Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Société Générale subsidiary becomes the first fully-licensed crypto provider in France

Société Générale subsidiary becomes the first fully-licensed crypto provider in France. Forge will have a right to custody digital assets, to purchase and sell them for legal tender, and to trade them against each other. Forge, a subsidiary of Société Générale — the third-largest bank in France — became the first company to obtain the highest access license for providing crypto services in the country — a prerequisite for numerous service activities (PSAN). The provider will have a right to custody digital assets, to purchase and sell them for legal tender, and trade them against each other. So far, around 90 companies have already been on the AMF list of licensed providers. For example, the subsidiary of Société Générale’s powerful competitor, Crédit Agricole, got approval for digital custody in June 2023. However, Forge became the first to receive the highest approval for numerous services from the regulator. As the French radio station Business FM stated, such stringent requirements for this level of approval give an obvious advantage to large traditional banks over smaller crypto companies. Source: cointelegraph

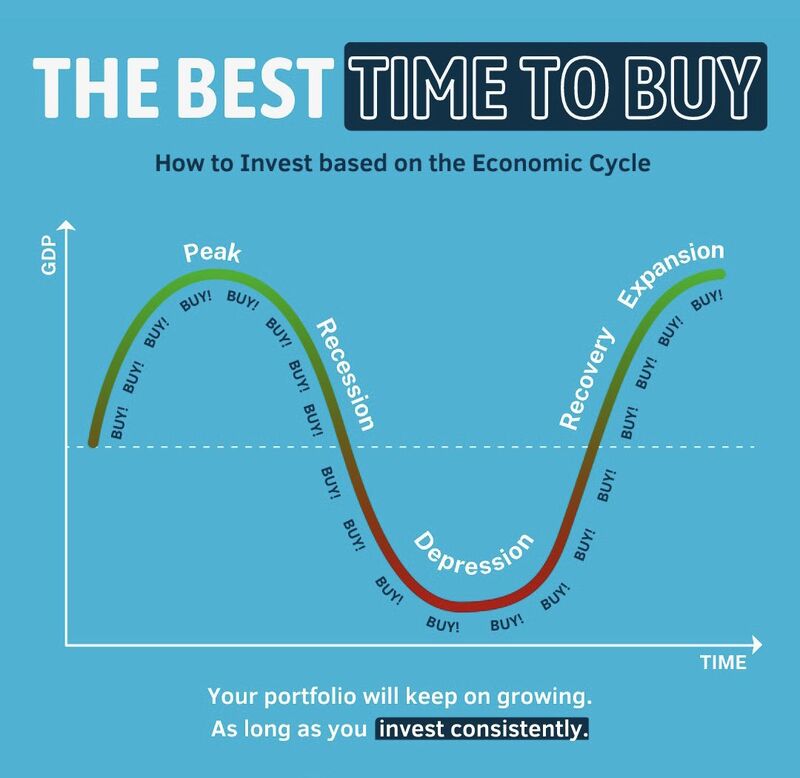

Timing the market has proven to be impossible

A simple dollar cost average strategy is the best way to go about investing. Consistent contributions made every week/month regardless of whether stocks are up or down. Source: Mark Wlosinski

M2 money supply has declined at the fastest rate ever recorded since the Fed began collecting data in 1959

Probably has helped cool inflation but could it usher in a new set of problems? Source: Fred, Barchart

The "soft landing" of the US economy is the new consensus.

Source: BofA survey

Probability of a Fed rate hike next week is approaching 100%.

Done deal. Source: Charlie Biello

The cost of cooking a classic Pizza Margherita in Italy continues to rise as olive oil prices soar.

Rise in cost of ingredients to make pizza outpaces inflation. Bloomberg custom index shows olive oil price up almost 27%. Source: Bloomberg, HolgerZ

US Industrial Production has turned negative on a YoY basis for the first time since February 2021.

Source: Charlie Bilello

U.K. inflation cooled significantly in June, coming in below consensus expectations at 7.9% annually

Economists polled by Reuters had projected an annual rise in the headline consumer price index of 8.2%, following May’s hotter-than-expected 8.7% reading, but annualized price rises continue to run well above the Bank of England’s 2% target. On a monthly basis, headline CPI increased by 0.1%, below a consensus forecast of 0.4%. Core inflation — which excludes volatile energy, food, alcohol and tobacco prices — remained sticky at an annualized 6.9%, but fell from a 31-year high of 7.1% in May. Source: CNBC

Investing with intelligence

Our latest research, commentary and market outlooks