Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

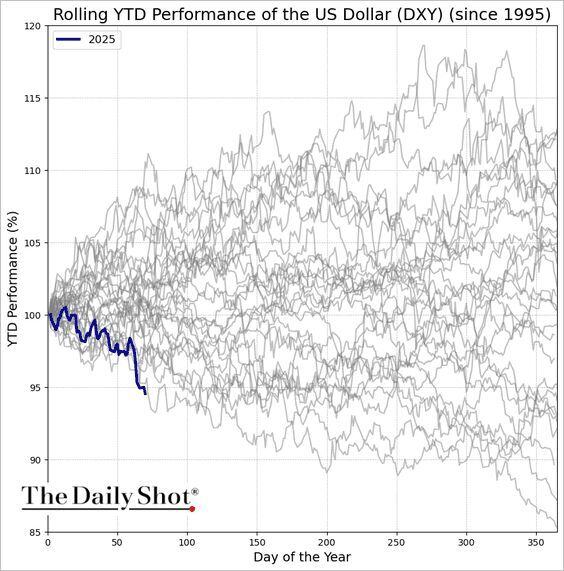

The US dollar is off to its worst start of the year in decades.

Source: The Daily Shot

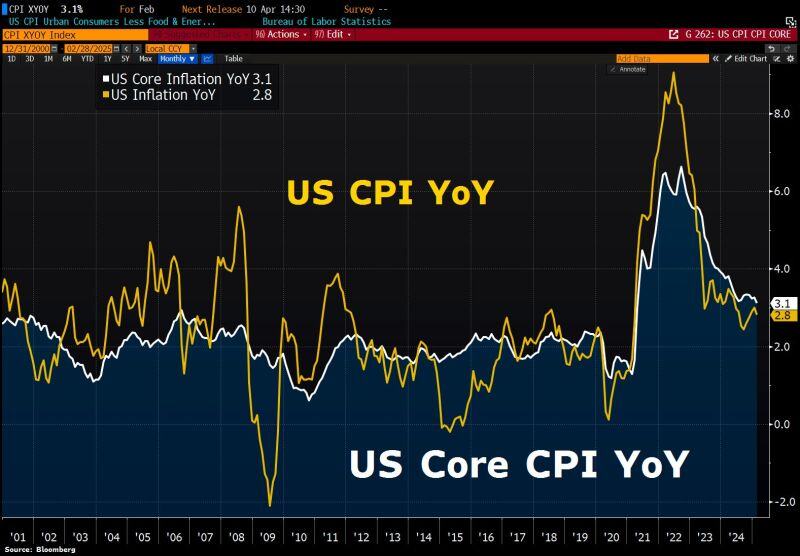

US inflation comes in lower than forecast:

Headline CPI slows to 2.8% in Feb from 3% in Jan, smallest since Nov2024, Core CPI cools to 3.1%, lowest since Apr2021. Housing inflation cools; airfares and pump prices drop. BUT: Inflation data doesn’t yet reflect tariff impact. Source: HolgerZ, Bloomberg

The seven most influential names in the market are testing a 1.5 year uptrend.

Source: TrendSpider

The United States now accounts for just 0.1% of global shipbuilding… 0.1%

Meanwhile, China alone is 53%+. (h/t: @BrianTHart) thru Geiger Capital

U.S. stock returns after declining 10% or more

Source: George Maroudas, CFP® @ChicagoAdvisor

Monday was the worst day of the year for the S&P 500 at -2.7%.

It turns out even the best years usually have a bad day. @Ryan Detrick found 22 times >20% for the year and the average worst day in those years was -3.5%. 1997 had a 6.9% worst day and still gained 31% for the year in fact. Source: Carson

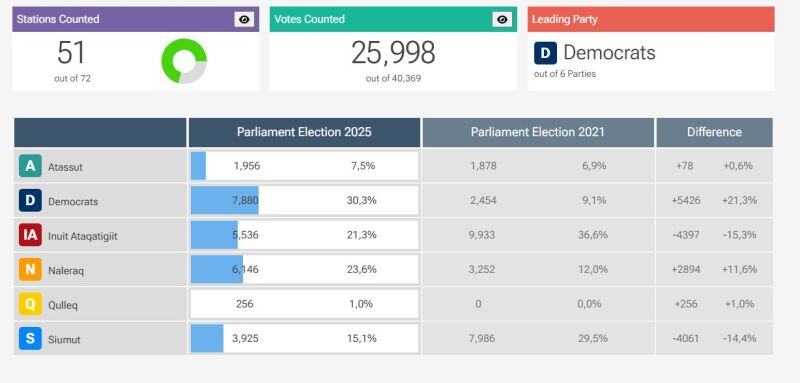

Greenland Election:

A SURPRISING RESULT ‼️ The Democrats (Center-Right) and Naleraq (Right) have almost 54% of the vote, meaning if they wanted to they could form a ruling coalition that, from what I have read, would likely be more USA centric than Denmark centric. About 65% of the total vote is in (51/72 stations), Democrats in first then Naleraq and then Inuit. Source: CA ET Nerd @earlyvotedata

Albert Einstein once said...

"Weak people take revenge, strong people forgive, intelligent people ignore" Source: Wise Mentor | Leadership

Investing with intelligence

Our latest research, commentary and market outlooks