Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- technical analysis

- gold

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Retail sales rose 5.1% from a year earlier in April, MISSING analysts’ estimates of 5.5% growth, according to a Reuters poll

Sales had grown by 5.9% in the previous month. Industrial output grew 6.1% year on year in April, STRONGER than analysts’ expectations for a 5.5% rise, while slowing down from the 7.7% jump in March. Fixed-asset investment for the first four months this year, which includes property and infrastructure investment, expanded 4.0% from a year earlier. ➡️ As mentioned by Mo El Erian on X, the latest Chinese macro numbers illustrate a familiar pattern in the country’s economy: government measures often succeed in boosting industrial production, but tend to be less effective at stimulating household consumption Source: CNBC

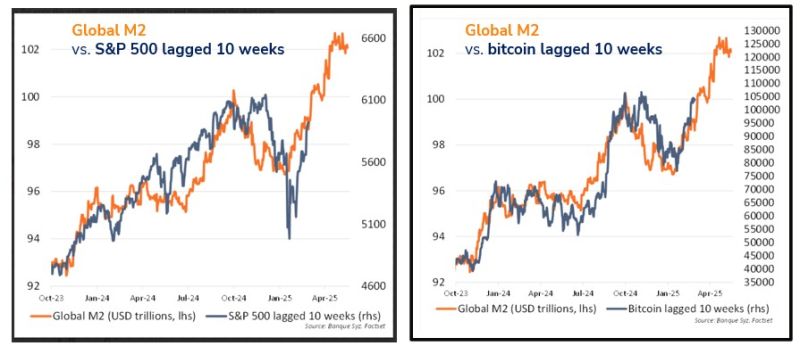

Weekly liquidity update (by our Chief Economist Adrien Pichoud)

➡️ Global M2 proxy flat again this week, still supportive for equities and bitcoin over the short-term ➡️ The S&P500 has been “catching up” our global M2 proxy. Our Global M2 proxy continues to point to supportive liquidity dynamics for risk assets in the weeks ahead. ➡️ The link between our Global M2 proxy and the Bitcoin continues to hold remarkably well and to point to more upside potential for the BTC. NB: These are NOT investment recommendations. A broad range of factors need to be taken into account before taking any investment decisions

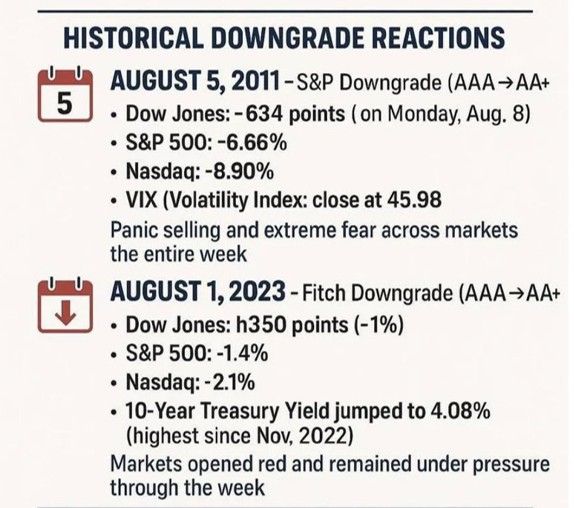

Thoughts on the Moody's Downgrade of the US sovereign credit rating (inspired by a tweet by Jim Bianco):

➡️ In August 2011, S&P first downgraded the US from AAA to AA+. Back then, many derivative contracts, loan agreements, investment directives, and similar documents prohibited the use of non-AAA securities. The fear was that a downgrade meant Treasuries were no longer eligible under these rules and would mean forced selling was to follow. ➡️ The 2011 downgrade left the US Split-Rated AAA (Moody's Aaa, Fitch AAA, S&P AA+). So, the US was still an AAA country and NOT in violation of these contracts. But everyone knew it was only a matter of time before the US lost its AAA status. So, in the years after 2011, those contracts were rewritten from "AAA securities" to "government securities," thereby excluding the credit rating qualification.

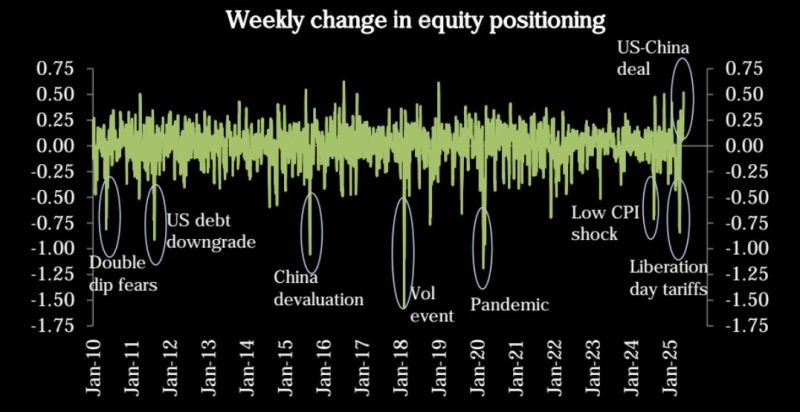

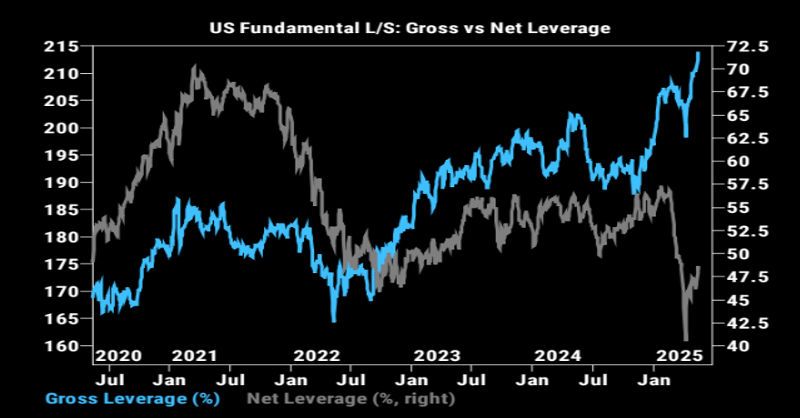

Welcome to panic-driven buying!

Going into this week: * Hedge funds just hit 100th percentile gross leverage * Biggest 6-week positioning jump since 2020. * Net buying at +2.5 SD (largest since Dec ’21) * Put protection near multi-year lows * "Offers wanted" floods GS desk This isn’t cautious buying—it’s panic-driven chase mode. Source: The Market Ear

Sometimes we need to be careful with magazine cover page.

Or use them as contrarian indicator?

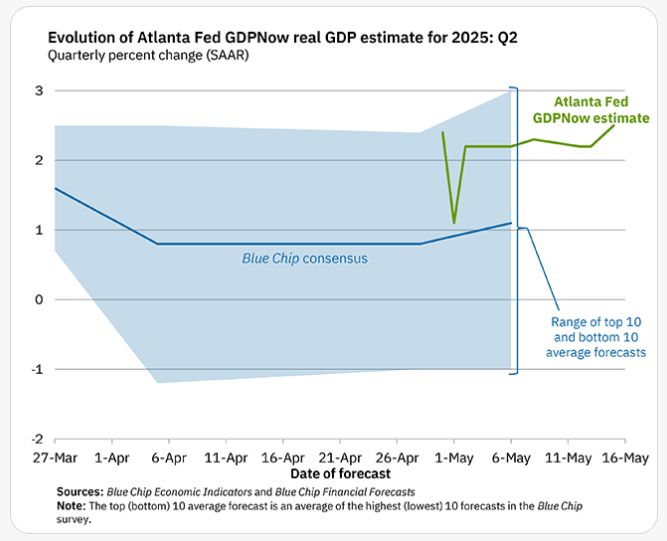

On May 15, the GDPNow model nowcast of real GDP growth in Q2 2025 is 2.5%

.

Investing with intelligence

Our latest research, commentary and market outlooks