Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- technical analysis

- gold

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- russia

- ethereum

- microsoft

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

For the first time ever

Apple $AAPL is reportedly planning 3 straight years of major iPhone redesigns, according to Bloomberg 2025: The iPhone Air 2026: Foldable iPhone 2027: 20th anniversary iPhone with a curved glass Source: Mario Nawfal

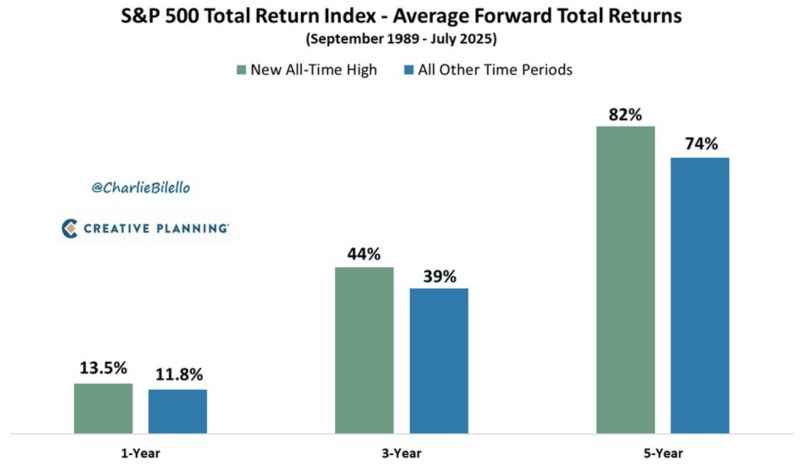

😨 Worried about investing at all-time highs?

History says you shouldn’t be. Since 1989, forward returns after new highs have actually been better than at other times: 1yr: +13.5% vs +11.8% 3yr: +44% vs +39% 5yr: +82% vs +74%. Source: Charlie Bilello

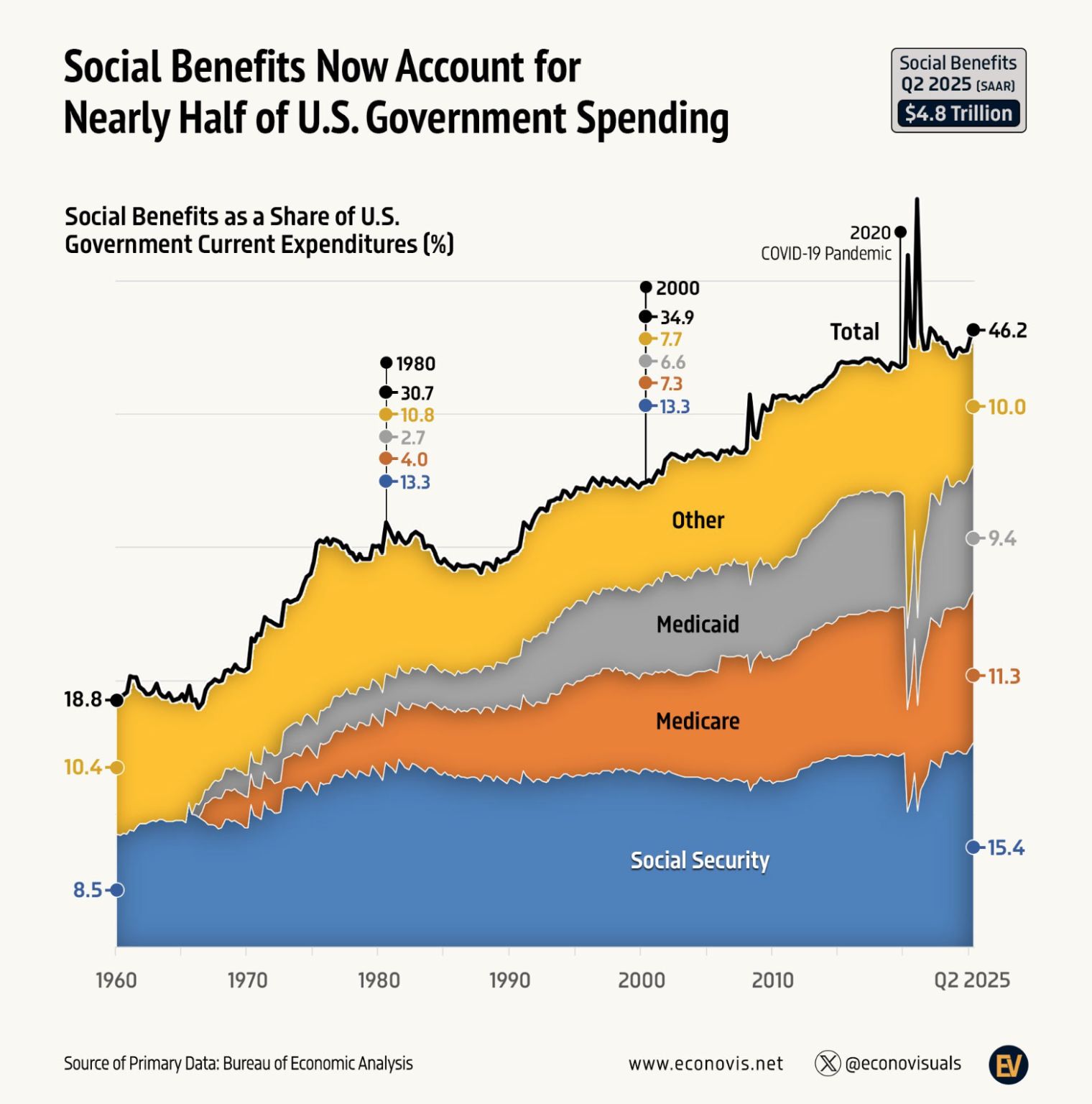

⚠️US government spending is constantly rising

Social benefits now reflect 46% of all US government expenditures, an all-time high, excluding the 2020-2021 crisis. Social Security alone is accounting for 15.4%. This will only rise further as the US population is aging. Source: Global Markets Investor

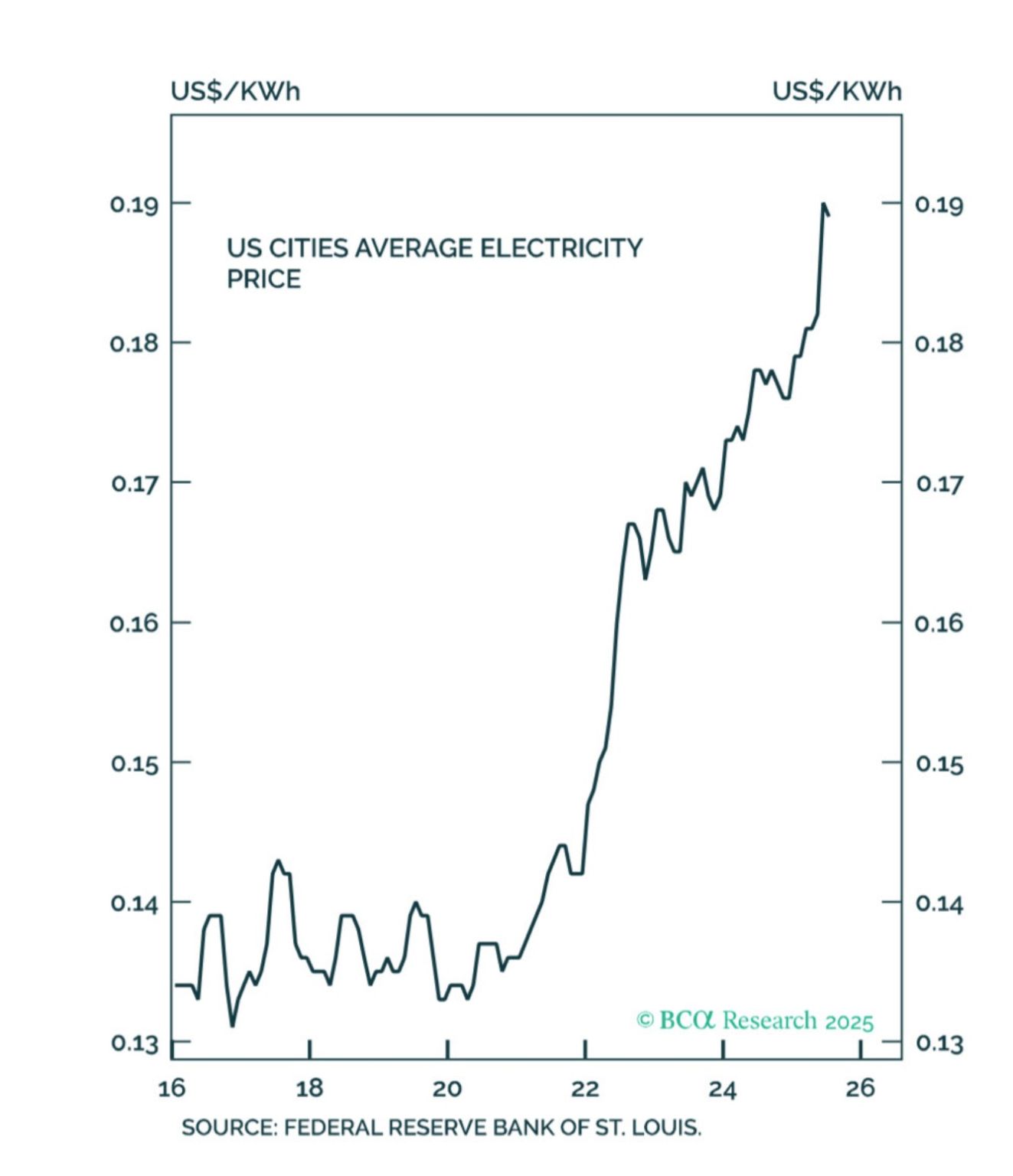

Is data center capex about to hit an energy wall?

Source: Peter Berezin @PeterBerezinBCA

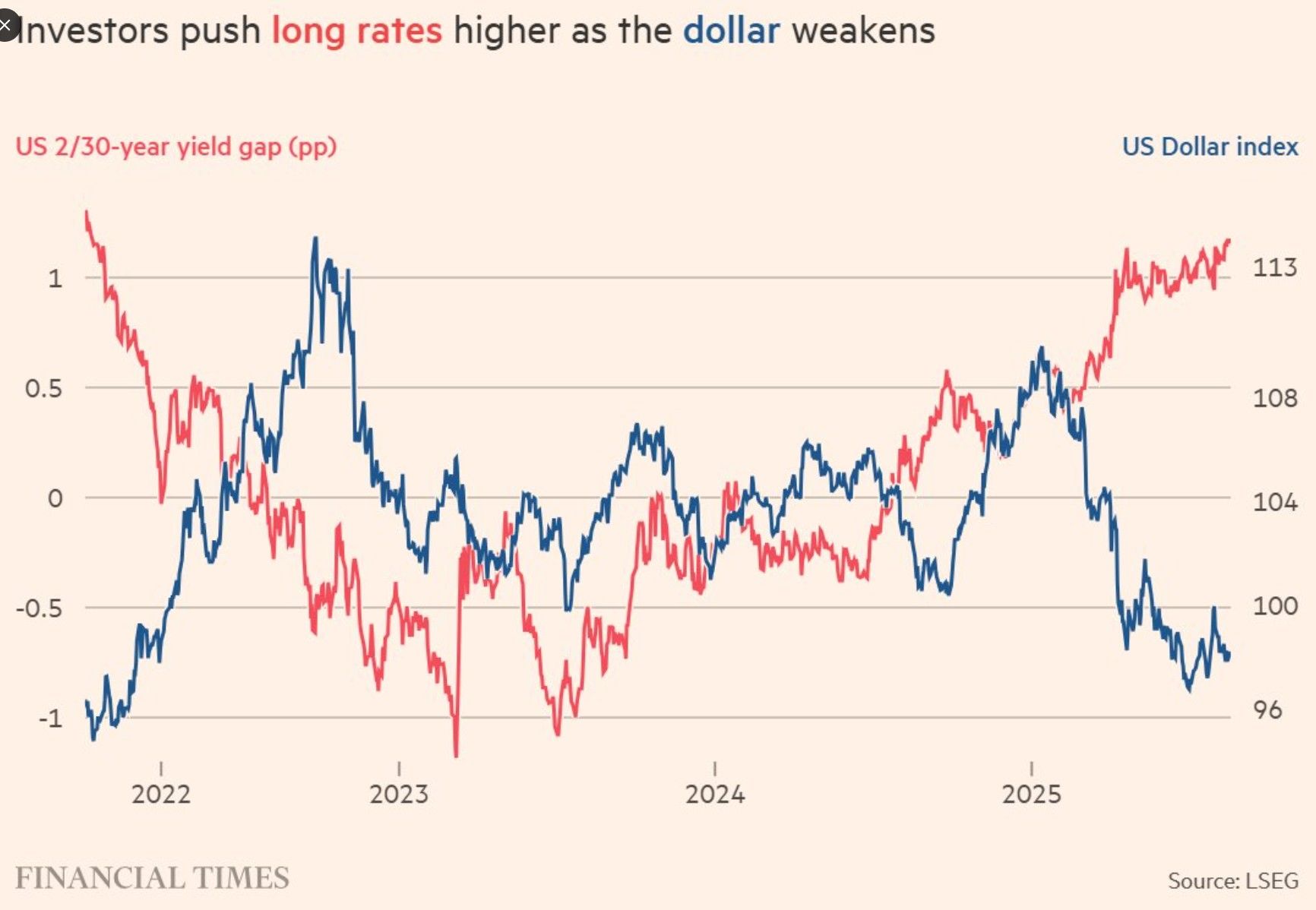

The German yield curve is steepening.

The gap between 2-year and 30-year bond yields has widened to its highest level since 2019 — driven by growing concerns over a looming surge in German government debt. Source: Bloomberg, HolgerZ

"Investors warn of ‘new era of fiscal dominance’ in global markets: Combination of record government debt and rising borrowing costs puts central banks under pressure."

Source: Mo El Erian, LSEG, FT

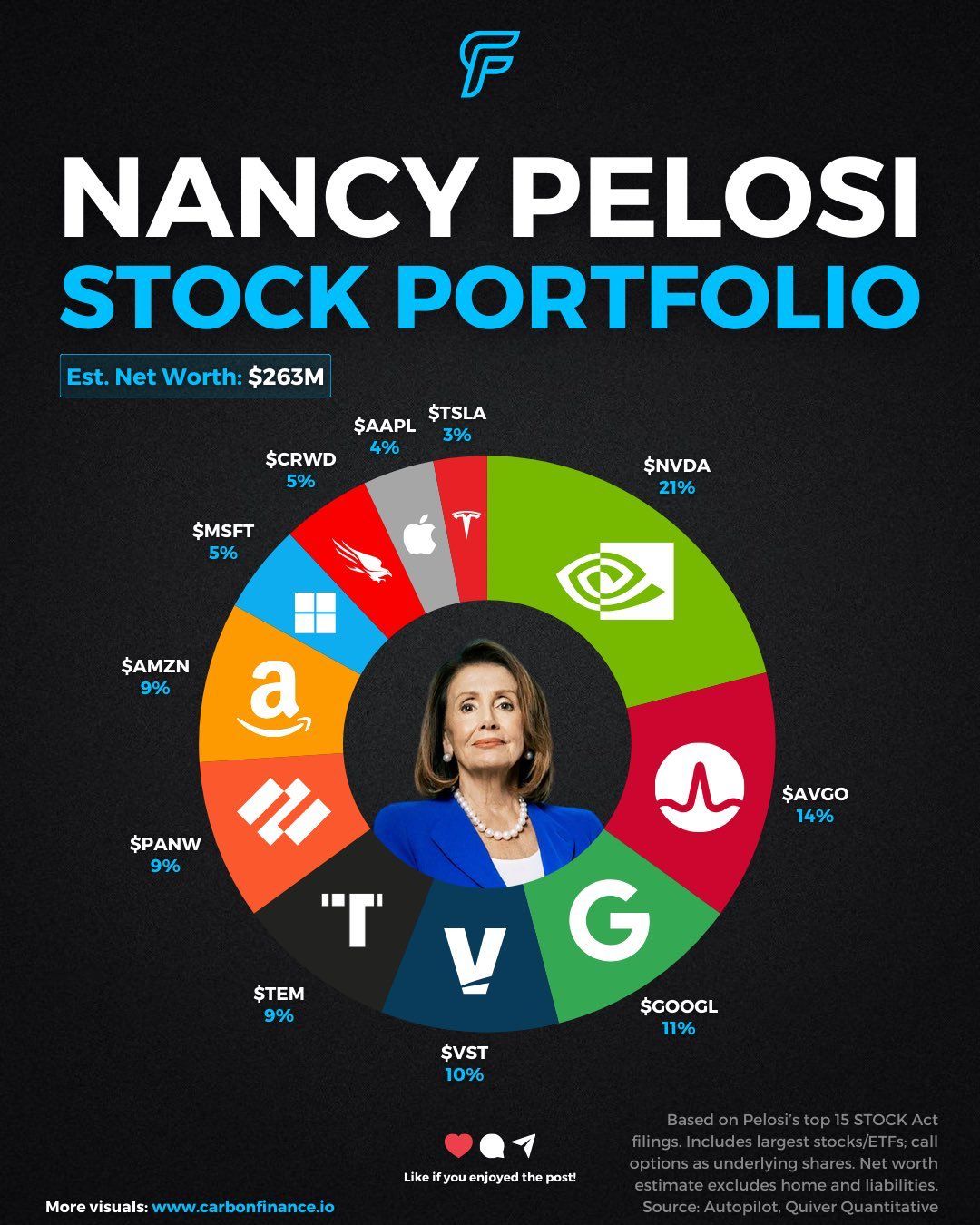

Nancy Pelosi's stock portfolio

Source: Sam Badawi @samsolid57, Carbon Finance

Eye-opening chart, while earnings of Magnificent 7 have had an unprecedented run, earnings of S&P 493 have been more or less stagnant since 2020.

Is the US economy really so strong? Source: Michel A.Arouet, Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks