Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- technical analysis

- gold

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

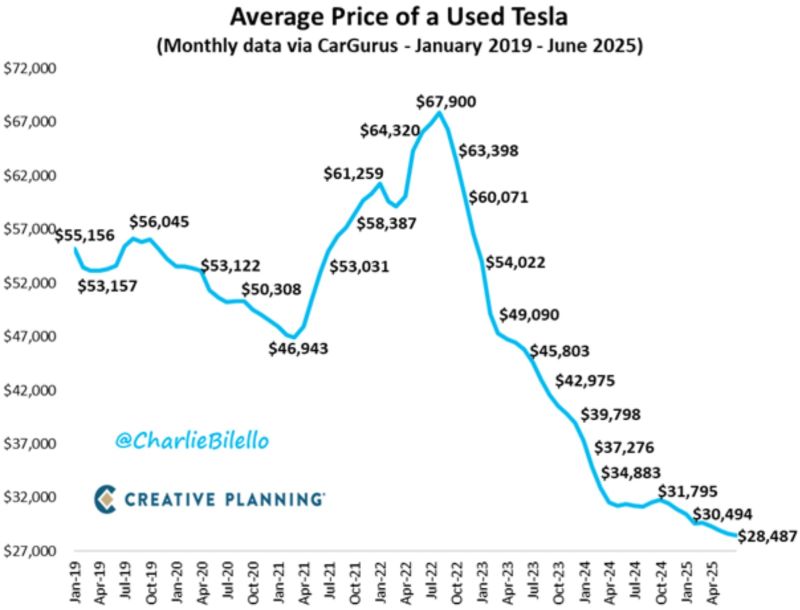

Buying a Tesla is becoming more and more affordable with each passing month.

The average price of a used Tesla has moved down to a record low of $28,487. That's 58% below the peak price from July 2022. $TSLA Source: Charlie Bilello

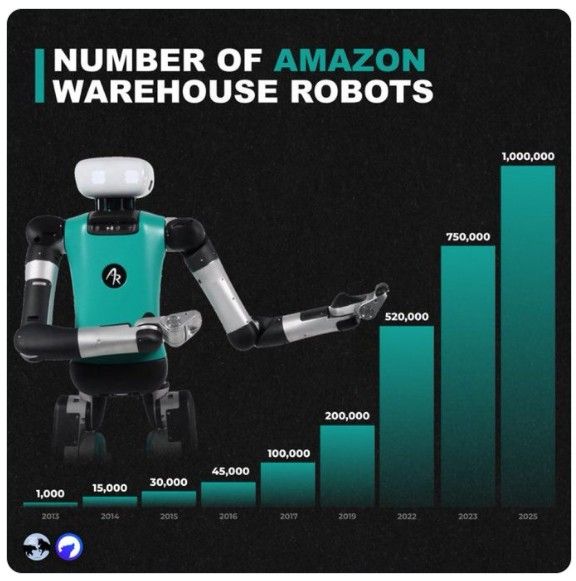

Amazon $AMZN now has 1 Million robots deployed in its business operations

Source: Blossom @meetblossomapp

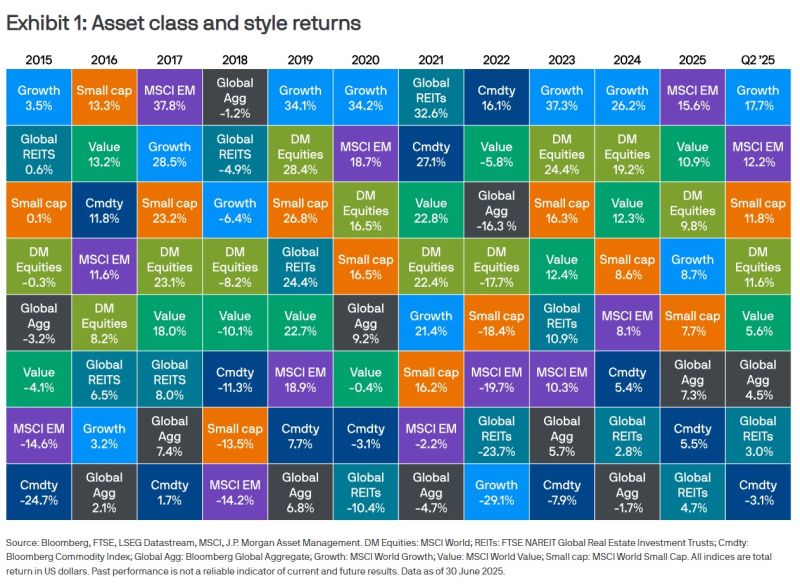

The usual quarterly review by JP Morgan

"The second quarter of 2025 saw significant volatility across markets as investors grappled with tariff policy uncertainty and war in the Middle East. In both cases, investors’ worst fears ultimately proved unfounded and in the absence of a meaningful weakening in the hard data, most major asset classes delivered positive returns over the quarter. The liberation day tariff announcement on 2 April caused a sharp selloff across markets. The reciprocal tariff package was larger than expected and both stock and bond markets reacted quickly. The S&P 500 fell 12% over the following week, while US 10-year Treasury yields rose 50 basis points between the 4 and 11 April. The US administration responded to market volatility and moved to soften its trade policy, pausing reciprocal tariffs for 90 days and agreeing the principles of a trade deal with China. This mollified investors and risk assets quickly recovered, with developed market equities delivering total returns of 11.6% over the quarter. A combination of renewed investor confidence, and a strong earnings season helped boost mega-cap tech stocks. After underperforming in the first quarter of 2025, the ‘Magnificent 7’ delivered price returns of 18.6% over the second, outperforming the remainder of the S&P 500 by 14 percentage points. This helped global growth stocks deliver total returns of 17.7% over the quarter to end the period as the top performing asset class.

President Donald Trump said Wednesday that the United States has struck a trade deal with Vietnam that includes a 20% tariff on the southeast Asian country’s imports to the U.S.

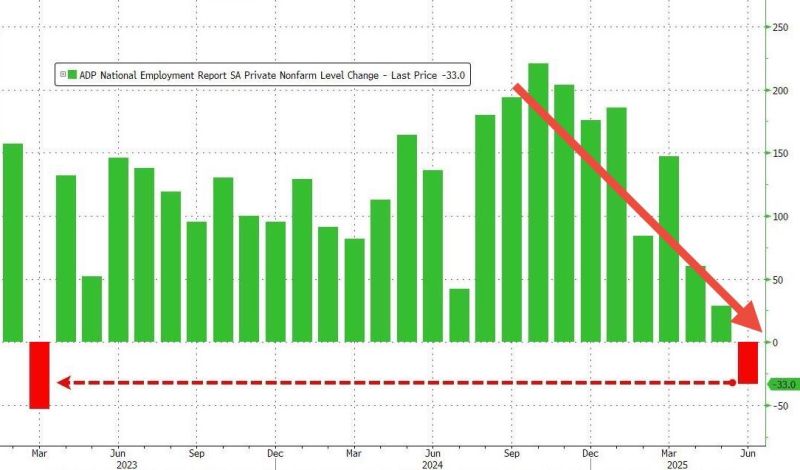

*ADP PRIVATE PAYROLLS: -33K vs 98K exp. First negative print since March 2023. Private sector hiring unexpectedly contracted in June, payrolls processing firm ADP said Wednesday, in a possible sign that the economy may not be as sturdy as investors believe as they bid the S&P 500 back up to record territory to end the month. Private payrolls lost 33,000 jobs in June, the ADP report showed, the first decrease since March 2023. Economists polled by Dow Jones forecast an increase of 100,000 for the month. The May job growth figure was revised even lower to just 29,000 jobs added from 37,000. To be sure, the ADP report has a spotty track record on predicting the subsequent government jobs report, which investors tend to weigh more heavily. May’s soft ADP data ended up differing significantly from the monthly jobs report figures that came later in the week. Source: Zerohedge, Bloomberg, CNBC

Huge ADP miss… the trend is clear.

*ADP PRIVATE PAYROLLS: -33K vs 98K exp. First negative print since March 2023. Private sector hiring unexpectedly contracted in June, payrolls processing firm ADP said Wednesday, in a possible sign that the economy may not be as sturdy as investors believe as they bid the S&P 500 back up to record territory to end the month. Private payrolls lost 33,000 jobs in June, the ADP report showed, the first decrease since March 2023. Economists polled by Dow Jones forecast an increase of 100,000 for the month. The May job growth figure was revised even lower to just 29,000 jobs added from 37,000. To be sure, the ADP report has a spotty track record on predicting the subsequent government jobs report, which investors tend to weigh more heavily. May’s soft ADP data ended up differing significantly from the monthly jobs report figures that came later in the week. Source: Zerohedge, Bloomberg, CNBC

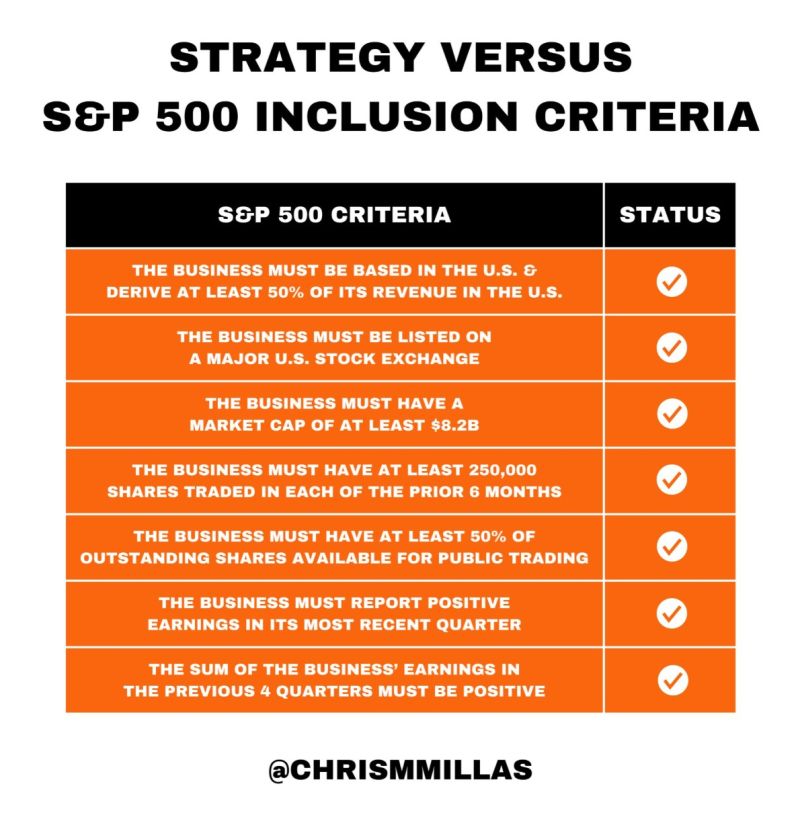

Strategy now satisfies all SP500 inclusion criteria. $MSTR

Source: Chris Millas @ChrisMMillas

JPMORGAN $JPM JUST ANNOUNCED A NEW $50 BILLION SHARE BUYBACK PROGRAM

JPMORGAN JUST INCREASED ITS QUARTERLY DIVIDEND OF $1.50 PER SHARE UP FROM $1.40 Source: Evan on X

Investing with intelligence

Our latest research, commentary and market outlooks