Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

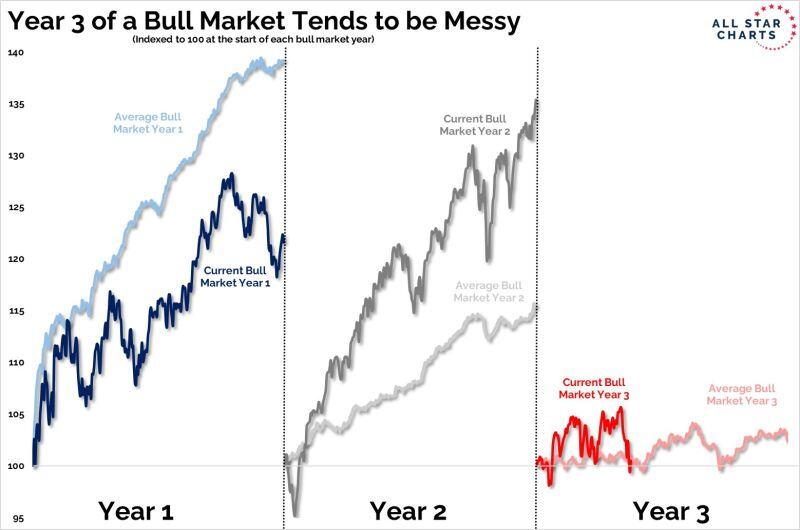

Year 3 of a bull market tends to be messy, and the current bull market is behaving as expected.

Source: Grant Hawkridge @granthawkridge

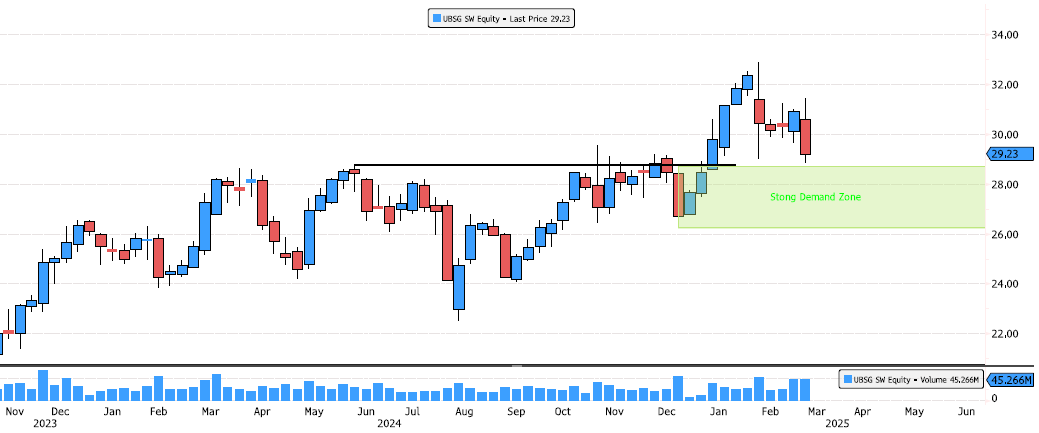

UBS Retesting Strong Demand Zone

After a 12% consolidation since the February high, UBS is reaching its January breakout level and also a major demand zone. Keep an eye on these levels for price action and potential opportunities. Source: Bloomberg

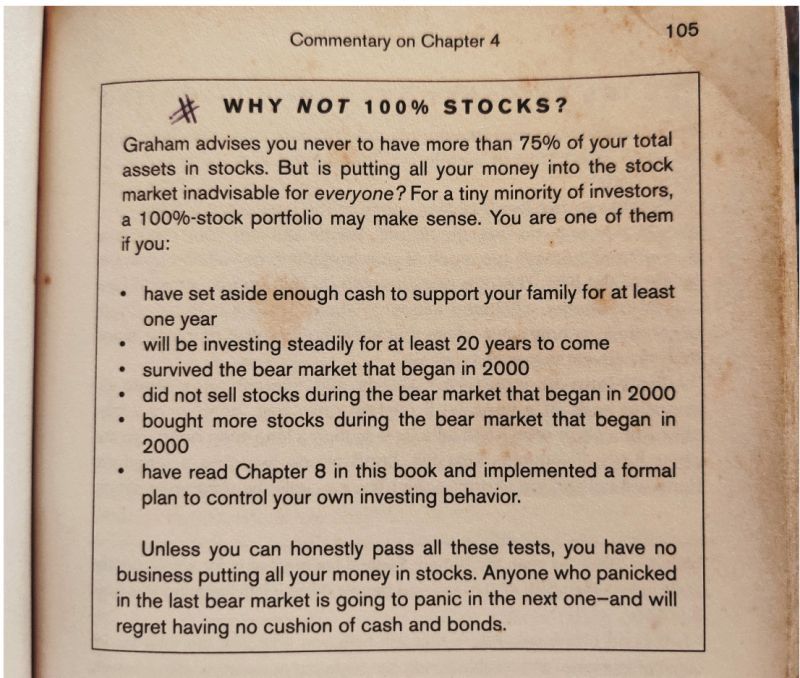

Jason Zweig on reasons to not allocate 100% to stocks:

Source: Brian Feroldi

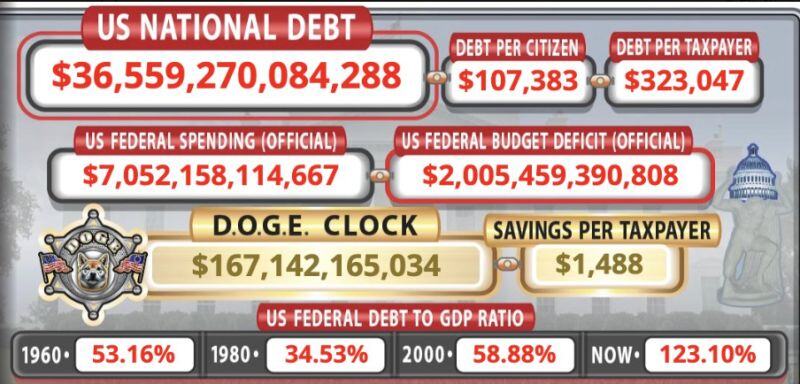

The US National Debt is currently at $36.6T or $323K per taxpayer

source : usdebtclock.org

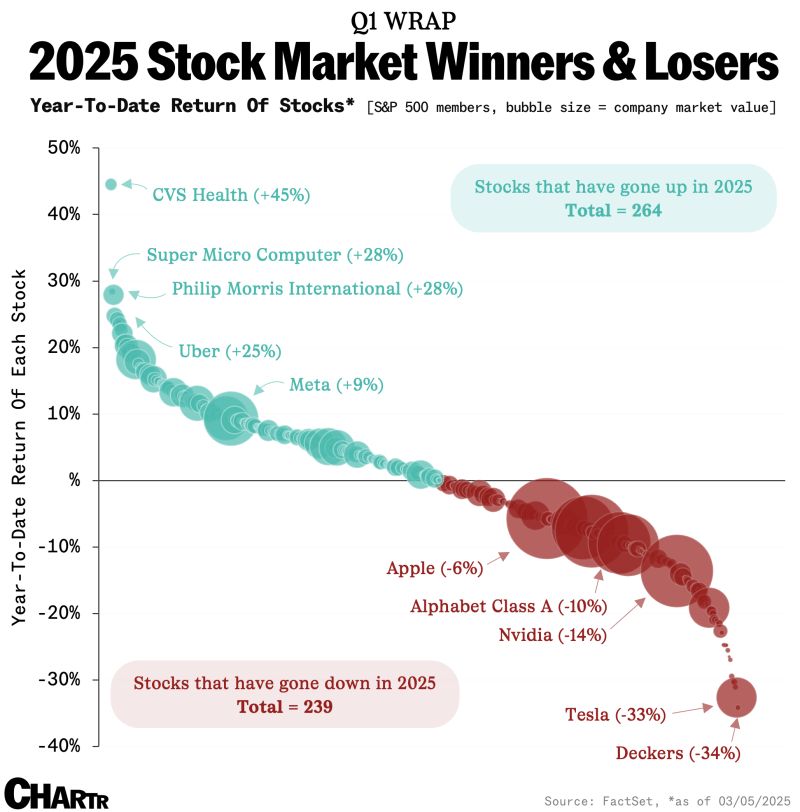

264 of the S&P 500’s constituents, or a little over 52% of the index, are actually still up in 2025.

The star of the S&P 500 Class of Q1 so far is CVS HealthCVS $65.81 (2.74%), which has jumped 45% since the start of the year, closely followed by Philip Morris InternationalPM $153.14 (-0.58%) and Super Micro, which is doing the absolute bare minimum to remain on the market. Uber also joins the all-star lineup, ahead of Meta, which is the best of the Big Tech stocks, evading the pain of peers Amazon (-7%), Nvidia (-14%), and Tesla (-33%), which are all down. But the one company that’s down deepest in the trenches is UGG and Hoka shoe company DeckersDECK $136.40 (1.67%), which never recovered from getting stomped after its underwhelming Q3 update. Source: Chartr

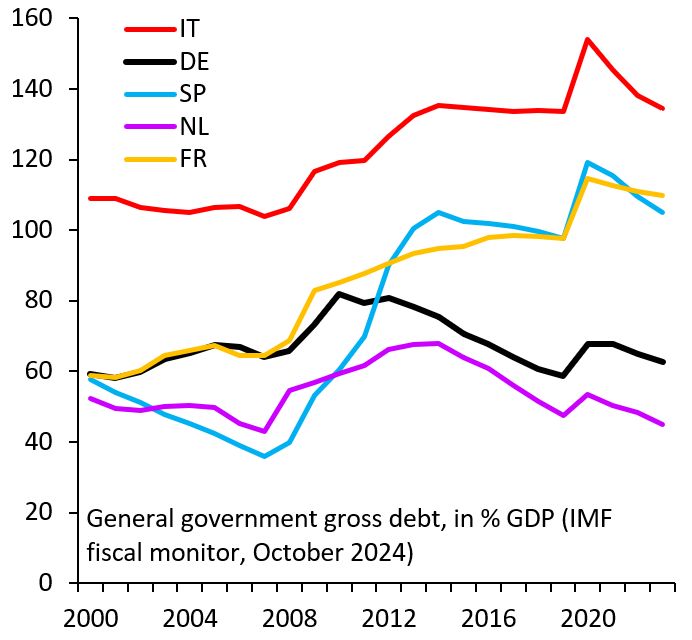

Europe's high-debt countries - like France, Italy and Spain - cheer Germany's fiscal expansion.

They're not doing that out of the goodness of their hearts. Germany now can't possibly say no to more joint EU debt issuance. A win for high-debt countries and their muddle through... Source: Robin Brooks

⚠️The famous Trade War Cycle is back in full swing...

Source: Global Markets Investor

Investing with intelligence

Our latest research, commentary and market outlooks