Straight from the Desk

Syz the moment

Live feeds, charts, breaking stories, all day long.

- All

- equities

- United States

- Macroeconomics

- Food for Thoughts

- markets

- Central banks

- Fixed Income

- bitcoin

- Asia

- europe

- investing

- geopolitics

- gold

- technical analysis

- Commodities

- Crypto

- AI

- Technology

- nvidia

- ETF

- earnings

- Forex

- china

- Real Estate

- oil

- banking

- Volatility

- energy

- magnificent-7

- apple

- Alternatives

- emerging-markets

- switzerland

- tesla

- United Kingdom

- Middle East

- assetmanagement

- amazon

- microsoft

- russia

- ethereum

- ESG

- meta

- Industrial-production

- bankruptcy

- Healthcare

- Turkey

- Global Markets Outlook

- africa

- Market Outlook

- brics

- performance

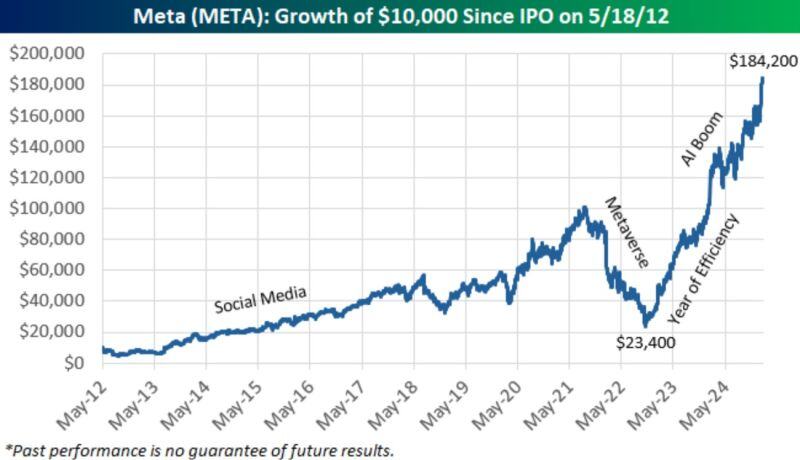

As Facebook turns 21, here's a look at the growth of $10k in $META since its IPO in May 2012.

As a reminder, this stock saw a 76% drawdown from late 2021 to late 2022. It has rallied nearly 700% since its 2022 low. source : bespoke

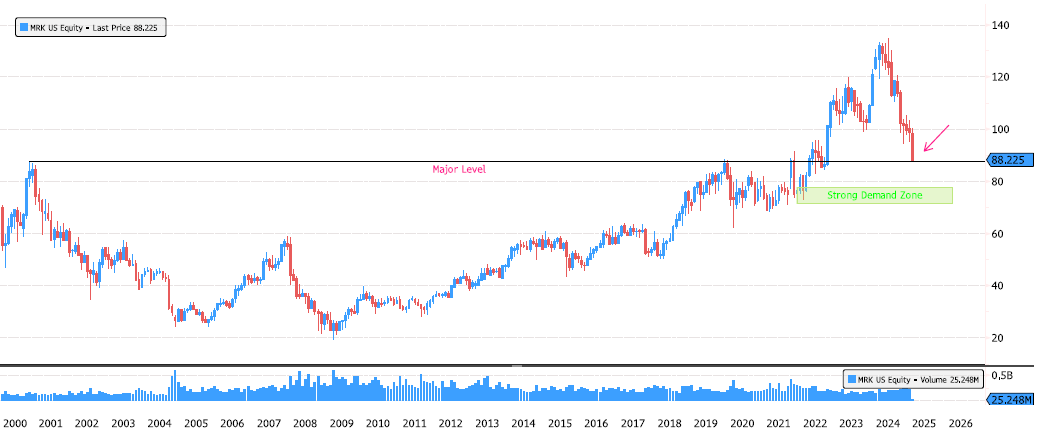

Merck Back on Breakout Level !

Merck (MRK) is down 35% from its June highs and has just reached the 87.25 level, which represents the high of 2000. A retest of this major level is normal and necessary. However, we’re currently in a bit of a falling knives situation, so caution is required. Keep an eye on 87.25 and the demand zone between 71.50-77.75 for potential opportunities. Source: Bloomberg

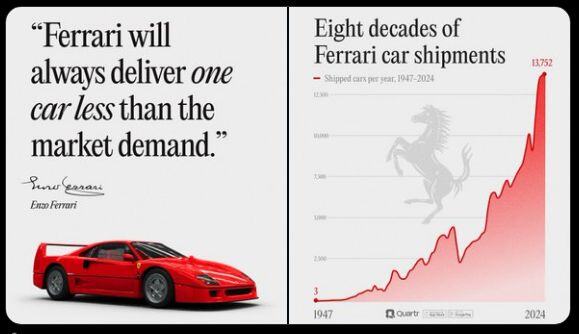

Ferrari $RACE Q4 2024 results

"Quality of revenues over volumes: I believe this best explains our outstanding financial results in 2024" – Benedetto Vigna, CEO. Shipments +2% *EMEA +4% *Americas +8% *Greater China -21% *APAC +5% Revenue +14% EBIT +26% *marg 27% (24.4) EPS +32% Source: Quartr

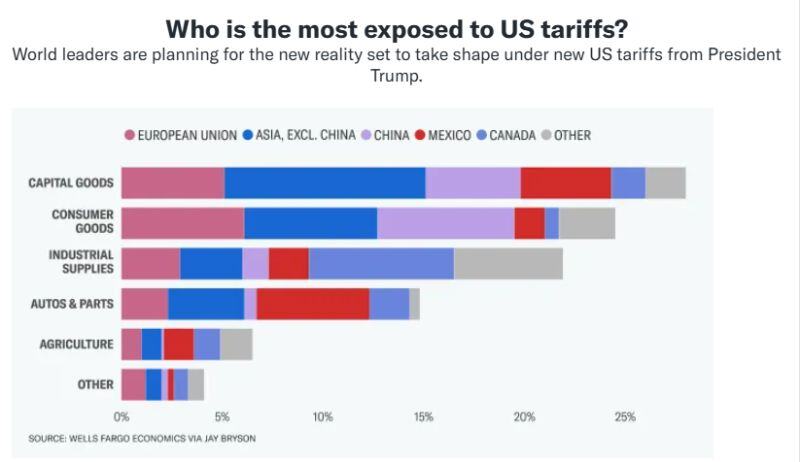

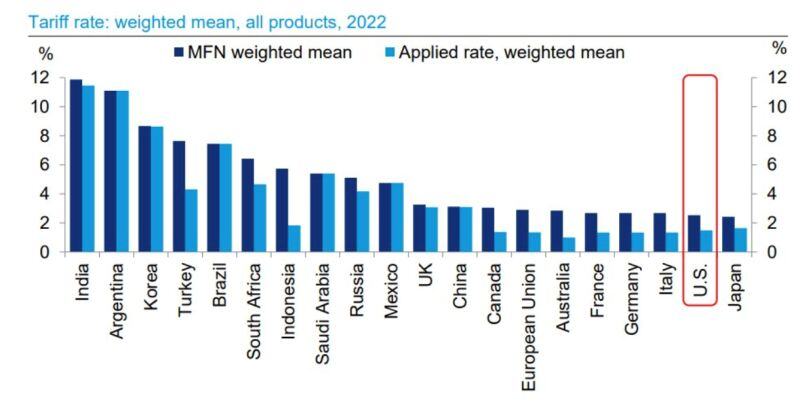

Believe it or not, but the us has one one of the lowest tariff rates in the developed world... See chart below courtesy of DB.

NB: Most favored nations (MFN) Weighted mean tariff is the average of most favored nation rates weighted by the product import shares corresponding to each partner country.

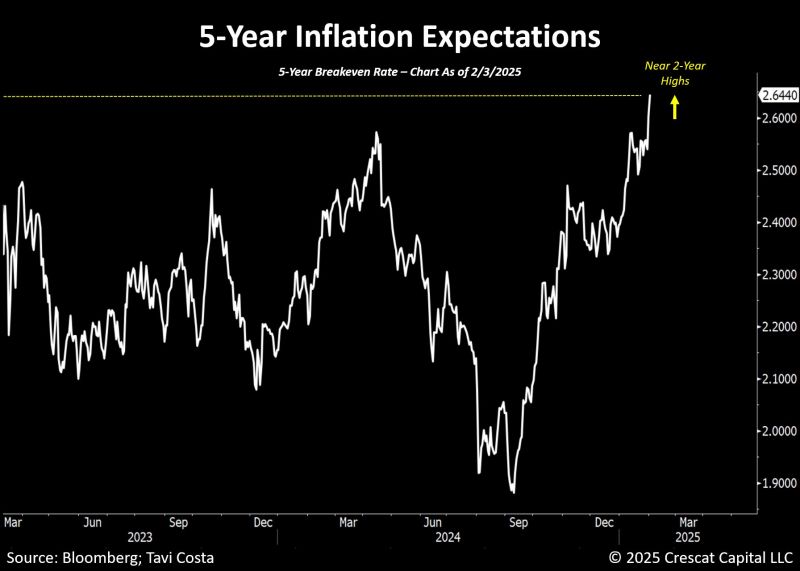

Are tariffs inflationary? us 5-year breakeven rate just surged to its highest level in nearly 2 years.

Source: Tavi Costa, Bloomberg

Investing with intelligence

Our latest research, commentary and market outlooks