Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Congress Averts US Government Shutdown Hours Before Deadline – Bloomberg

The US narrowly averted a disruptive and costly shutdown of federal agencies as Congress passed compromise legislation to keep the government running until Nov. 17. The legislation, passed in both chambers Saturday just hours before a midnight deadline, buys Democrats and Republicans time to negotiate longer-term federal funding. It doesn’t include new funding for Ukraine. President Joe Biden signed the bill late Saturday night, capping an extraordinary day in Washington that began with the country careening to what appeared to be an inevitable and prolonged federal funding lapse.

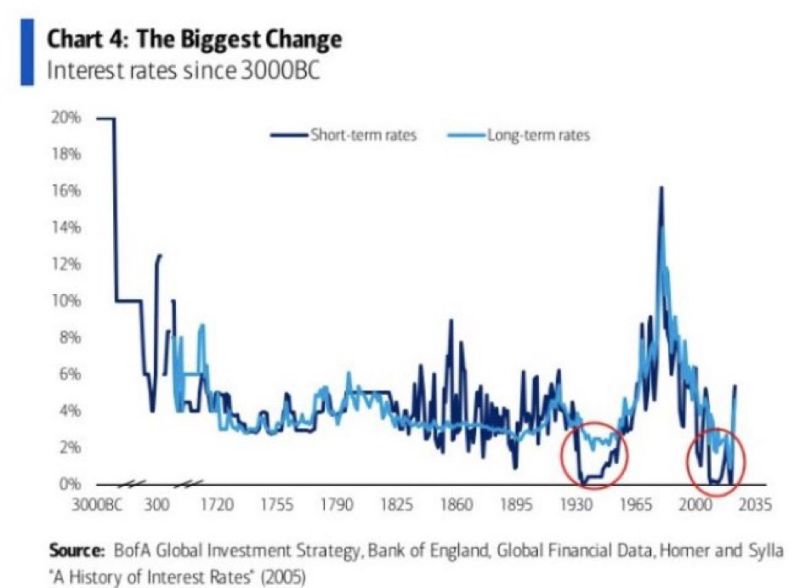

The longest time period chart on US interest rates you will ever find...

Source: BofA

Last month returns for the sp500 constituents in one chart

Source: Trading View

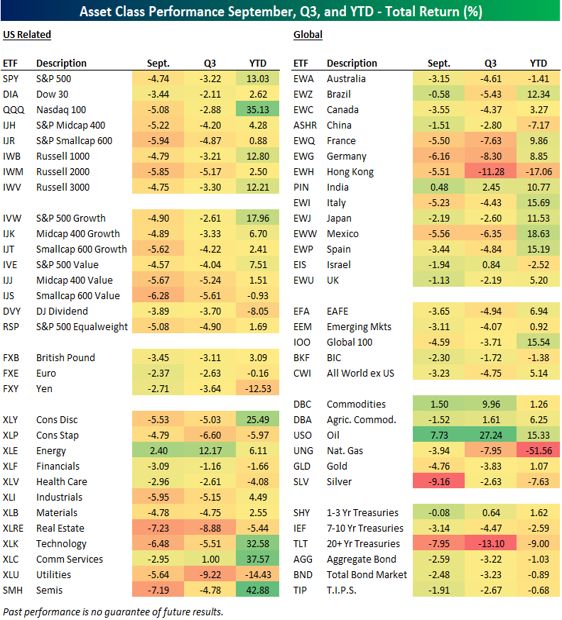

While mega-caps tech stocks are recording huge returns on their cash pile thanks to the rise of interest rates, this is not the case for the rest of the market

Small cap companies are paying the most interest expense ever recorded and unfortunately their interest income is not keeping pace. This will become an even larger problem when small companies are forced to refinance at significantly higher rates. Source: FT, barchart

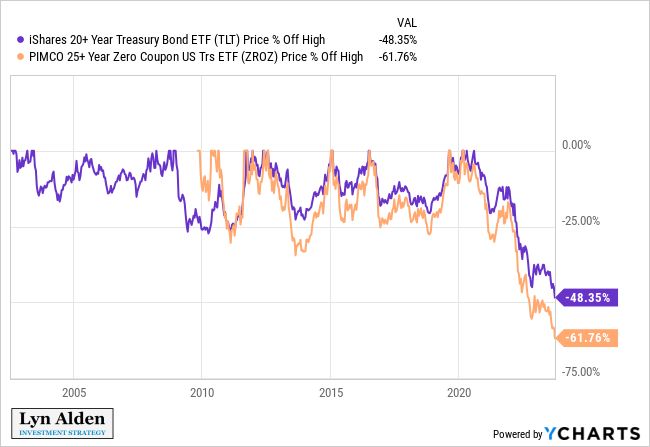

Yes you can lose a lot of money with bonds...

The Pimco 25+ Year Zero Coupon US Treasury ETF is off more than 60% from its high

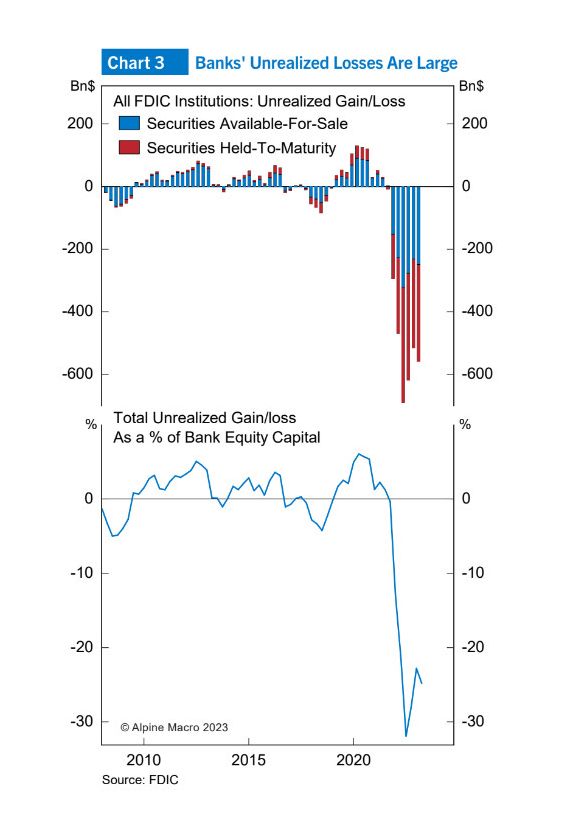

U.S. Banks are facing roughly $600 billion of unrealized losses which accounts for roughly 25% of total banking capital, near the highest levels in history

Source: Barchart, FDIC, Alpine Macro

The Timeline of U.S. Government Shutdowns ⏱️⏱️⏱️⏱️

House Republican leaders canceled a planned two-week recess as a government shutdown appeared more likely after they failed to pass a short-term spending bill with fewer than two days to avoid the shutdown. House Speaker Kevin McCarthy informed the GOP caucus of the canceled break at a closed-door meeting after more than 20 Republicans embarrassed him by voting with Democrats to defeat the bill. The government is scheduled to shut down at 12:01 a.m. ET Sunday if a funding bill is not approved by Congress and President Joe Biden. Source: Statista, CNBC

Investing with intelligence

Our latest research, commentary and market outlooks