Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

Treasury Secretary Scott Bessent says Trump 2.0 focusing on 10Y yields, not Fed

Bessent repeated his view that expanding energy supply will help lower inflation. For working-class Americans, “the energy component for them is one of the surest indicators for long-term inflation expectations,” he said. Cheap capital is coming... Source: www.moneycontrol.com

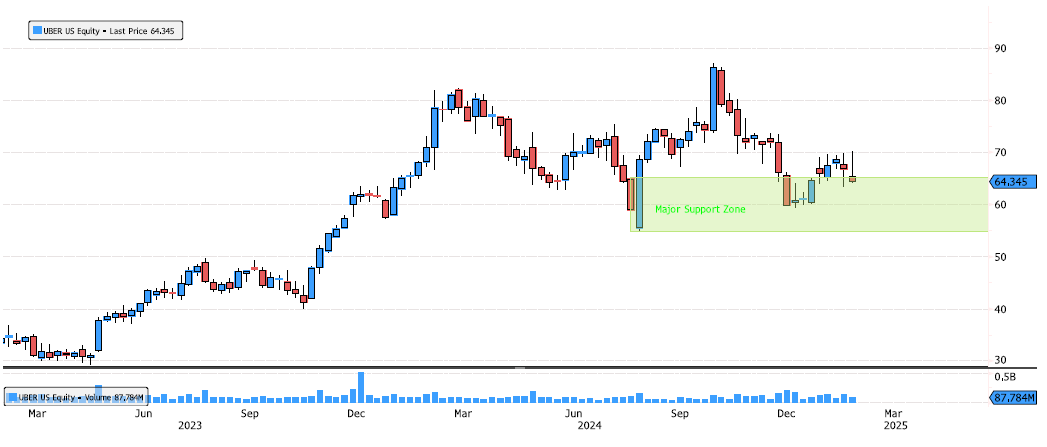

Uber on Major Support Zone

Uber (UBER US) is testing once again the major support zone between 54.84-65.25. The stock has consolidated 31% since October. Keep an eye on the price action for potential opportunities. Source: Bloomberg

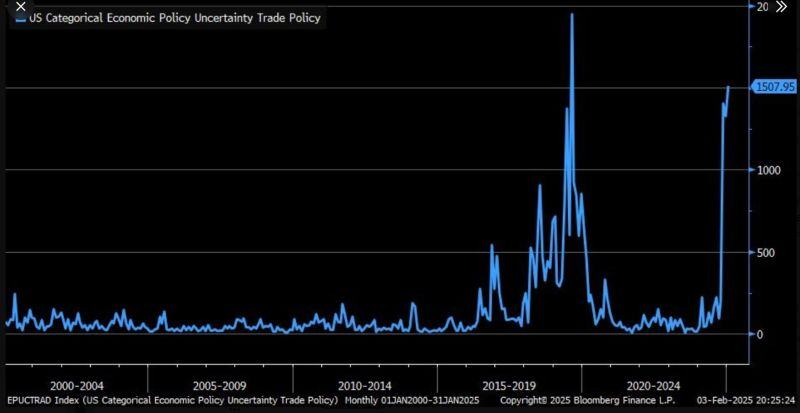

Trade Policy Uncertainty Index hits 2nd highest level in AT LEAST the last 25 years

source : barchart

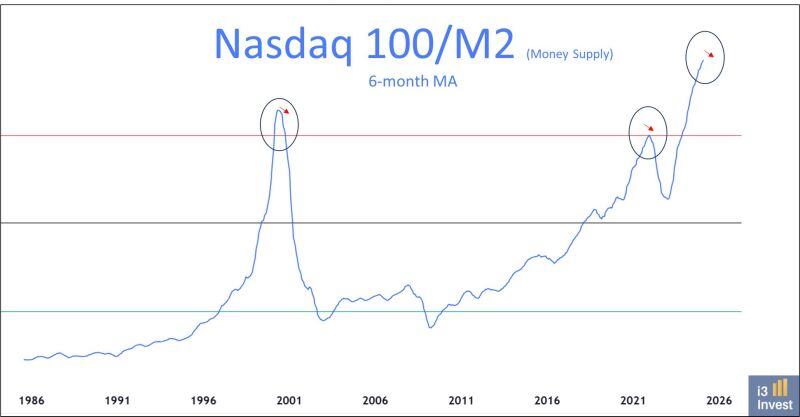

As shared by Guilherme Tavares i3 invest :

Nasdaq 100 / M2 Levels never seen before...

Xi’s Reply to Trump Tariffs Shows China Has More to Lose - Bloomberg

https://lnkd.in/ez4qCpZa Source: Bloomberg thru C.Barraud

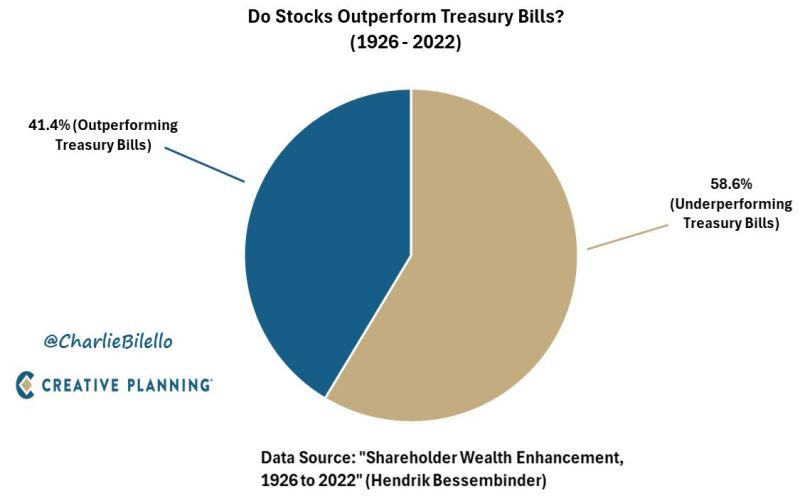

A majority of stocks (59%) underperform Treasury bills over their lifetime and more than half end up having a negative cumulative return.

“Don’t look for the needle in the haystack. Just buy the haystack.” - Jack Bogle Source: Charlie Bilello, Peter Malouk

Job Openings Unexpectedly Crater By More Than 500K In December

Source: zerohedge

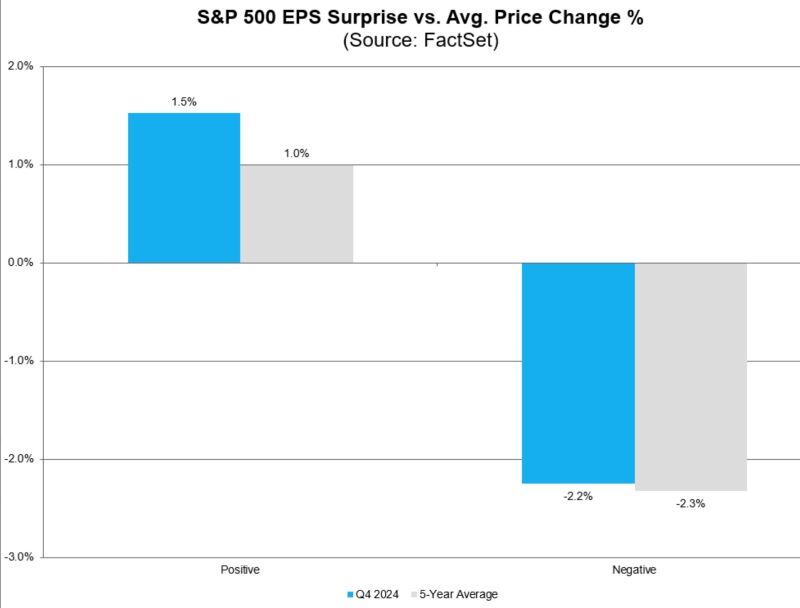

With deepSeek and tariffs, we almost forgot that we are in the middle of the earnings season.

FactSet notes that beats are being rewarded above average and misses are being punished around average.

Investing with intelligence

Our latest research, commentary and market outlooks