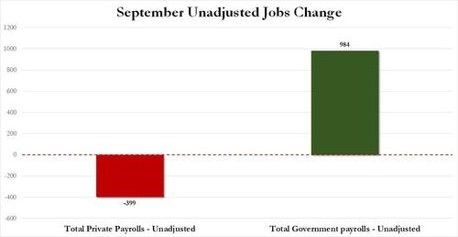

Looking at the September US payroll numbers through another lens

Unadjusted total payrolls rose by 585K and yet private payrolls dropped by 399K. All of the unadjusted jobs in September came from the government, which added a whopping 984K jobs (mostly teachers). What if all the mess in Washington (shutdowns, political gridlock in Congress, etc.) and rising cost of debt put a cap on the fiscal support? Where are the jobs going to come from? Source: www.zerohedge.com, Bloomberg

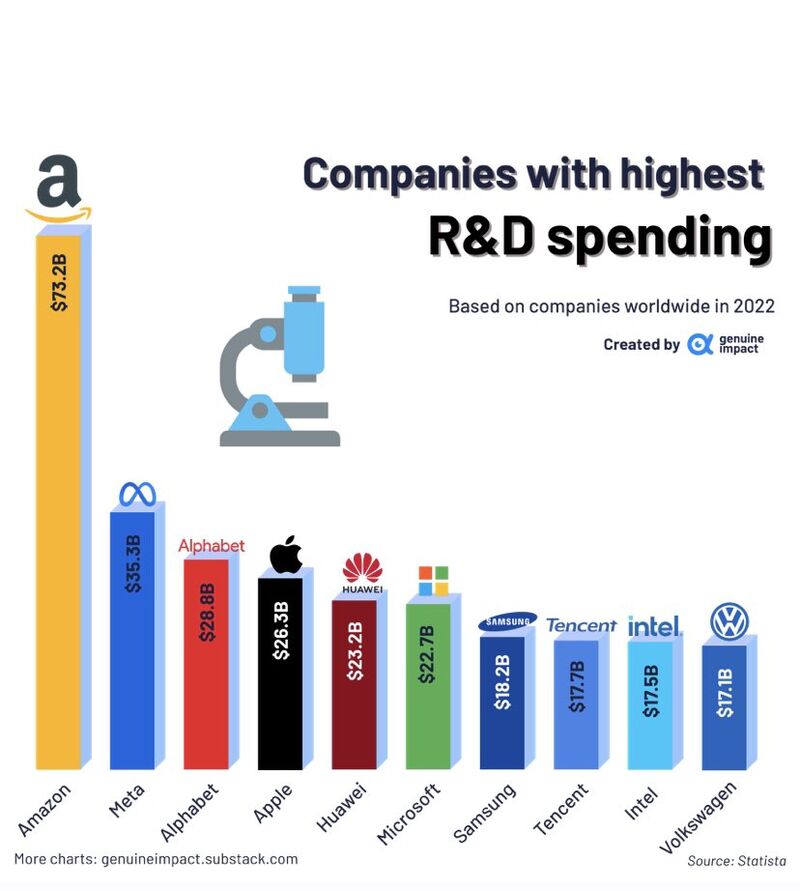

Amazon's annual R&D expenses for 2022 amounted to $73.213 billion, marking a 30.62% increase from 2021

These R&D costs accounted for 14% of its total revenue. Source: Genuine Impact

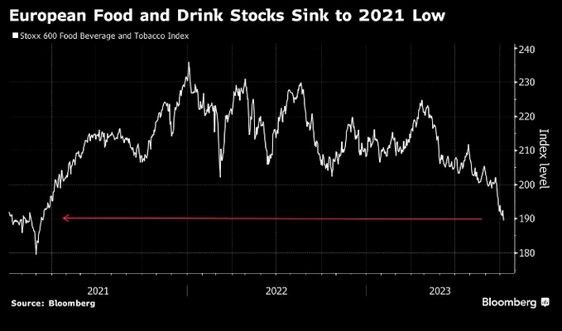

Novo Nordisk weight loss drug Ozempic is causing selloff in candy and beer stocks, per Bloomberg.

Walmart said it’s already seeing an impact on shopping demand from people taking Ozempic. That sent shares of food and beverage companies sliding, some to multiyear lows. Source: Bloomberg, TME

Investing with intelligence

Our latest research, commentary and market outlooks