Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- geopolitics

- investing

- gold

- Commodities

- technical analysis

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

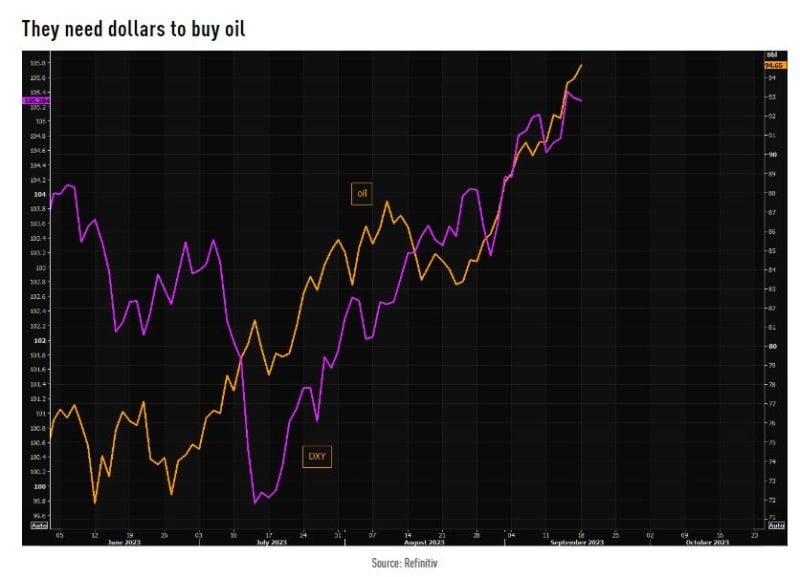

- oil

- Real Estate

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

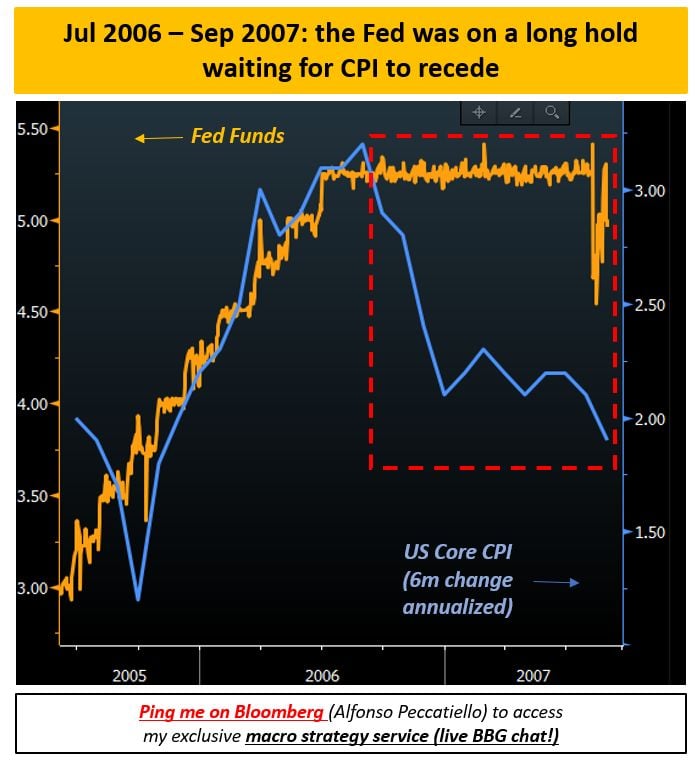

Can be the second half of 2007 be a good parallel for today's market?

As highlighted by MacroAlf, back in 2007, the FED kept rates at 5.25% (orange) despite core inflation was trending around 2% (blue) for quarters already. That ''higher for longer'' stubborness kept policy unnecessarily tight - as we figured out in 2008... Source: Alfonso Peccatiello

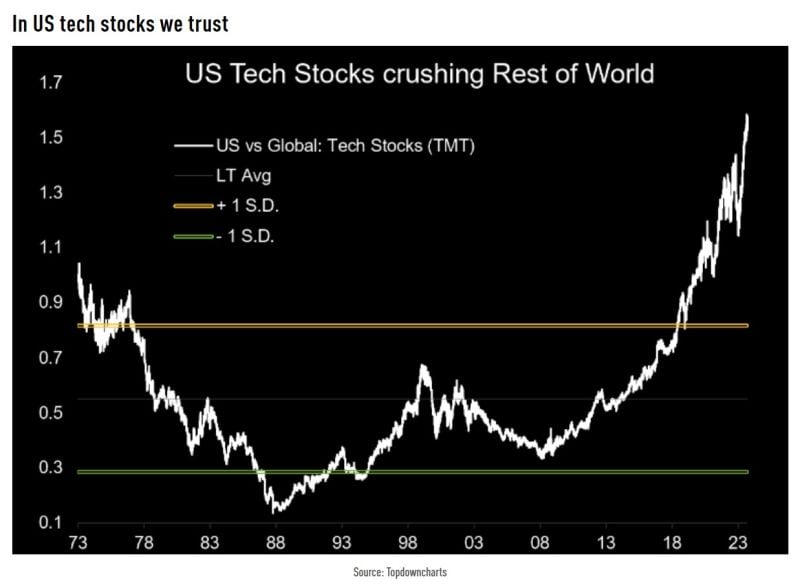

Valuation premium of US tech stocks vs. rest of the world is going beyond parabolic...

Source: Topdowncharts, TME

It is official? Total US Debt surpasses $33 trillion for the first time. For those keeping tabs, the US added $1 trillion in debt in just 3 months

Cartoon: Gary Varvel

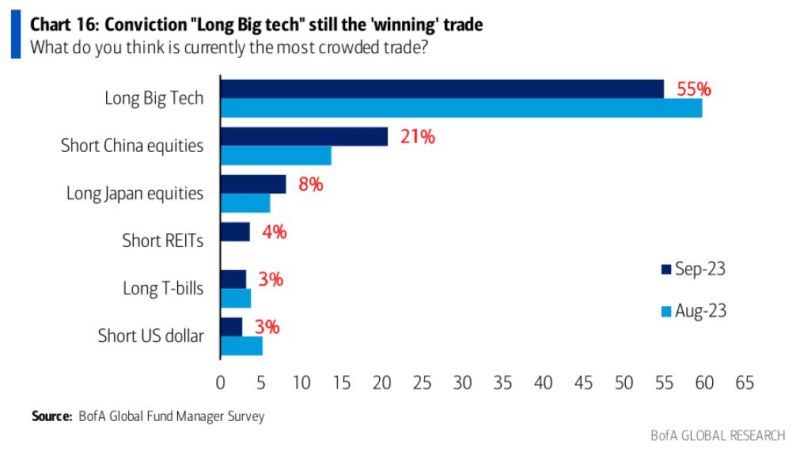

Long Big tech is now the most crowded trade in the latest Global Fund Manager Survey by BofA

Short China equities comes next.

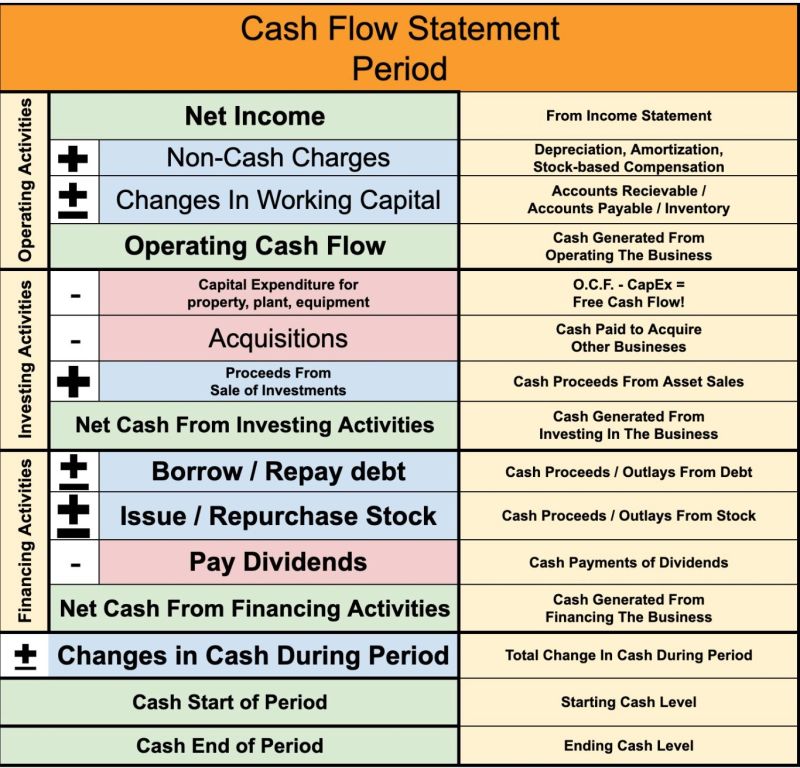

The Cash Flow Statement Explained Simply

Source: Brian Feroldi

Investing with intelligence

Our latest research, commentary and market outlooks