Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- technical analysis

- gold

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

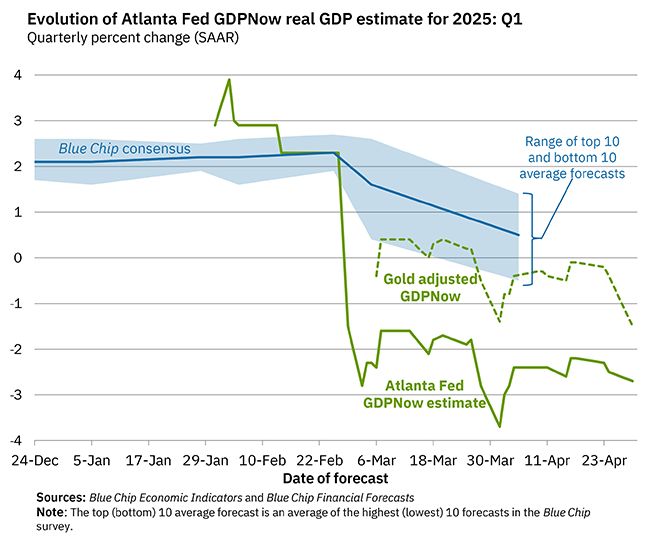

On April 29, the GDPNow model nowcast of real GDP growth in Q1 2025 is -2.7%.

The final alternative model forecast, which adjusts for imports and exports of gold, is -1.5% Source: Atlanta Fed

UPS has said it will cut 20,000 jobs this year and close more than 70 buildings

as the logistics group seeks to reduce costs and prepare for a halving in package volume from Amazon, its biggest customer. The job cuts will target workers responsible for delivering packages to customers and supporting UPS’s transportation and logistics services, and come after the group last year cut about 14,000 jobs, primarily in management roles. The latest reduction in headcount is part of UPS’s plan to boost efficiency and consolidate its US domestic network after it said in January it had reached an agreement in principle with its “largest customer” to lower its volume by the second half of 2026.

The Market Ear

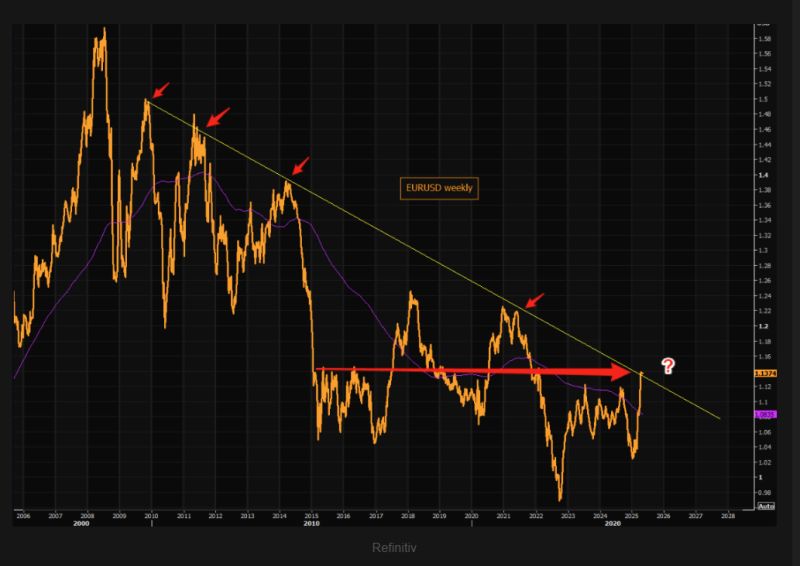

EURUSD longer term chart right at the big negative trend line. The 200 weekly moving average is sloping negatively still...and the FX pair has done nothing since 2015. FX is a relative game, but getting excited about the euro here looks like a late short term trade

🔴 BREAKING >>>

According to Reuters, the Trump administration is working on changes to a Biden-era rule that would limit global access to AI chips, including possibly doing away with its splitting the world into tiers that help determine how many advanced semiconductors a country can obtain, three sources familiar with the matter said. The sources said the plans were still under discussion and warned they could change. But if enacted, removing the tiers could open the door to using U.S. chips as an even more powerful negotiating tool in trade talks.

The Iberian Peninsula…

wiped off the map of lights. This is how it looked from orbit last night after a massive blackout hit Spain and Portugal. Cosmic silence over the region.” Source: David Sobolewski on X

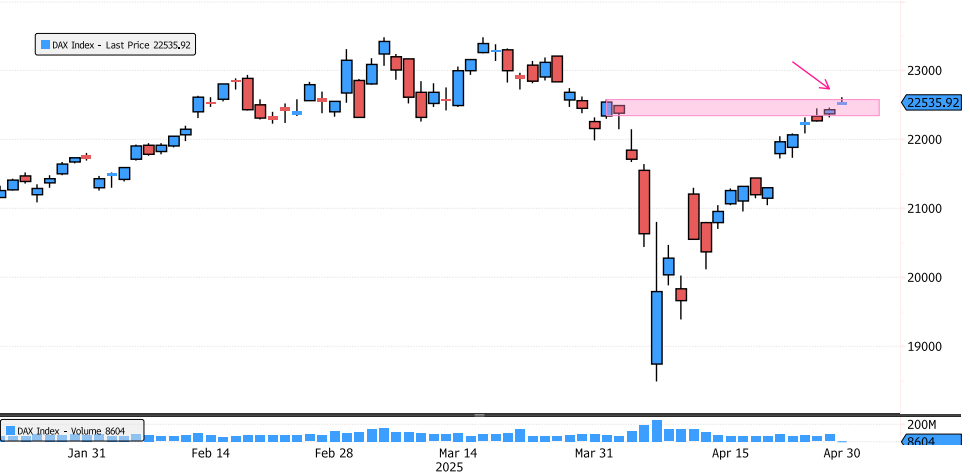

DAX Index Back on 1st Supply Zone

The DAX Index has recovered 22% since the lows in just 17 opening days! It’s now reaching the first supply zone between 22,343-22,573. Will the market be able to close above 22,573? Keep an eye on the price action over the next few days. Source: Bloomberg

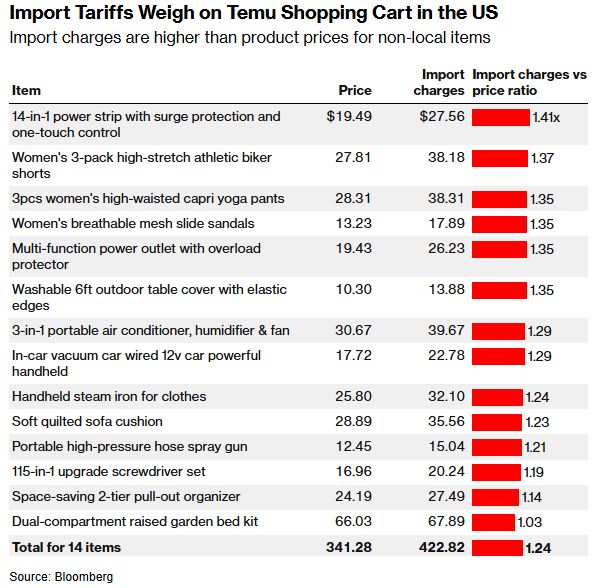

The import charges for many items on Temu (Chinese discount retailer) are higher than the cost of the products themselves.

Source: Charlie Bilello

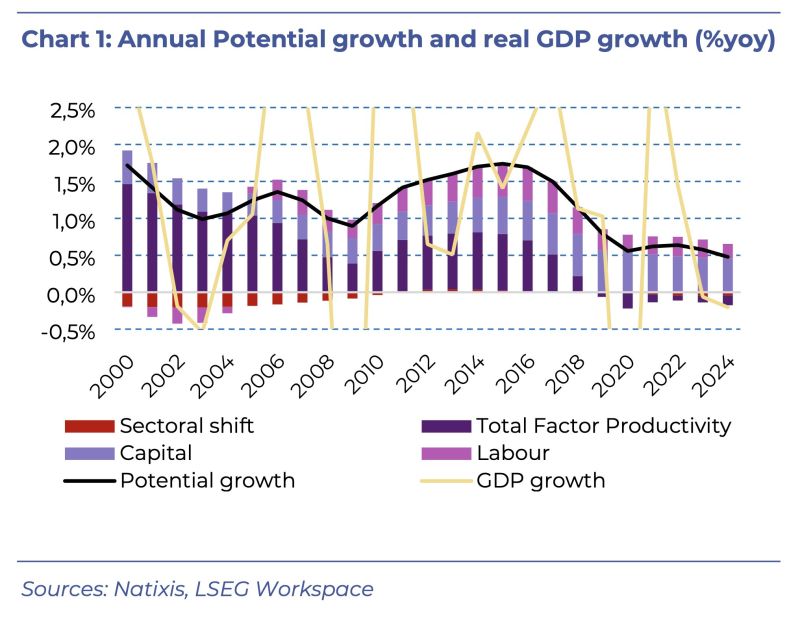

In Germany, potential economic growth has dropped to just 0.5%, mainly because of falling productivity.

The last time Germany saw potential growth above 1% was back in 2018 — also the last year when productivity made a positive impact. For the new government to hit its target of lifting potential growth above 1% again, reviving productivity will be crucial, especially as the workforce continues to shrink. (Source: Natixis thru HolgerZ)

Investing with intelligence

Our latest research, commentary and market outlooks