Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- technical analysis

- gold

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- russia

- ethereum

- microsoft

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

In case you missed it...

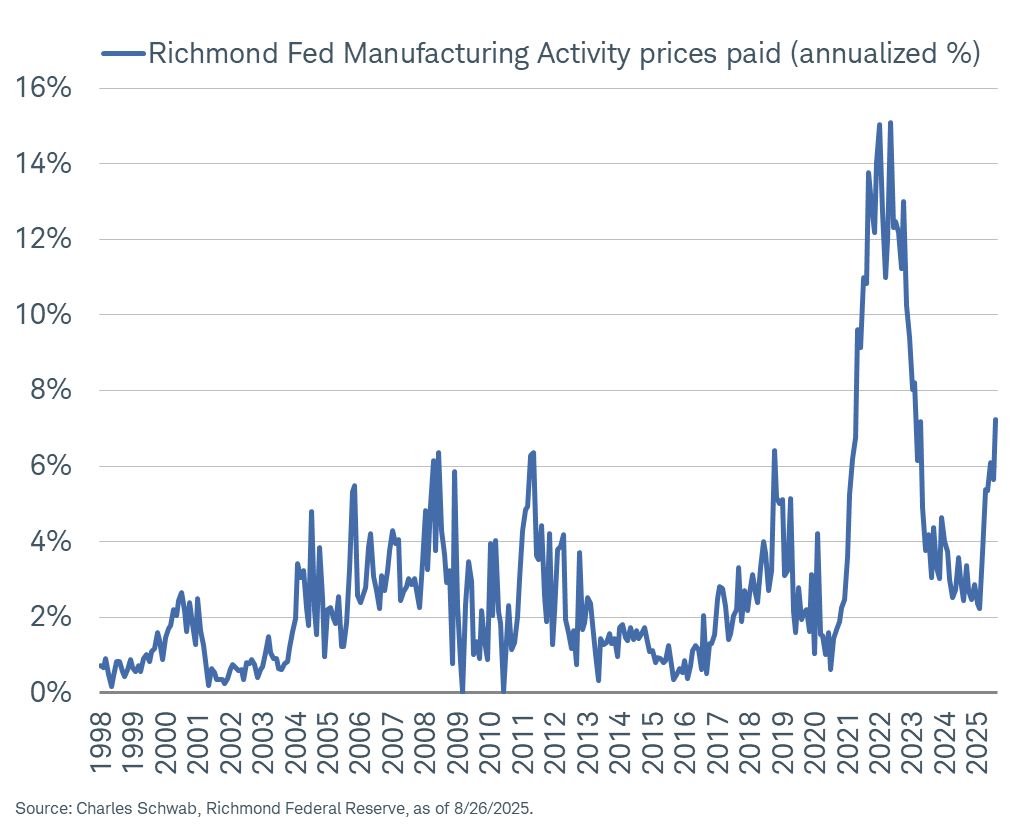

Prices paid component in Richmond Fed Manufacturing Index spiked in August... highest since February 2023. Source: Kevin Gordon @KevRGordon

The 69% decline in the $VIX over the last 20 weeks is the biggest volatility crash in history.

Source: Charlie Bilello

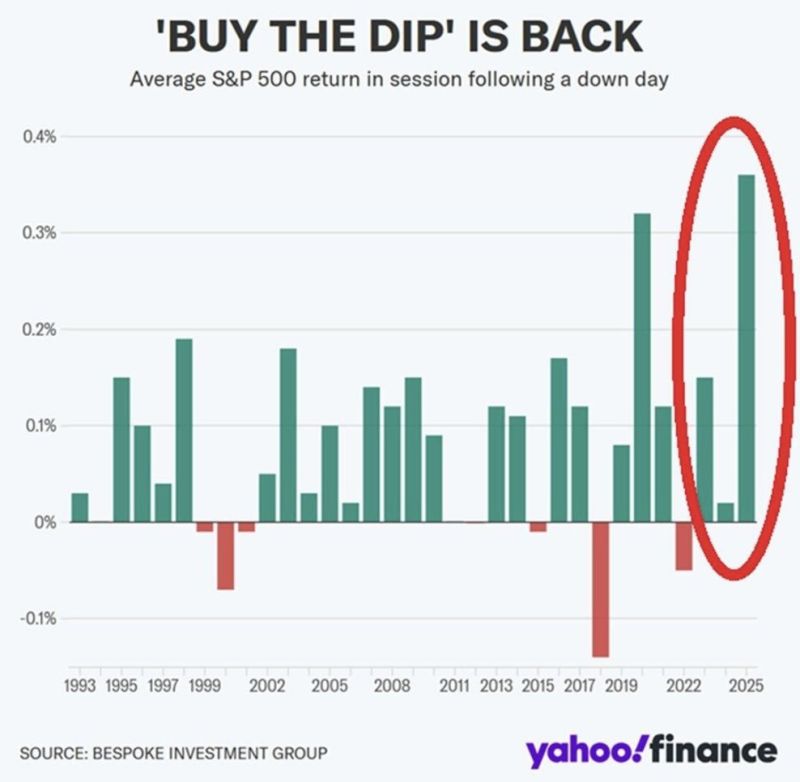

"Buy the Dip" Trading Strategy is having its best return in more than 30 years

Source: Barchart

➡️ Trump administration military leaders are “thinking about” whether the U.S. should acquire equity stakes in top defense contractors, Commerce Secretary Howard Lutnick said.

➡️ Lockheed Martin, which makes most of its revenue from federal contracts, is “basically an arm of the U.S. government,” he said. ➡️ Lutnick’s remarks on CNBC’s “Squawk Box” came days after the U.S. government acquired 10% of Intel stock in a roughly $9 billion deal. Source: CNBC

What a time to be alive...

How Weapons of Mass Destruction Became Popular With ESG Investors The deadliest weapons ever manufactured are becoming a regular feature of Europe’s nearly $9 trillion ESG fund industry. Source: Bloomberg

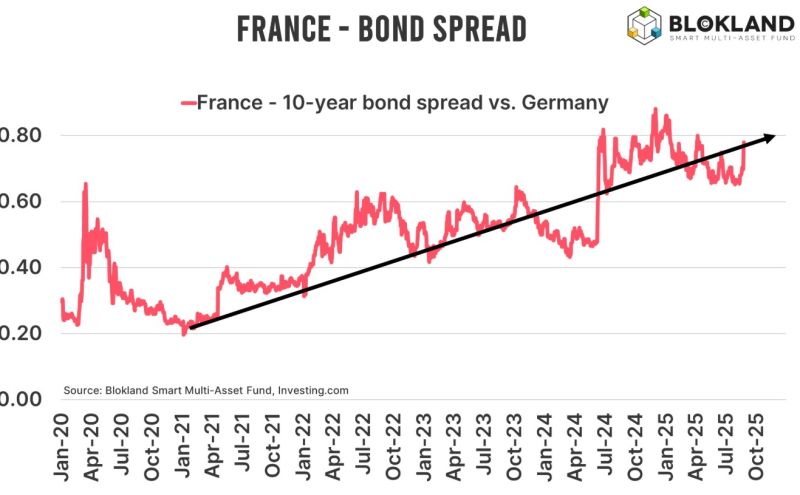

France has done nothing to stabilize its fiscal deficit & debt/GDP.

It already has the highest tax burden in Europe. These higher taxes would throttle growth potential even more. With its political paralysis it won’t cut spending neither. Next confidence vote is coming. And OAT spreads seem to start reflecting that. Source: Michel A.Arouet, INSEE

Prime Minister Bayrou is calling for a confidence vote, risking another collapse of the French government.

OAT-Bund spread keeps widening Source: Blokland Research

Investing with intelligence

Our latest research, commentary and market outlooks