Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- technical analysis

- gold

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

UBS Ukraine Reconstruction Index hit a fresh ATH on Trump peace push.

Top gainers in the index include: Ferrexpo (+20%), Raiffeisen Bank (+12%), Wienerberger (+9.5%), CRH (+7%). Source: HolgerZ, Bloomberg

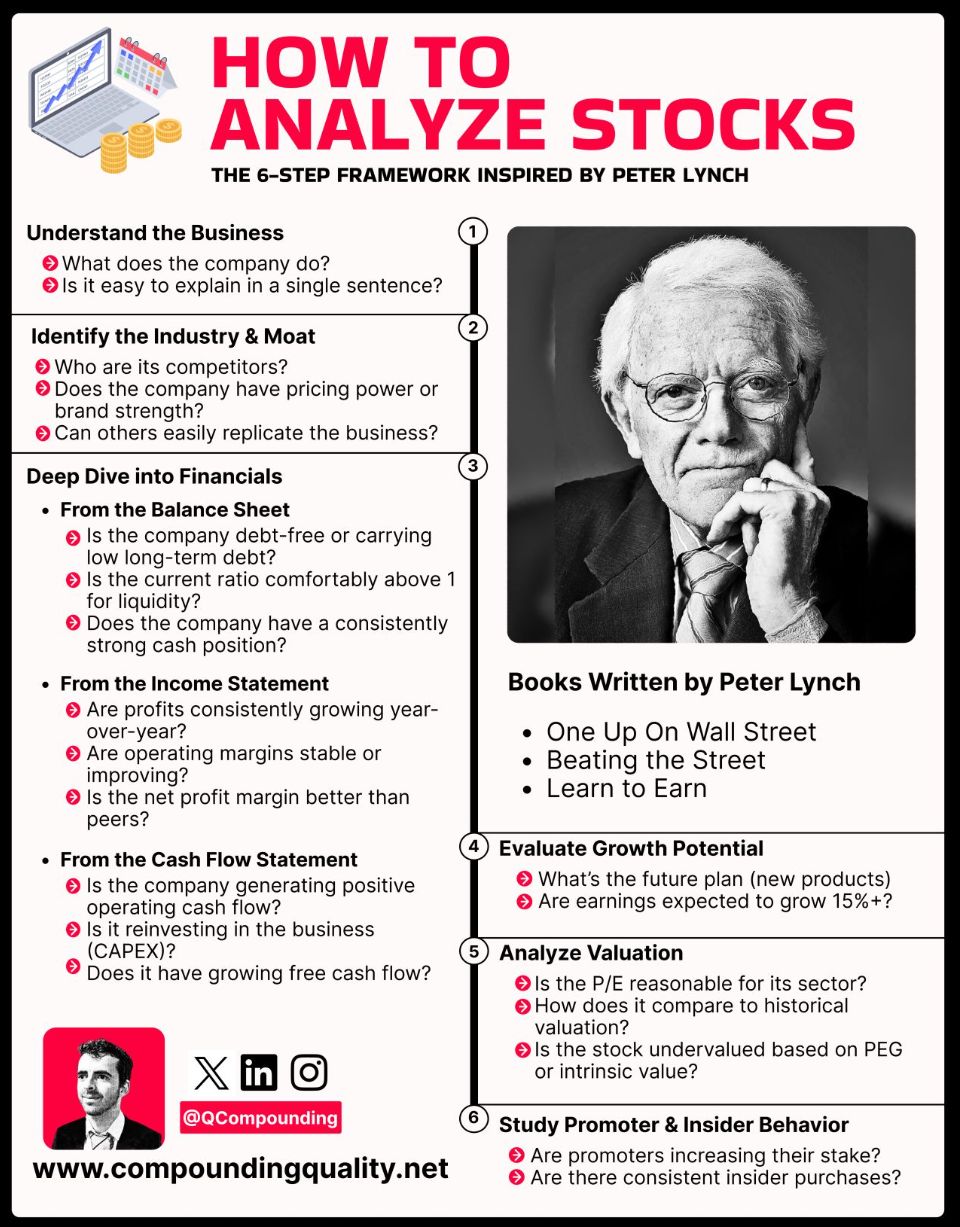

How to analyze stocks

the 6-step framework inspired by Peter Lynch. Source: Compounding Quality

The trade-weighted tariff on swiss exports to the us is close to 20% - not 39%.

Indeed, as discussed in this article by NZZ, medicines and most gold imports are currently exempt from Trump's tariffs. Therefore, the 39% punitive tariff is likely to affect less than half of all Swiss goods exports to the United States. On a trade-weighted basis, the tariff rate for Switzerland would thus be around 20%. The main victims would be watch manufacturers and other companies in the mechanical engineering, electrical and metal industries. Link to the article: https://lnkd.in/esu_XvFM

Donald Trump has nominated Stephen Miran to fill a soon-to-be vacant seat on the Federal Reserve’s board of governors.

Miran, chair of the White House’s Council of Economic Advisers, will take the seat vacated by Adriana Kugler, who is leaving the central bank on Friday, months before her term was set to end in January. The president said in a Truth Social post on Thursday that Miran would serve through to the end of January as the administration continues its search for a “permanent replacement” to fill the seat. The seat would give Miran a vote on the rate-setting Federal Open Market Committee, where he is seen as likely to support Trump’s calls for aggressive interest rate cuts. It is expected that Trump will eventually use the seat to nominate a replacement for Jay Powell, whose term as Fed chair ends in May 2026, but who could serve as a governor until the end of January 2028. Miran will need to be confirmed by the Senate for the role. The Senate approved his appointment to the CEA by 53 votes to 46. The hashtag#Fed declined to comment. Source: FT

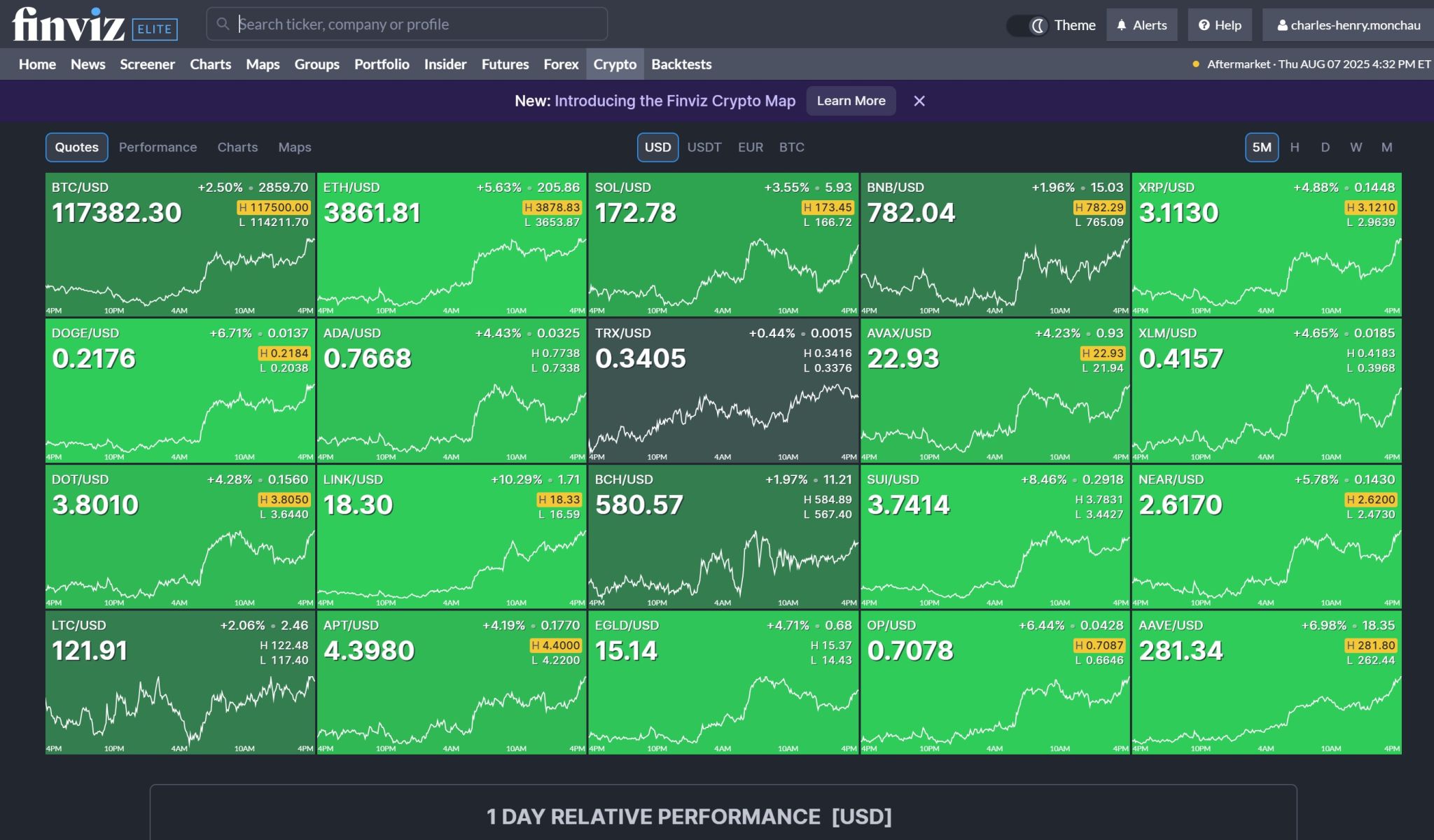

President Trump signs executive order to allow Bitcoin and crypto in 401(k)s.

Source: Finviz

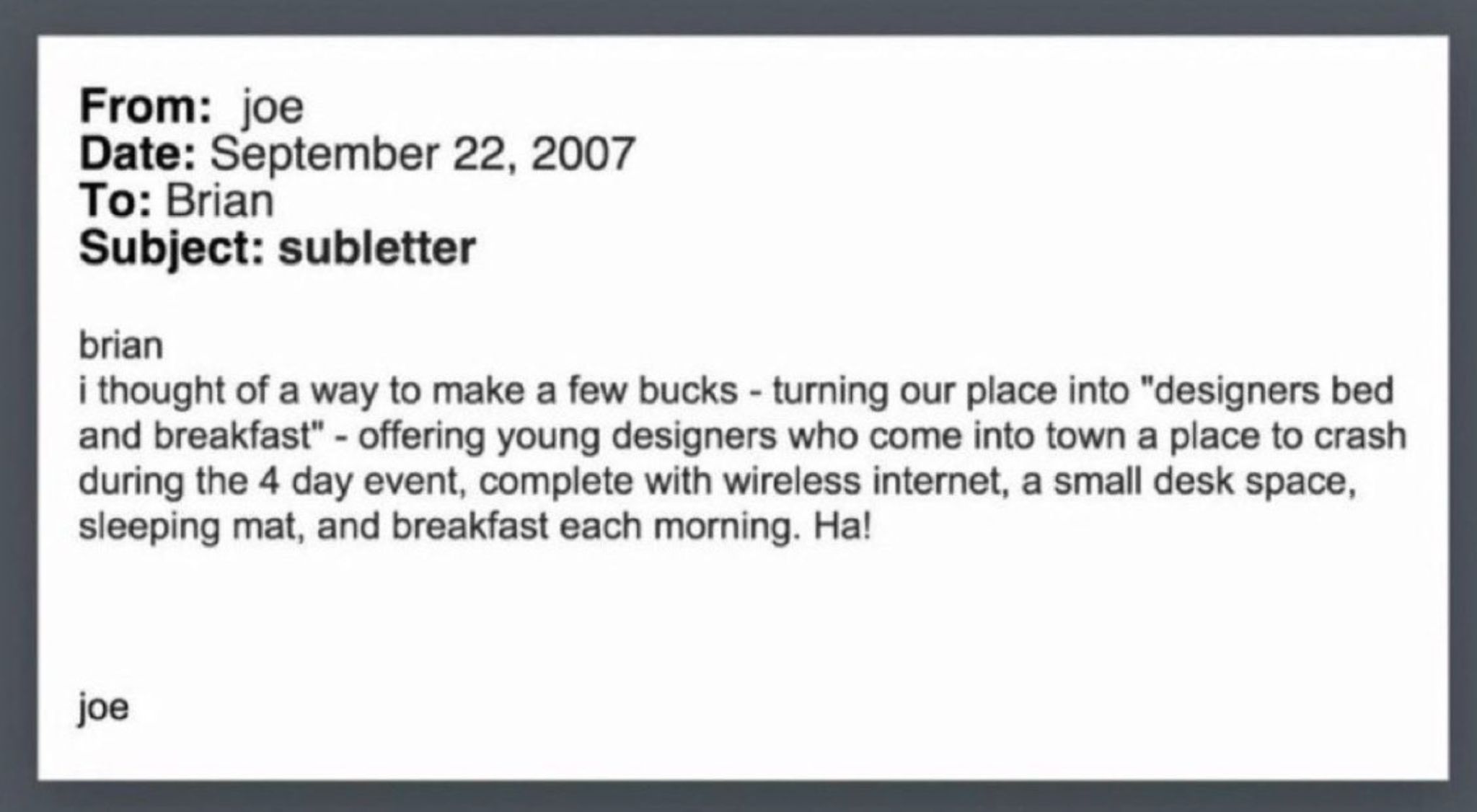

2007: Airbnb was an idea. 2025: $45 million in revenue a day.

Source: Jon Erlichman

Investing with intelligence

Our latest research, commentary and market outlooks