Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- AI

- Crypto

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- energy

- Volatility

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- amazon

- assetmanagement

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

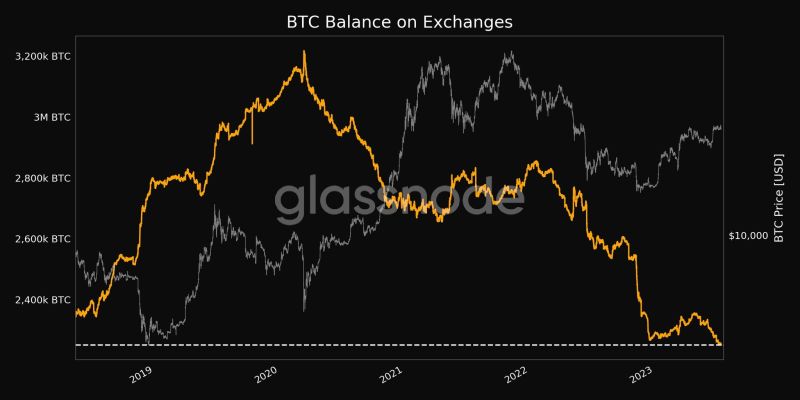

Bitcoin continues to fly off exchanges into self-custody at an unprecedented rate

see below chart by Glassnode with orange line being the BTC balance on Exchanges. With 70% of all BTC having NOT moved in a year, despite the longest bear market on record and nearly 60% having not moved in 2 years or more, a supply crisis could be in the making (at the time the largest asset managers in the world are making progress towards the launch of Bitcoin spot etfs...). What did Economics 101 teach us about rising demand and lack of supply??? Source: Oliver L. Velez, Glassnode

Is the wageflation story behind us?

Maybe not yet...United pilots could get raises of up to 40% under a preliminary deal, after similar agreements were made at Delta and American Airlines For the first time in many decades the labor force has the upper hand in negotiating across a broad swath of industries, and they're using it as much as they can. Bottom-line: The wageflation story isn't quite over yet. Instead, it is evolving. Source: Markets Mayhem, Wall Street Journal

Bridgewater warns US inflation fight is far from over

The investment chief at one of the world’s top hedge funds has warned the US battle with inflation is far from over, and bets on a rapid series of interest rate cuts from the Federal Reserve next year are premature. Bob Prince, co-chief investment officer of Bridgewater Associates, said markets were wrong to assume the Fed will soon ease monetary policy. “The Fed is not going to cut,” he told the Financial Times. “They are not going to do what is priced in.” Pricing in futures markets indicates that investors anticipate one further 0.25 percentage point rate rise from the Fed’s current target range of 5 to 5.25 per cent by the autumn. Over the following 12 months they expect the central bank to reverse course, cutting borrowing costs six times to around 3.8 per cent by November 2024. “Inflation has come down but it is still too high, and it is probably going to level out where it is — we’re likely to be stuck around this level of inflation,” Prince said. “The big risk right now is that you get a bounce in energy prices when wages are still strong”, which could drive a rebound in inflation, he added. Prince, who oversees the Connecticut-based firm’s assets with co-CIOs Karen Karniol-Tambour and Greg Jensen, said he believes core inflation is likely to bottom out between 3.5 and 4 per cent, pushing the Fed to tighten monetary policy further and disappointing investors who this week sent US stocks to their highest level in over a year. That tightening “could take the form of holding rates steady in the face of expectations of a cut”, he said. Source: FT

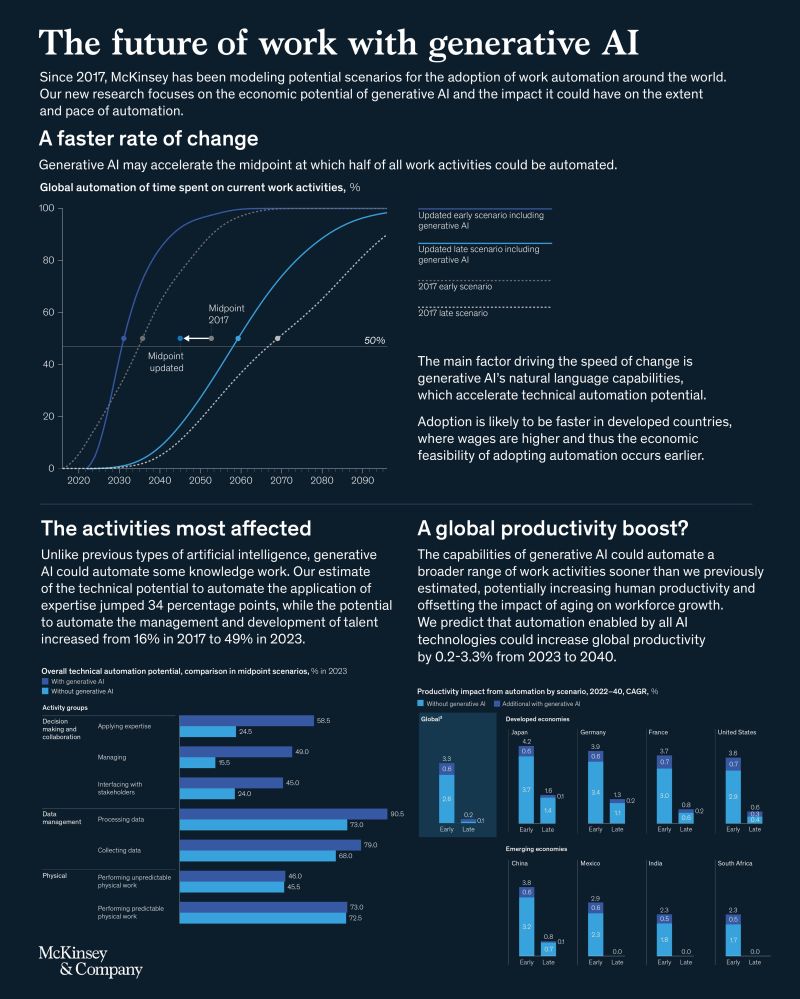

The Economic potential of generative ai, the next productivity frontier:

The Economic potential of generative ai, the next productivity frontier Source: McKinsey

SEC Formally Accepts BlackRock Spot Bitcoin ETF Application for Review

SEC Formally Accepts BlackRock Spot Bitcoin ETF Application for Review. The procedural move suggests that the federal agency will give the closely-watched application a serious look. BlackRock's application to offer a spot Bitcoin exchange-traded fund (ETF) has been added to the official docket of the Securities and Exchange Commission as part of its proposed rule change process. The move, recorded late Thursday, advances the most closely-watched Bitcoin-related proposal to the SEC to date. Source: Decrypt

This didn't do the headlines but the fact is that Trade-weighted Euro reached a new all-time high this week

Source: Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks