Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

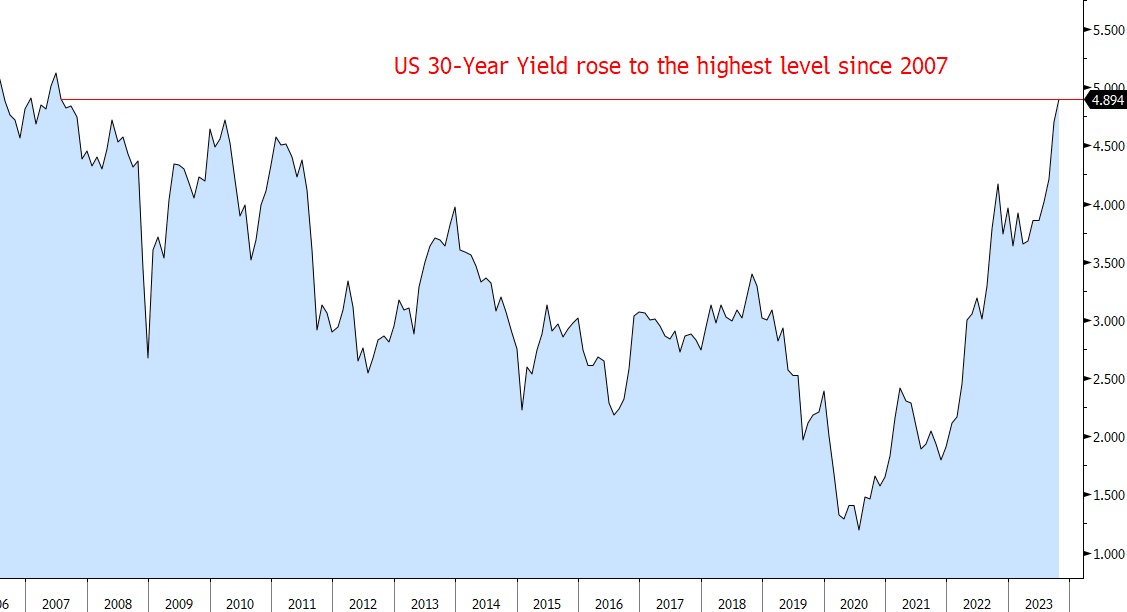

US 30Year Yield reaches 2007 High

The US 30-year yield rose to the highest level since 2007. This week's Treasury selloff came after US lawmakers managed to avert a government shutdown, prompting traders to increase bets that the Federal Reserve will raise rates in November.

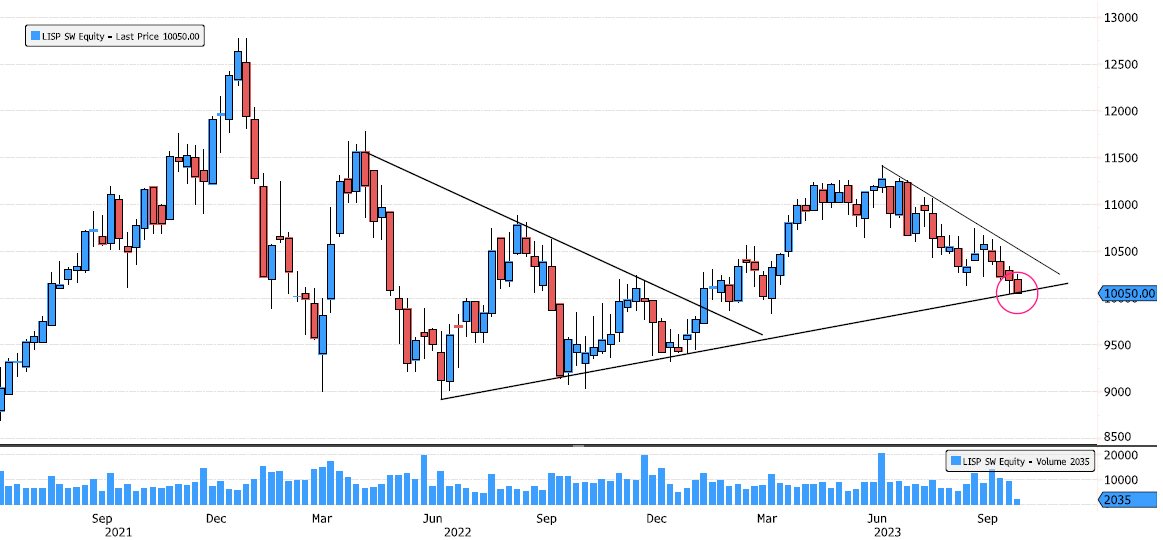

Lindt & Spruengli testing June 2022 trendline support

Lindt & Spruengli (LISP SW) is back on June 2022 trendline support. Keep an eye on it. Source : Bloomberg

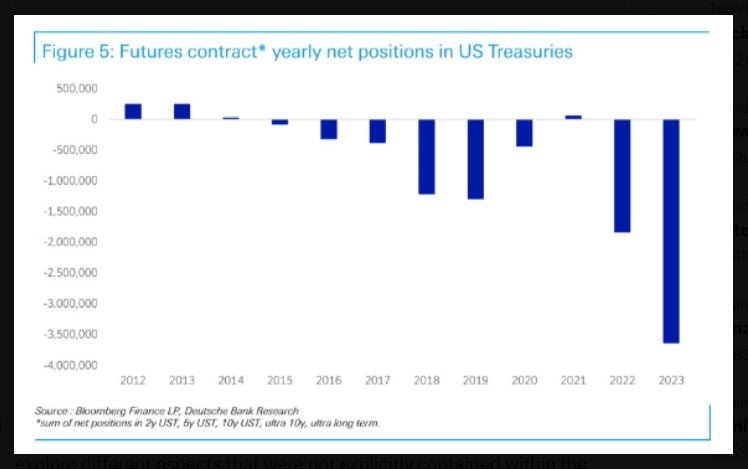

Hedge funds have now built the largest short position in U.S. Treasuries in history

Source: DB, barchart

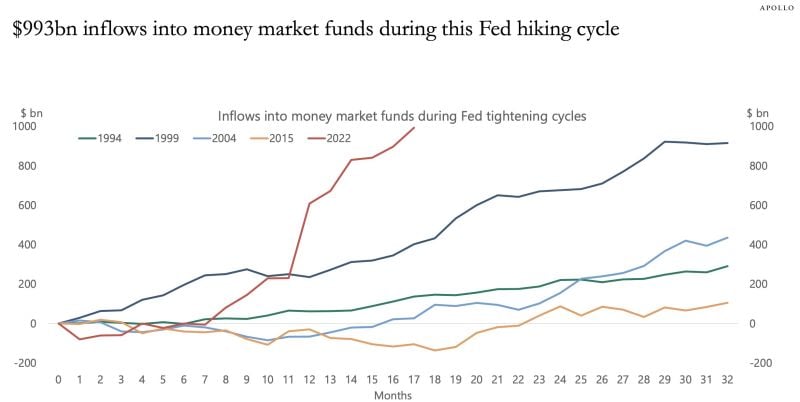

The new safety trade

-> An incredible $993 billion has gone into money market funds since the Fed started raising rates in March 2020. Inflows to money market funds are well ahead those seen in 2015, 2004, 1999 and 1994 rate hike cycles. Why take risk on your "safety" trade when you can make 5% risk-free? Source: The Kobeissi Letter

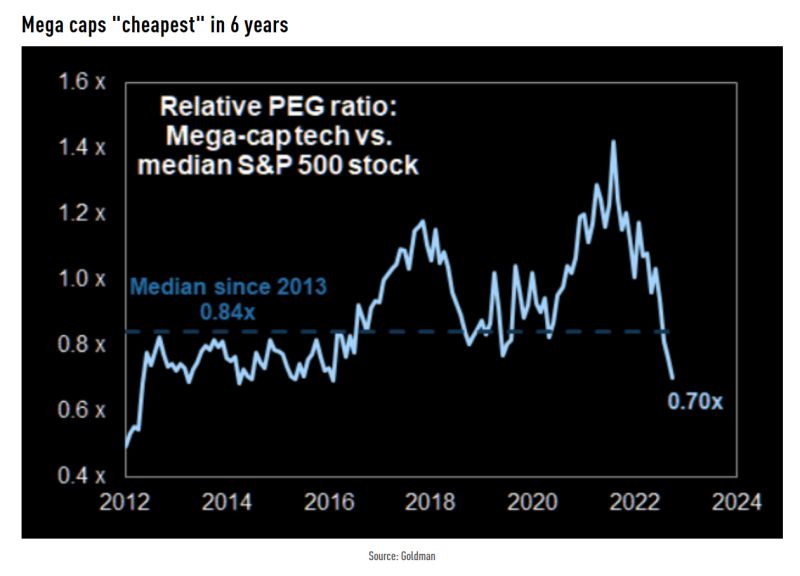

On a growth-adjusted basis, the mega caps trade at the largest discount to the median S&P 500 stock in over six years

Source: TME, Goldman Sachs

A death cross on the Euro-dollar

Watch out the key 1.05 support level. There is not safety net underneath Source: TME Activate to view larger image,

Asset class and style returns by JP Morgan

As bonds and stocks fell simultaneously, commodities were the notable outperformer in Q3, returning 4.7% and echoing the market dynamics of 2022. Source: JP Morgan

Investing with intelligence

Our latest research, commentary and market outlooks