Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

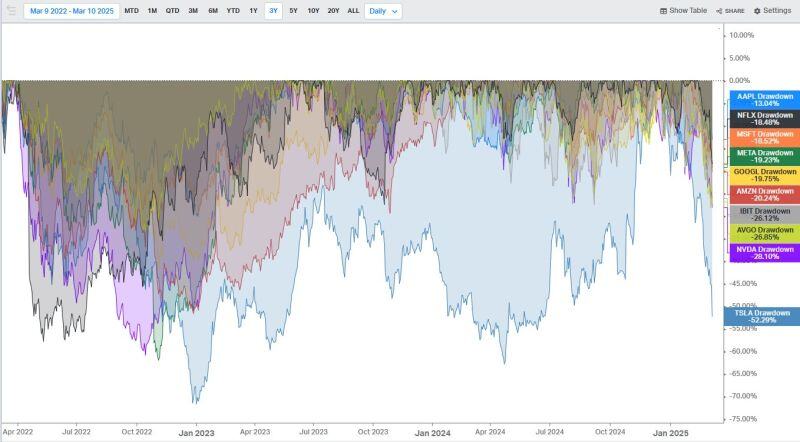

Magnificent drawdowns

$AAPL -13% $NFLX -18% $MSFT -19% $META -19% $GOOGL -20% $AMZN -20% $IBIT bitcoin -26% $AVGO -27% $NVDA -28% $TLSA -52% Source: Mike Zaccardi, CFA, CMT, MBA

Why investing is so difficult

Investment Books (Dhaval) @InvestmentBook1

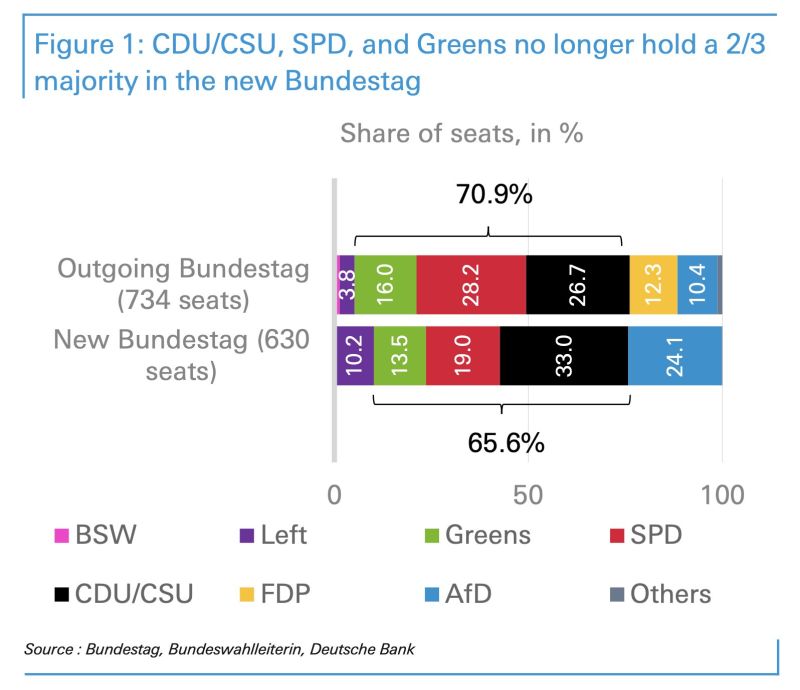

‼️ BREAKING: EU EQUITIES UNDER PRESSURE ‼️

Germany's Greens won't support draft debt package in parliament. The CDU/CSU and SPD need the support of the Greens to achieve the two-thirds majority in the Bundestag in its old composition. The FDP, which was represented in the old Bundestag, will hardly vote in favor of such a debt package. Source: HolgerZ, DB

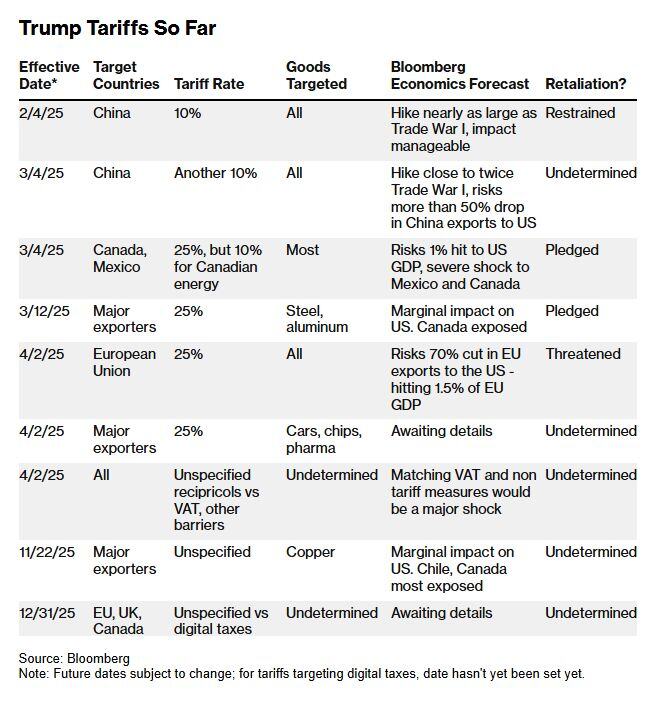

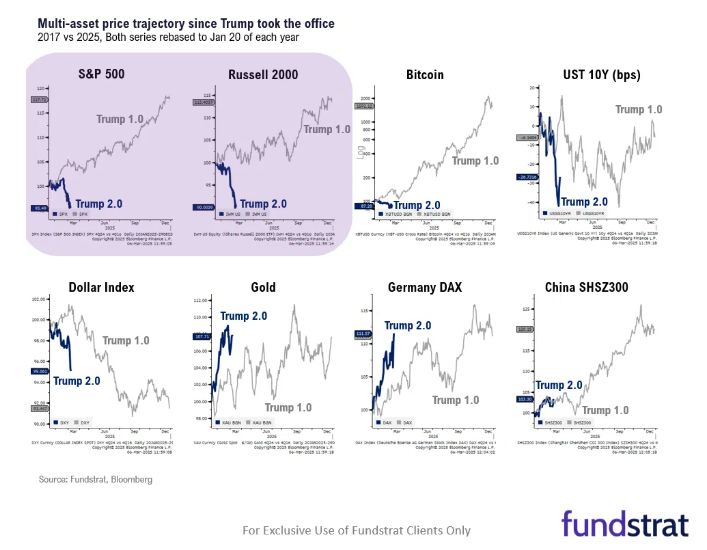

Trump 2.0 vs. Trump 1.0

The full market picture by Fund Strat Interesting to link this to Trump's comments yesterday on FoxNews: "There could be a little disruption (…) Look, what I have to do is build a strong country. You can't really watch the stock market. If you look at China, they have a 100 year perspective. We go by quarters. And you can't go by that”. Not the same kind of Trump's put than in 2017...

Tesla Back on Important Zone

Tesla (TSLA) has consolidated 50% since its December highs! The stock is now back in its discount zone (more than 50% retracement Fibonacci on the last swing) and is also reaching the imbalance zone between 225-245. Additionally, there is a strong demand zone between 212-249. Keep an eye on price action in these critical zones. Source: Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks